Mining Rig Rentals and Profitability

So, you’re interested in crypto mining but balk at the idea of buying, setting up, and maintaining your own expensive hardware? You’re not alone. Mining rig rentals offer a way to get in the game without the massive upfront investment and technical headaches.

Think of it like leasing a high-performance race car for a weekend instead of buying it. You get all the power and excitement without the long-term commitment, maintenance bills, or need for a garage. You’re essentially leasing computational power—also known as hashrate—to do the heavy lifting for you. In short, it’s a simpler, more accessible path into the world of cryptocurrency mining.

Understanding Mining Rig Rentals

At its heart, a mining rig rental is a straightforward deal: you pay a provider to point their powerful hardware at a mining pool of your choosing for a specific amount of time. Instead of a loud, hot, and pricey machine arriving at your doorstep, you simply rent its processing muscle remotely.

The process is incredibly direct. Here’s how it generally works:

- Choose a Cryptocurrency: Decide which coin you want to mine.

- Select Hashrate: Pick how much computational power you need (usually measured in terahashes per second, or TH/s).

- Set the Duration: Choose how long you want the rental to last.

Once you’ve paid, the provider directs that power to your mining pool account, and you begin earning a share of the rewards. It’s a clean entry into the world of securing a blockchain network and getting paid in crypto for it. If you need a refresher on the basics, our guide on what crypto mining is breaks it all down.

Owning vs. Renting a Mining Rig at a Glance

Deciding whether to buy your own rig or rent one comes down to a few key trade-offs. This table cuts through the noise and lays out the core differences to help you make an informed choice.

| Factor | Owning a Rig | Renting a Rig |

|---|---|---|

| Upfront Cost | High (thousands of dollars per unit) | Low (starts from a few dollars) |

| Setup & Maintenance | Your full responsibility (technical knowledge required) | None (handled entirely by the provider) |

| Flexibility | Low (locked into specific hardware/algorithms) | High (switch coins and contracts easily) |

| Start Time | Slow (days or weeks for shipping and setup) | Immediate (can start mining in minutes) |

| Profit Potential | Higher (you keep 100% of rewards, minus pool fees) | Lower (rental fees eat into profits) |

| Risk | High (hardware depreciation, resale market volatility) | Low (only risk the rental fee for a short term) |

The bottom line? Renting gives you a way to test the waters and learn the ropes without diving into the deep end financially. It’s a low-commitment strategy perfect for beginners or for experienced miners wanting to experiment.

Why Rent Instead of Buy?

Renting is especially appealing for newcomers or for experienced miners who want to stay nimble. The main draws are pretty clear:

- Lower Barrier to Entry: You can skip the hefty price tag that comes with buying a top-tier ASIC or GPU rig.

- Flexibility and Testing: Want to try mining a new coin or see if a particular strategy is profitable? Renting lets you experiment without a long-term hardware commitment.

- Zero Technical Headaches: Forget about the complexities of setup, maintenance, cooling, electricity bills, and the constant noise. The provider handles all of that.

- Get Started Immediately: You can be up and mining within minutes of signing up. No waiting weeks for hardware to ship and get configured.

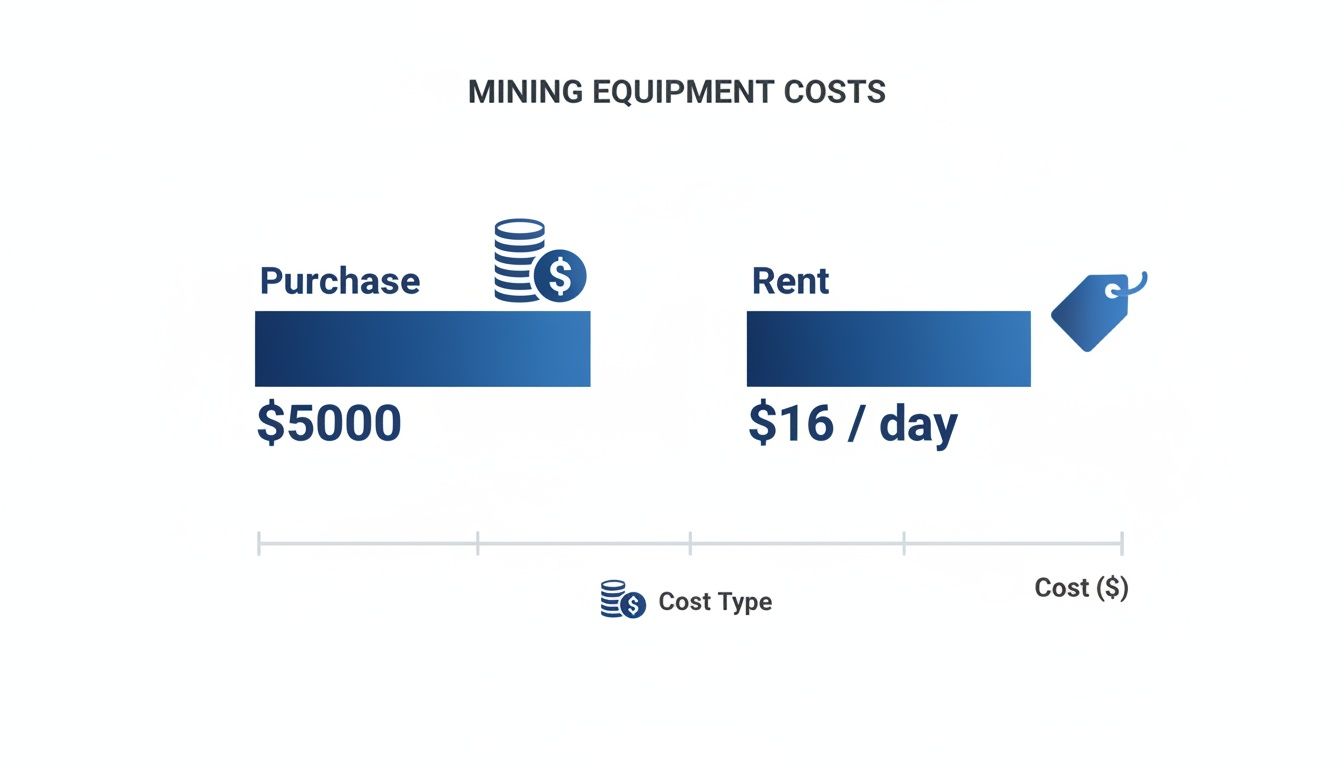

This rental model has gained a lot of traction, especially as the crypto market has matured. Instead of shelling out $3,000-$5,000 for an Antminer S21, miners can now rent the same power for as little as $16 per terahash. This shift is no accident—it’s a direct response to tighter profit margins after recent halving events, making large capital outlays a riskier bet. For more on this, check out the analysis of crypto mining profitability in 2026.

Key Takeaway: Mining rig rentals open the door to cryptocurrency mining for a much wider audience. They turn a capital-heavy operation into a more predictable operational expense, allowing anyone to participate based on their budget and appetite for risk.

In the end, the choice between buying and renting is personal. It hinges on your available capital, technical confidence, and long-term goals. Both paths can lead to earning cryptocurrency, but they offer two very different journeys to get there.

How to Calculate Costs and Potential ROI

Before you jump into a rental contract, you need to get comfortable with the numbers. At its core, a successful rental is a simple game of arbitrage: the crypto you mine must be worth more than what you paid for the hashrate. Let’s break down how to figure out if a deal is actually worth it.

Your biggest outlay is the rental fee, which is almost always priced per unit of hashrate per day (like TH/s/day for Bitcoin). This part is nice and clear. Then you have the maintenance fee, a catch-all term that usually covers electricity and other operational costs. Add those two together, and you have your total daily expense.

The real appeal of renting becomes obvious when you compare it to buying your own gear.

As you can see, renting turns a massive upfront investment into a predictable, manageable daily cost. You’re trading a capital-intensive headache for a simple operational expense.

Using a Profitability Calculator

Flying blind is the fastest way to lose your shirt in this game. To get a realistic sense of what you might earn, you absolutely must use a mining profitability calculator. These online tools are your best friend, crunching all the complex variables for you.

To get a useful estimate, you’ll need to plug in a few key details:

- Hashrate: The processing power you’re renting (e.g., 100 TH/s).

- Power Consumption: The rig’s energy draw, which should be listed by the rental service.

- Cost per kWh: Your electricity rate, though this is usually baked into the maintenance fee.

- Pool Fee: The cut your mining pool takes, typically between 0.5% and 2%.

- Cryptocurrency Price: The coin’s current market value.

- Network Difficulty: How competitive it is to find a new block right now.

Feed this information into the calculator, and it will spit out projected earnings minus your costs. If you want to really get into the weeds, you can learn more about how a crypto mining profitability calculator works to refine your inputs and get an even sharper picture.

Key Insight: A profitability calculator isn’t a crystal ball. It’s a snapshot in time. Market conditions can and will change, but this tool gives you a data-backed starting point to assess risk instead of just taking a wild guess.

A Practical ROI Example

Let’s run the numbers on a couple of real-world scenarios to see how this all shakes out. We’ll look at renting a Bitcoin ASIC versus a GPU for mining an altcoin. The table below compares two hypothetical daily rentals.

| Metric | Scenario 1: Bitcoin (ASIC) | Scenario 2: Altcoin (GPU) |

|---|---|---|

| Rental Power | 100 TH/s | 500 MH/s |

| Rental Cost | $8.00/day | $5.00/day |

| Maintenance Fee | $3.00/day | $1.50/day |

| Total Daily Cost | $11.00 | $6.50 |

| Projected Gross Revenue | $13.50/day | $7.20/day |

| Pool Fee (1%) | $0.135 | $0.072 |

| Net Daily Revenue | $13.365 | $7.128 |

| Net Daily Profit | $2.365 | $0.628 |

What these examples make clear is that profitability in this space often lives on a razor’s edge. A slight dip in a coin’s price or a sudden spike in network difficulty can instantly erase your profit margin. Always, always run your own numbers before you sign any rental agreement.

How to Choose a Reputable Rental Provider

Picking where you rent your mining rigs is probably the most important decision you’ll make in this entire process. The market is a mix of solid, legitimate services and outright scams, and the only thing protecting your investment is your own due diligence. Think of it like hiring a contractor for a big home project—you wouldn’t just go with the cheapest quote without meticulously checking their work history, reviews, and credentials first.

The same mindset applies here. A great provider isn’t just selling you hashrate; they’re selling trust, reliability, and transparency. Your job is to find a partner who actually delivers what they promise, making sure the computational power you’re paying for is consistently working on your behalf.

Core Criteria for Vetting Providers

To cut through the noise and separate the good actors from the risky ventures, you need to focus on a few non-negotiable criteria. These are the pillars of a trustworthy operation and will give you a clear framework for making a smart choice.

- Transparent Pricing: A trustworthy provider puts all the costs right on the table. You should easily find a clear breakdown of the hashrate cost and any separate fees for maintenance or electricity. If the pricing feels confusing or you suspect fees are buried in the fine print, that’s a huge red flag.

- Verifiable Hardware: Real services are proud of the infrastructure they’ve built. They should be able to prove they own and operate actual mining hardware. The acid test? Ask if you can point your rented hashrate to any third-party mining pool you want. This lets you independently verify the output and confirm you’re getting what you paid for.

- Real Community Reviews: Look way beyond the hand-picked testimonials on their website. Dig into forums like Reddit, Bitcointalk, and active Discord channels to see what actual users are saying. A consistent track record of positive feedback on payouts, support, and uptime is one of the strongest signals of a reliable company.

- Responsive Customer Support: Before you send them a dime, test their support. Shoot them a few specific, technical questions through their email or support portal. A prompt, knowledgeable, and genuinely helpful response shows they actually care about their customers and are ready to handle problems when they pop up.

Key Takeaway: A provider’s legitimacy shines through in their actions. You’re looking for transparent pricing, the ability to direct hashrate to your own pool, strong community validation, and accessible support. These are the hallmarks of a service you can actually trust.

Red Flags to Watch Out For

Knowing what to look for is only half the battle; you also need to know what to avoid. Scammers often use the same old tricks designed to prey on the optimism of newcomers. Keep a sharp eye out for these warning signs:

- Guaranteed Returns: This is the big one. If you see this, run. No one can guarantee profits in crypto mining. Market prices and network difficulty are in constant flux, which makes promising a fixed ROI not just impossible, but dishonest.

- Vague Contract Terms: Your rental agreement should be crystal clear. It needs to spell out the exact hashrate, duration, total cost, and payout conditions. Ambiguous language is usually a deliberate tactic to confuse you and hide terms that work against you.

- Mandatory In-House Pools: If a provider forces you to use their own private mining pool, you lose any ability to independently verify your hashrate. This is a classic move by fraudulent operations to show you a fancy dashboard with fake numbers while no real mining is happening behind the scenes.

The Growing Market and Provider Stability

The demand for mining rentals is exploding. The whole crypto hardware market is projected to grow by an incredible USD 19.77 billion by 2029, with rentals being a huge piece of that pie, especially in North America and Asia. This boom means more providers are jumping in, making your vetting process more crucial than ever. For more on this trend, you can find great insights into the growth of the crypto hardware market on Technavio.

Post-halving economics, where miners earn less Bitcoin per block, have also pushed many smaller operators toward rentals. It’s their only viable way to access powerful new hardware like the 200 TH/s Antminer S21 without shelling out a fortune upfront.

When you’re comparing providers, look for signs of stability and a long-term vision. For instance, services that invest in facilities powered by renewable energy often have more predictable electricity costs, which can mean more stable maintenance fees for you. A provider with a clear physical footprint and a commitment to sustainable practices is almost always a more reliable long-term partner than some anonymous outfit with a slick website. Ultimately, your choice of provider is what will make or break your potential for success.

A Step-by-Step Guide to Your First Rental

Renting your first mining rig can seem daunting, but it’s a surprisingly straightforward process once you know the steps. I’m going to walk you through the entire journey, from picking a service to seeing your first rewards roll in. Think of this as a practical checklist to get a rental up and running in under an hour.

This isn’t just about clicking a few buttons. It’s about learning how to point a massive amount of computational power where you want it to go and start earning crypto. Let’s break it down into five clear steps.

Step 1: Select a Provider and Create an Account

First things first, you need to choose where you’ll rent from. Go back to the criteria we discussed earlier—look for transparency, verifiable hardware, and solid community feedback. Once you’ve landed on a service you trust, signing up is usually a breeze. You’ll give them the basics like an email address and set a strong password. Most reputable platforms will push you to set up two-factor authentication (2FA). Don’t skip this. It’s a critical layer of security for protecting your account and your funds.

Step 2: Choose Your Cryptocurrency and Rental Plan

With your account set up, it’s time for the fun part: deciding what to mine and how much firepower you want. Rental services typically operate like a marketplace where you can browse available hashrate for different algorithms, like SHA-256 for Bitcoin or Scrypt for Litecoin.

Here, you’re making two key calls:

- Hashrate Amount: How much raw power do you need? This is measured in terahashes per second (TH/s) or megahashes per second (MH/s).

- Rental Duration: For how long? You can often rent for as little as 24 hours or go for longer terms like a week or more.

My advice? Start small. A short, low-hashrate rental is the perfect way to test the waters. It lets you verify that everything is working correctly before you commit to a bigger contract.

Step 3: Configure Your Mining Pool Details

This is the most important technical step, so pay close attention. You have to tell the rental service where to aim all that hashrate. This is done by giving them your mining pool’s connection details, which are always a stratum address and a worker name.

Key Insight: Using your own third-party mining pool isn’t optional—it’s essential. It’s the only way to independently verify that you’re getting the hashrate you paid for. This simple step separates legitimate services from sophisticated scams.

You’ll find the correct stratum address on your chosen pool’s “Help” or “Getting Started” page. The worker name is just an identifier you make up in your pool account (e.g., YourUsername.Rental1). You’ll copy and paste both of these into the rental provider’s dashboard.

Step 4: Complete Your Payment Securely

Once your pool details are locked in, the last step before going live is payment. Most mining rig rentals are paid for with cryptocurrency—usually Bitcoin or a stablecoin like USDT. The platform will generate a unique wallet address and show you the exact amount to send. Be meticulous here. Double-check the address and make sure you send the precise amount requested. As soon as your transaction gets a few confirmations on the blockchain, your rental contract will kick in automatically.

Step 5: Monitor Your Hashrate and Payouts

Your rental is now live and hashing away. Time to make sure you’re getting what you paid for. You need to watch your hashrate in two places:

- The Rental Provider’s Dashboard: This shows the hashrate they claim to be delivering.

- Your Mining Pool’s Dashboard: This is your source of truth. It shows the hashrate your worker is actually receiving.

These two numbers should be very close. Small fluctuations are perfectly normal, but if you see a big, sustained difference, it could signal a problem with the provider. As your rented rig churns out work, you’ll see your pending rewards build up in your pool account, ready to be paid out on the pool’s schedule.

How to Pair Rentals with the Right Mining Pool

Maximizing your profit from a mining rig rental is a two-part equation. It’s not just about leasing a chunk of hashrate; it’s about pointing that power at the right target. Your choice of a mining pool is every bit as critical as the rental provider you pick.

Think of it like this: your rented hashrate is a high-performance engine, but the mining pool is the racetrack. The condition of that track—its fees, reliability, and most importantly, its payout rules—directly determines whether you win the race or run out of gas.

Renting gives you incredible flexibility, but it also means the clock is always ticking. Every single minute of a short-term contract has to count. Pointing your powerful, temporary hashrate at an inefficient or unstable pool is like paying for a Formula 1 car and driving it on a muddy backroad. You’re just wasting potential and, ultimately, losing money.

Comparing Pool Payout Models

Not all mining pools are built the same. The single biggest difference you’ll find is in how they pay their miners. This payout model dictates how stable and predictable your income will be, which is a make-or-break factor when you’re renting hashrate. You’ll almost always run into one of these three models:

- Pay Per Share (PPS): You get paid for every valid share your rented hardware submits, period. It doesn’t matter if the pool finds a block or not. This model offers the most predictable and steady income.

- Pay Per Last N Shares (PPLNS): You only get paid when the pool actually finds a block, based on how many shares you contributed in the time leading up to the find. This model injects a huge amount of luck into the equation.

- Full Pay Per Share (FPPS): This is a hybrid. It gives you the steady income of PPS for the block reward plus a share of the transaction fees from any blocks the pool successfully mines.

For a more granular look at these structures, our guide explaining how to join a mining pool breaks down the mechanics behind each one in great detail.

Which Payout Model Works Best for Rental Miners

When you’re working with a short-term rental contract, predictability is everything. You have a fixed cost and a limited window to earn it back and turn a profit. This is exactly why the Pay Per Share (PPS) model is almost always the best choice for renters. It strips away the uncertainty and lets you focus on pure hashrate-to-income conversion.

Key Insight: PPS takes pool luck completely out of your profitability calculation. You get paid for the work you do, full stop. This aligns perfectly with the fixed-term, fixed-cost nature of a rental contract, ensuring you earn a steady, measurable income stream for the entire duration of your lease.

PPLNS, on the other hand, is a massive gamble for renters. Your rental contract could expire just moments before the pool finds a block, leaving you with zero earnings for all the hashrate you paid for. This high variance is the enemy of the precise financial arbitrage that successful renting depends on. The table below clearly shows why one model is a safe bet while others introduce risk you just don’t need.

| Payout Model | How It Works | Pros for Renters | Cons for Renters |

|---|---|---|---|

| PPS | Pays for every valid share submitted. | Guaranteed, predictable income. Makes ROI calculation straightforward and reliable. | Rewards can be slightly lower to compensate the pool for taking on all the risk. |

| PPLNS | Pays a percentage of blocks found based on shares submitted. | Can offer higher rewards if the pool gets very lucky during your rental period. | Highly volatile. You could easily earn nothing if your contract ends before a block is found. |

| FPPS | Pays for shares plus a portion of transaction fees. | Blends stability with the potential for higher rewards from transaction fees. | Can still have some variance and is less common than pure PPS, making options limited. |

Ultimately, choosing PPS allows you to build a financial model you can trust. You know the cost of the hashrate and you know the income it will generate per hour, making your profit (or loss) crystal clear.

Connecting Your Rental to the Pool

The final step is the simple technical setup. When you’re checking out on the rental platform, you’ll be asked for your mining pool’s connection details. You just need two pieces of information from your mining pool account:

- Stratum Address: This is the server URL and port number that tells the mining hardware where to connect. It typically looks something like

stratum+tcp://pool.example.com:3333. - Worker Name: This is your personal identifier. It usually follows the format

YourUsername.WorkerName, for example,Miner123.RentalRig1.

You simply copy these two strings from your mining pool’s “Getting Started” or “Connect” page and paste them into the configuration fields on the rental site. Once you confirm the rental, the provider’s system automatically points all that hashrate to your pool account. You can then log into your pool’s dashboard and watch in real-time as your rented power starts submitting shares and earning you crypto.

Understanding the Risks and Legal Considerations

Let’s not sugarcoat it: renting a mining rig isn’t a guaranteed path to riches. Just like any other financial venture, it comes with its own set of risks. While leasing hashrate is a fantastic way to get into the mining game without buying expensive hardware, you need to go in with your eyes wide open. These aren’t reasons to avoid rentals, but you absolutely need a solid plan to handle them.

The biggest hurdle, without a doubt, is market volatility. Crypto prices are notorious for their wild swings. You could lock in a rental contract that looks incredibly profitable, only for the coin’s price to crash the next day. Suddenly, you’re paying more for the rental than the crypto you’re mining is worth. That’s a fundamental risk you take on the moment you sign the contract.

Navigating Market and Technical Hurdles

Beyond the market’s mood swings, there are technical factors that can chip away at your profits if you aren’t watching closely.

- Rising Network Difficulty: Think of this as more people showing up to the same gold rush. As a cryptocurrency network grows and more miners join, the protocol automatically makes it harder to find a block. This means the same amount of hashrate you rented will earn you less and less crypto over time. It’s not a possibility; it’s a mathematical certainty built into the system.

- Provider Failures and Scams: The rental space has its fair share of shady operators. A provider might just disappear overnight, or a slick-looking website could be an elaborate scam from the start. This is precisely why doing your homework on a provider is non-negotiable. Proper vetting is your first and best line of defense against losing your investment.

Key Summary: To succeed with mining rentals, you have to actively manage three core risks: the unpredictable price of crypto, the inevitable increase in network difficulty, and the very real possibility of a provider being unreliable or fraudulent. Renting makes mining accessible, but it doesn’t sidestep the core economic challenges of the industry.

Legal and Tax Obligations

Here’s an area that trips up a lot of newcomers: your legal and tax duties. The crypto you earn isn’t free money in the eyes of the government. In most places, it’s treated as taxable income.

The specific rules can be a tangled mess and change from one country to the next. Typically, the fair market value of the coins at the moment they land in your wallet is considered income. Ignoring this can lead to some very unpleasant conversations with tax agencies, not to mention hefty penalties.

Ultimately, it’s your responsibility to know the law where you live. Seriously consider talking to a tax professional who knows their way around digital assets. It’s a small investment that can save you a fortune and a massive headache later on by ensuring you’re tracking everything correctly and staying compliant.

So, where does that leave us? Mining rig rentals are a powerful and flexible tool for entering the crypto world. They dramatically lower the barrier to entry. But that power and flexibility come with risks that you must actively manage. If you do your due diligence, run the numbers on your potential ROI, and keep your legal house in order, you can turn rentals into a successful part of your crypto strategy.

Frequently Asked Questions (FAQ)

Let’s tackle some of the most common questions that pop up when people start looking into renting mining rigs.

Can I Rent a Rig for Any Cryptocurrency?

Not exactly. The crypto you can mine is tied directly to the hardware you rent. Most rental services offer rigs for the big players like Bitcoin (SHA-256 algorithm) or Litecoin/Dogecoin (Scrypt algorithm).

If you’re looking to mine something else, you’ll need to find a provider that rents out hardware compatible with that specific coin’s algorithm. Always double-check a service’s list of supported algorithms before you commit to anything.

What Happens if the Coin I’m Mining Crashes?

This is where the risk really comes into play. If the price of the coin you’re mining takes a nosedive, your rental can quickly become unprofitable. The harsh reality is that your mining rewards might end up being worth less than what you’re paying for the rental. Even if that happens, you’re still on the hook for the full cost of the contract you signed.

Pro Tip: Many miners weather these storms by holding onto their mined coins, betting on a future price recovery. But you absolutely must account for this volatility before you rent. Run the numbers on a few worst-case scenarios to see if you can handle the potential downside.

How Do I Know I’m Getting the Hashrate I Paid For?

This is a great question, and it’s all about verification. Any trustworthy rental provider will let you point the hashrate you’ve rented to your own account at a third-party mining pool.

Once you’re set up, you can simply log into that pool’s dashboard and watch your hashrate in real-time. If the numbers on the pool’s site consistently match what’s in your rental agreement, you can be confident you’re getting exactly what you paid for. It’s the ultimate proof of performance.