How to Start Crypto Mining

So, you’re thinking about getting into crypto mining. In a nutshell, crypto mining is the process of using powerful computers to solve incredibly complex math problems. This work is essential—it secures a cryptocurrency’s network and validates all its transactions. In return for your computational heavy lifting, you get rewarded with brand-new coins.

But getting started involves more than just plugging in a machine. It demands the right hardware, the right software, and a clear-eyed strategy to make sure you actually turn a profit. This guide will walk you through everything you need to know.

Your First Steps in Crypto Mining

Before you even think about buying a rig or downloading software, you need to wrap your head around what’s actually happening under the hood. Crypto mining isn’t some digital magic trick; it’s the engine that powers many of the biggest cryptocurrencies through a consensus mechanism called Proof-of-Work (PoW).

Think of it like a massive, global competition. In a PoW system, miners like you are all racing to solve the same cryptographic puzzle. The first one to crack it gets to add the next “block” of transactions to the blockchain and collects a reward for their effort. This intense competition is precisely what makes the network so secure—to cheat the system, you’d need to out-compute everyone else, which is practically impossible.

Key Concepts You Need to Grasp

Get these core terms down, and the rest of the process will make a lot more sense. It’s the language of mining, and knowing it will help you make much smarter decisions down the road.

- Hash Rate: This is your machine’s raw power—the speed at which it can guess solutions to the puzzle. A higher hash rate gives you a better shot at winning the race. For serious hardware, this is often measured in terahashes per second (TH/s).

- Network Difficulty: This is a self-adjusting metric that keeps the network on schedule. For Bitcoin, it’s designed to ensure a new block is found roughly every 10 minutes. When more miners jump in, the total hash rate goes up, so the network automatically increases the difficulty to keep that 10-minute target.

- Mining Pool: Going it alone as a solo miner is like trying to win the Powerball. The odds are astronomically against you. Instead, you join a mining pool, where you combine your hash rate with thousands of other miners. This drastically increases the group’s chances of solving a block, and the rewards are then split fairly based on how much work each person contributed.

My Two Cents: For anyone new to this, joining a mining pool isn’t just a good idea—it’s the only practical way to start. It turns mining from a high-stakes gamble into a source of smaller, more consistent payouts.

In summary, successful mining boils down to a simple formula: the crypto you earn must be worth more than what you spend on electricity and hardware to get it. Now that you have the basic concepts down, let’s look at the gear that makes it all happen.

Choosing Your Mining Hardware: ASIC vs. GPU Rigs

The very first—and most critical—decision on your mining journey is picking the right hardware. This single choice will define everything that comes after: which coins you can mine, how much you’ll spend upfront, what your monthly power bill looks like, and ultimately, whether you turn a profit.

The whole debate boils down to two types of hardware: Application-Specific Integrated Circuit (ASIC) miners and Graphics Processing Unit (GPU) rigs.

An ASIC miner is a piece of hardware built for one job and one job only: mining a specific crypto algorithm with brutal efficiency. Think of it as a specialized tool. You wouldn’t use a sledgehammer for finish carpentry, and you wouldn’t use a Bitcoin ASIC to mine anything else. It’s purpose-built for maximum power on a single task, like mining Bitcoin on the SHA-256 algorithm.

A GPU mining rig, on the other hand, is the Swiss Army knife of the mining world. It’s essentially a custom PC loaded with the same high-end graphics cards that gamers and video editors use. While it can’t compete with an ASIC’s raw, specialized power, its strength lies in its incredible flexibility. You can pivot to mine hundreds of different altcoins, adapting on the fly as the market shifts.

This flowchart gives you a simple way to think about where you’re starting from.

It helps frame the decision: are you ready to jump in and build, or do you need to spend a bit more time learning the fundamentals?

Diving Deep into ASIC Miners

ASICs are the undisputed heavyweights, especially for mining giants like Bitcoin. Their main draw is a combination of massive hash rate (mining power) and incredible power efficiency. A single, modern ASIC from a manufacturer like Bitmain can outperform thousands of GPUs put together, all while using less electricity per hash.

But that specialization is a double-edged sword. Here are the trade-offs you have to accept:

- Serious Upfront Cost: Top-of-the-line ASICs are not cheap. Expect to pay thousands of dollars for a new, efficient unit.

- Zero Flexibility: If the coin you’re mining crashes or the network’s algorithm changes, your very expensive machine could become a very expensive paperweight overnight.

- They’re Industrial Machines: ASICs are LOUD and pump out an enormous amount of heat. They belong in a dedicated space like a garage or workshop, not your living room.

An ASIC makes sense if you’re serious about mining a specific, dominant coin like Bitcoin and have the capital and dedicated space to run an industrial-grade machine.

The ASIC market itself is constantly changing. After the 2024 Bitcoin halving, for example, many feared profits would disappear. Instead, a rising Bitcoin price and more efficient machines helped miners stay in the black. In fact, data shows the cost for the best hardware fell from around $80 per terahash (TH) in 2022 to a projected $16 per TH by 2025, making elite hardware more affordable. You can find excellent industry analyses that dig into the profitability trends.

The All-Arounder: GPU Rigs

GPU rigs bring a totally different philosophy to the table: versatility. The ability to switch between coins with a few software adjustments is a massive advantage in a market as volatile as crypto. You aren’t tied to the fate of a single project.

This is why so many hobbyists and newcomers get their start with GPUs:

- Lower Barrier to Entry: You don’t need thousands of dollars to begin. You can start with a single graphics card and add more to your rig as you go.

- Great Resale Value: High-end GPUs are always in demand for PC gaming and creative work. If you decide mining isn’t for you, you can easily sell your cards and get a good chunk of your investment back.

- Home-Friendly: A multi-GPU rig still needs proper cooling, but it’s a world away from the deafening roar of an ASIC. It’s a setup you can realistically run at home.

The main downside? Efficiency. On a watt-for-watt basis, a GPU rig simply can’t match the hash rate of an ASIC when mining a compatible algorithm.

ASIC Miners vs. GPU Rigs: A Head-to-Head Comparison

Choosing the right path comes down to your personal goals, budget, and how hands-on you want to be. This table lays out the core differences to help you decide.

| Feature | ASIC Miners | GPU Mining Rigs |

|---|---|---|

| Primary Use Case | Mining one specific algorithm (e.g., Bitcoin) with maximum efficiency. | Mining various altcoins with the flexibility to switch. |

| Initial Cost | High. A single modern unit can cost $3,000 – $10,000+. | Scalable. Can start with one GPU for under $1,000 and expand. |

| Efficiency | Extremely high hash rate per watt of power consumed. | Lower hash rate per watt; less power-efficient than ASICs. |

| Flexibility | Very low. Locked into a single algorithm. | High. Can mine any GPU-friendly coin and switch easily. |

| Resale Value | Low. Value is tied directly to the profitability of one coin. | High. Strong secondary market for gaming and professional use. |

| Technical Skill | Simpler setup; often “plug-and-play” but requires industrial environment. | More complex to build and configure but manageable at home. |

Ultimately, there’s no single “best” choice—only the best choice for you. An ASIC is a high-risk, high-reward commitment to a single coin, while a GPU rig offers a more adaptable and forgiving entry into the world of crypto mining.

Crunching the Numbers: Profitability and Costs

So, you’ve picked your hardware. Now comes the part that separates the successful miners from those with a very expensive, very loud space heater. Before you buy anything, you have to treat this like a business and run the numbers.

It’s easy to get caught up in the excitement of potential earnings, but many newcomers stumble because they don’t get a realistic picture of the costs involved. Profitability isn’t just about the coin’s price; it’s a constant balancing act between what you earn and what you spend.

The Main Levers of Profitability

Your mining operation’s success really boils down to four key factors. You absolutely have to get a firm grip on these before you start.

- Hardware Efficiency (Hash Rate vs. Power Draw): This is the core metric of any mining rig. It’s all about how much hashing power you get for every watt of electricity you pull from the wall. More efficient hardware simply means more crypto for less cost.

- Electricity Cost ($/kWh): This is the big one. Your power bill will likely be your largest ongoing expense, and it can single-handedly determine if you make money or lose it. Even a few cents per kilowatt-hour ($/kWh) makes a massive difference. Honestly, if your rate isn’t below $0.10/kWh, it’s going to be a tough climb.

- Network Difficulty and Coin Price: These two are always moving. As more miners jump onto a network, its difficulty rises, and your slice of the rewards gets smaller. A bull run in the coin’s price can more than make up for it, but you have to be ready for the market’s wild swings.

- Mining Pool Fees: You’ll need a pool for consistent payouts, but they take a cut. Most charge between 1-3% of your earnings, which comes right off the top of your revenue.

Key Takeaway: Profitability is a moving target. You have to constantly keep an eye on these numbers, especially your power costs and the network difficulty. What’s profitable today might not be next month.

Using Profitability Calculators the Right Way

Online profitability calculators are a miner’s best friend, but they have one major flaw: they’re only as accurate as the numbers you feed them. Garbage in, garbage out.

Let’s run through a quick, practical example for a single GPU mining an altcoin to see how it works.

Example Scenario: Mining with a Single GPU

| Variable | Input Value | Notes |

|---|---|---|

| Hardware | NVIDIA RTX 4080 | A solid, efficient card for mining a variety of coins. |

| Algorithm | KawPoW | Used by coins like Ravoin (RVN). |

| Hash Rate | 50 MH/s | A realistic estimate for this GPU on KawPoW. |

| Power Consumption | 250 Watts | What the card actually draws from the wall while mining. |

| Electricity Cost | $0.12/kWh | A fairly standard residential rate in many parts of the U.S. |

| Pool Fee | 1% | A common fee for a good mining pool. |

Once you plug these in, the calculator will spit out an estimated daily or monthly profit. Just remember, that number is a snapshot. You need to check back and re-run the calculation whenever the market moves.

The Hidden Costs New Miners Forget

Your main expenses are hardware and power, but a few other “gotchas” can sneak up on you and chip away at your profits.

- Cooling: Running hardware 24/7 generates a ton of heat. That means you’ll need good ventilation—fans, maybe even a dedicated AC unit—and that uses more electricity.

- Maintenance and Repairs: Things break. Fans die, power supplies burn out. It’s smart to set aside a small budget for inevitable repairs and replacements.

- Infrastructure Upgrades: A beast of an ASIC miner can’t just be plugged into any old wall socket. You might need to hire an electrician to install a dedicated 240V circuit. Don’t forget to factor in these one-off setup costs.

By mapping out all your expenses—the obvious and the hidden—you can build a true financial picture and decide if mining is right for you. A great place to start your research is to check out the stats for different coins on platforms like MiningPoolStats to find one that fits your hardware and electricity costs.

Getting Your Rig Online: Software and Mining Pools

You’ve done the hard part—choosing your hardware and running the numbers. Now for the fun part: bringing your rig to life. This involves installing the software that acts as the brain for your hardware and connecting to a mining pool, which is essential for consistent returns.

Think of it this way: your mining software is the engine, and the mining pool is the road. The software pushes your hardware to solve complex problems, but the pool is what connects you to the network and, more importantly, to the block rewards. Solo mining is like trying to win the lottery; for 99% of people, joining a pool is the only way to turn mining into a predictable venture.

Choosing Your Mining Software

The software you’ll use depends entirely on your hardware. If you bought an ASIC, you’re in luck. Most of them come with software pre-installed. You just log into a web dashboard, plug in your pool details and wallet address, and you’re off to the races.

For GPU miners, however, you have more choices, and your pick can make a real difference in performance. Here are a few popular options:

- For Beginners (NiceHash Miner): This is the most user-friendly option. It automatically tests your GPU, figures out what coin is most profitable to mine at any given moment, and pays you out in Bitcoin. Simple.

- For NVIDIA Users (T-Rex Miner): A long-time favorite in the NVIDIA community, known for rock-solid stability and performance.

- For AMD Users (TeamRedMiner): If you’re running AMD cards, this is your go-to. It’s built from the ground up for AMD’s architecture and is highly optimized.

- For CPU Mining (XMRig): While primarily the king of Monero (XMR) CPU mining, this open-source tool is versatile enough to support GPUs on other algorithms, too.

Getting set up usually involves downloading a zip file, extracting it, and then tweaking a configuration file (typically a .bat file on Windows). This is where you’ll tell the software which pool server to connect to, what your crypto wallet address is, and give your machine a unique “worker name.”

A word of warning: only download mining software from the developer’s official source, like their GitHub page. Shady forums and random links are often filled with malware that will skim your earnings or, worse, compromise your entire PC.

Why Mining Pools Are a Must

So, what is a mining pool? It’s a group of miners who all agree to pool their computing power (hash rate). By working together, the group has a much, much higher chance of finding a block and earning the reward.

When the pool finds a block, that reward is split among everyone based on how much work they contributed. This completely changes the game. Instead of a lottery ticket, mining becomes a steady, predictable source of income. You could mine for years on your own and never see a dime. With a pool, you’ll start seeing small, regular payouts, often within a day.

How to Pick the Right Mining Pool

Not all pools are created equal. Your choice here directly impacts your bottom line, so don’t just pick one at random. Here are four key things to look for:

- Payout Model: This is how you get paid. The big two are Pay-Per-Last-N-Shares (PPLNS) and Pay-Per-Share (PPS). PPLNS can be more profitable when the pool is on a lucky streak but is more volatile. PPS gives you a guaranteed payout for every valid “share” of work you submit, making your income super stable.

- Pool Fees: Every pool takes a cut, usually between 0.5% and 2%. While lower is generally better, don’t let a 0% fee on an unknown pool tempt you. Reliability is often worth a slightly higher fee.

- Server Location & Latency (Ping): Physics matters. You want to connect to a pool server that’s geographically close to you. A high ping time means your completed work can arrive late, becoming a “stale share” you don’t get paid for. The lower the ping, the better.

- Reputation & Uptime: Go with pools that have been around the block. A pool with a solid history of consistent payouts and minimal downtime is what you’re after. If a pool is constantly offline, your miner is sitting idle, and you’re losing money.

A site like MiningPoolStats is an invaluable resource for comparing hundreds of pools, their fees, payout schemes, and supported coins. Here’s a quick comparison of two common pool types:

| Feature | ViaBTC (PPS+) | F2Pool (PPLNS) |

|---|---|---|

| Typical Fee | 4% | 2% |

| Payout Stability | High and predictable | Variable, depends on pool luck |

| Best For | Miners who want stable, guaranteed daily income. | Miners willing to accept some volatility for potentially higher long-term rewards. |

To wrap up: your software and pool are the final pieces of the puzzle. Choose user-friendly software to start, and always join a reputable mining pool to ensure you get paid consistently for your work. Don’t be afraid to experiment with different pools to see which one works best for you.

Setting Up Your Physical Mining Environment

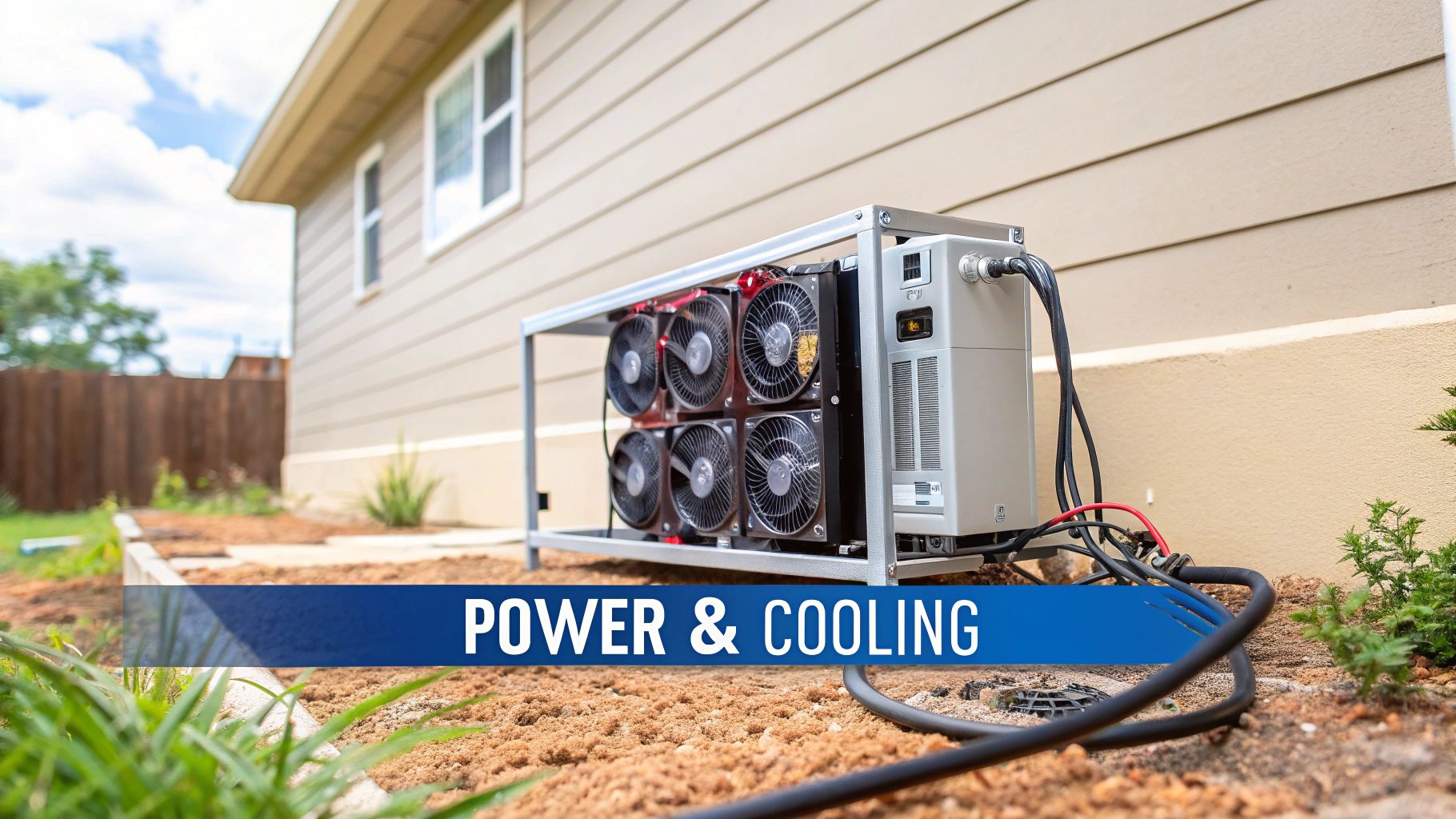

You’ve got the hardware, but that’s only half the battle. Your shiny new mining rig is useless without the right environment to support it. Ignoring the physical foundation of your operation can lead to fried components, constant shutdowns, and even fire hazards.

To keep your rig hashing safely and profitably 24/7, you have to get three things right: power, cooling, and location.

Power Delivery: The Lifeblood of Your Operation

Stable, clean power is non-negotiable. Standard household circuits simply aren’t built for the kind of continuous, heavy load that mining hardware draws.

Here’s what you need to focus on:

- Dedicated Circuits: Your rig needs its own circuit, period. This keeps it from battling for power with your refrigerator and constantly tripping the breaker. For any serious ASIC, you’ll need an electrician to install a 240V circuit—the same kind used for an electric stove or dryer.

- Quality Power Supply Units (PSUs): Never skimp on the PSU. A cheap, inefficient unit bleeds money by wasting electricity as heat and can fail catastrophically, taking your expensive GPUs or ASIC down with it. Always aim for a PSU with an 80 Plus Gold rating or better.

- Power Protection: A quality surge protector is the bare minimum. A much better investment is an uninterruptible power supply (UPS), which acts as a battery backup, allowing for a clean shutdown during a power outage and shielding your rig from voltage spikes.

Airflow and Cooling: Taming the Heat

Your hardware is going to be running full-throttle, which means it will generate a ton of heat. If you can’t get that heat away from the components effectively, they will automatically slow down to save themselves, tanking your hash rate and profitability. Sustained high temperatures will also drastically shorten the lifespan of your investment.

Your cooling strategy will change based on the size of your operation.

| Setup Scale | Primary Cooling Method | Key Considerations |

|---|---|---|

| Single GPU Rig | Case Fans & Good Ventilation | An open-air mining frame is infinitely better than a closed PC case. Make sure the room itself has decent airflow. |

| Multi-GPU Rig | High-CFM Box Fans | Strategically place powerful fans to create a wind tunnel, forcing cool air over the components and exhausting hot air away. |

| ASIC Miner(s) | Dedicated Exhaust Ducting | The heat and noise from an ASIC are intense. Venting the hot exhaust directly outside with ducting isn’t optional; it’s essential. |

Pro Tip: Your ambient room temperature is a huge factor. A rig running in a cool basement will always outperform one struggling in a stuffy attic in July. Every single degree you can lower the intake air temperature directly translates to better performance and longevity.

Choosing the Right Location

Where you physically place your rig has massive implications for noise, heat, and security. A garage, basement, or a dedicated shed is usually the best bet, keeping the jet-engine-level noise and furnace-like heat out of your living space.

The location also ties into the bigger picture of your operation’s sustainability and cost-effectiveness. With Bitcoin mining’s significant energy footprint—which you can see in the global consumption data from Statista—your choice of location matters. Setting up in a region with access to cheaper, renewable energy sources like hydro or solar can dramatically lower your operational costs and insulate you from volatile energy prices.

Getting Right with the Law and the Tax Man

It’s easy to get lost in the thrill of watching your first payouts roll in. But here’s the reality check many miners get too late: you’re effectively running a small business, and that comes with some serious legal and tax responsibilities.

Ignoring this part of the game is one of the biggest mistakes you can make. The rules around crypto are constantly shifting and can change drastically depending on where you live. Getting professional advice isn’t just a smart move; it’s essential.

How to Handle Your Tax Obligations

In most places, like the United States, the tax authorities see mined crypto as income. That means the moment a coin hits your wallet, the clock starts ticking on your tax liability. You owe tax on its fair market value at the exact time you received it.

Here’s how that breaks down in practice:

- Log Everything: Get into the habit of tracking every coin you mine. You need a detailed log: the date, the amount, and its value in your local currency on that day.

- Deduct Your Expenses: The silver lining is that your mining costs are usually business expenses you can write off. This includes the hardware itself (which you’ll depreciate), your electricity bill, pool fees, and any repairs.

- Selling is a Separate Tax Event: When you decide to sell or trade that crypto later on, you’ve created a second taxable event. This is where capital gains (or losses) come in. The tax is based on the difference between its value when you sold it versus its value back when you first mined it.

A Word of Caution: I’m a miner, not a CPA. This is just to give you a lay of the land. Tax laws are incredibly complex and change based on your location. Do yourself a favor and find a qualified tax professional who actually understands cryptocurrency.

Why Your Location Matters—A Lot

Where you plug in your rig is probably one of the biggest factors determining your long-term success. The whole landscape of crypto mining has been reshaped by regulatory crackdowns and the hunt for cheap power.

As of 2025, the United States has become a dominant force in the global hash rate, with massive farms popping up in energy-friendly states like Texas and Georgia.

Ultimately, staying on the right side of the law means doing your homework. Dig into local energy regulations, check for zoning laws about noise (ASICs are loud!), and keep an eye on national policies. Spending time on this due diligence is just as crucial as picking the right GPU or joining the perfect mining pool.

Got Questions About Crypto Mining? We’ve Got Answers

Stepping into the world of crypto mining can feel like learning a new language. You’re bound to have questions. Here are some straightforward answers to the things most newcomers are wondering about.

Is Crypto Mining Still Worth It for a Small-Scale Miner?

Profitability is a tightrope walk these days, but it’s not impossible. If you’re going to succeed as a small-time miner, everything comes down to two things: finding dirt-cheap electricity (we’re talking under $0.05 per kWh) and using the absolute newest, most efficient hardware you can get.

Trying to mine Bitcoin at home is a tough game. You’re up against massive, industrial-scale operations. Realistically, your best bet is often mining newer or less-known altcoins with a GPU rig. Get in early on a promising project, and you might find a sweet spot.

Key Takeaway: Before you spend a dime, punch your numbers into a real-time profitability calculator. The math doesn’t lie.

What’s the Real Cost to Start Crypto Mining?

Your startup costs can be anywhere from under $1,000 to well over $10,000. It just depends on how serious you want to get.

You could piece together a decent single-GPU setup for somewhere between $800 and $2,000. But if you’re aiming for the big leagues with a modern ASIC miner for Bitcoin, you’re looking at a starting price of around $3,000, with top-of-the-line models costing much more.

Remember, that’s just for the miner itself. You also have to budget for the supporting cast: a beefier power supply, extra cooling fans, and maybe even some electrical work to handle the load. Buying used gear is a way to cut initial costs, but you’re trading that for lower efficiency and a machine that might not last as long.

Can I Just Mine on My Laptop or Gaming PC?

Technically, you can, but you absolutely shouldn’t. It’s a fantastic way to lose money and destroy your computer. Your standard CPU or consumer GPU simply doesn’t have the muscle to earn anything meaningful, and your power bill will quickly swallow any tiny amount you might make.

The real danger, though, is to your hardware. Mining puts your components under constant, extreme stress. This will cause them to overheat, dramatically shortening their lifespan and putting you at risk of permanent damage. Serious mining demands dedicated hardware built for the 24/7 grind.

What Kind of Technical Skills Do I Actually Need?

You don’t need to be a coding genius, but you do need to be technically inclined. If you’re comfortable building a PC from parts, installing an operating system, and aren’t afraid of a command line now and then, you’re on the right track.

Honestly, the most valuable skill is good old-fashioned troubleshooting. Things will go wrong. Hardware will crash, software will have conflicts, and your network will drop. You have to be patient and willing to diagnose problems as they pop up. Think of it less like an appliance you just turn on and more like a high-performance car that needs constant tuning and attention.