How to Mine Ripple

If you’ve ever tried searching for “how to mine Ripple,” you’ve probably come up empty-handed. There’s a good reason for that: you can’t. Unlike Bitcoin and other Proof-of-Work (PoW) coins, all 100 billion XRP tokens were created when the network launched. This means traditional mining just isn’t part of its design.

So, what does that mean for you? It means you need to shift your approach. Instead of trying to mine it, you can participate in the network in other ways or use your mining hardware to acquire it indirectly. This guide will walk you through why XRP is unmineable and what you can do instead.

Why Mining Ripple (XRP) Is Not an Option

The core reason XRP can’t be mined lies in its fundamental architecture, which sets it apart from cryptocurrencies like Bitcoin. PoW networks rely on miners competing to solve complex mathematical problems to add new blocks to the chain and earn newly created coins as a reward. It’s an intensive, competitive process. If you want a deeper dive into how that works, our guide on what crypto mining is breaks it down further.

The XRP Ledger, however, operates on a system where every single coin already exists. Transactions are confirmed not by miners, but by a select group of independent servers called validators. These validators work together to agree on the state of the ledger, a process called the XRP Ledger Consensus Protocol.

Understanding The Pre-Mined Supply

Back in 2012, Ripple Labs created the entire supply of 100 billion XRP from the get-go. This “pre-mined” approach established a fixed, finite number of tokens right from the start.

This was a deliberate design choice aimed at building a blazingly fast and incredibly cheap system for international payments. Here’s why that matters:

- No Block Rewards: Since no new coins are ever generated, there’s no block reward for miners to pursue.

- Speed and Efficiency: This efficiency is what allows the network to process over 1,500 transactions per second for a cost that’s just a tiny fraction of a cent.

- Low Cost: Mining-based systems simply can’t compete with that level of speed and low cost.

You can learn more about XRP’s fixed supply model on Binance.

Key Takeaway: The hunt for an XRP mining rig is a dead end. The XRP Ledger’s consensus model, which uses validators instead of miners, was built for speed and efficiency. This makes it fundamentally incompatible with the energy-intensive PoW mining process.

Understanding this distinction is key. Instead of trying to mine the un-mineable, you can channel your energy into the legitimate, practical alternatives for acquiring XRP that we’ll cover next.

XRP Consensus vs. Bitcoin Mining: A Key Comparison

To really see the difference, it helps to put the two systems side-by-side. The contrast in their core designs makes it obvious why one is mineable and the other isn’t.

This table highlights the fundamental differences between how the two networks operate.

| Feature | Ripple (XRP) | Bitcoin (BTC) |

|---|---|---|

| Coin Creation | Pre-mined (100 billion total) | Mined via Proof-of-Work |

| Consensus Model | XRP Ledger Consensus Protocol | Proof-of-Work (PoW) |

| Participants | Trusted Validators | Miners |

| Transaction Speed | 3-5 seconds | ~10 minutes per block |

| Energy Use | Extremely low | Very high |

| Purpose | Fast, low-cost payments | Decentralized digital gold |

Ultimately, Ripple’s architecture was engineered for a specific job: enabling fast, reliable global financial settlements. This required a completely different technological foundation from Bitcoin’s. So, while you can’t fire up a mining rig for XRP, this guide will walk you through the real, effective strategies you can use to add it to your portfolio.

How the XRP Ledger Validates Transactions

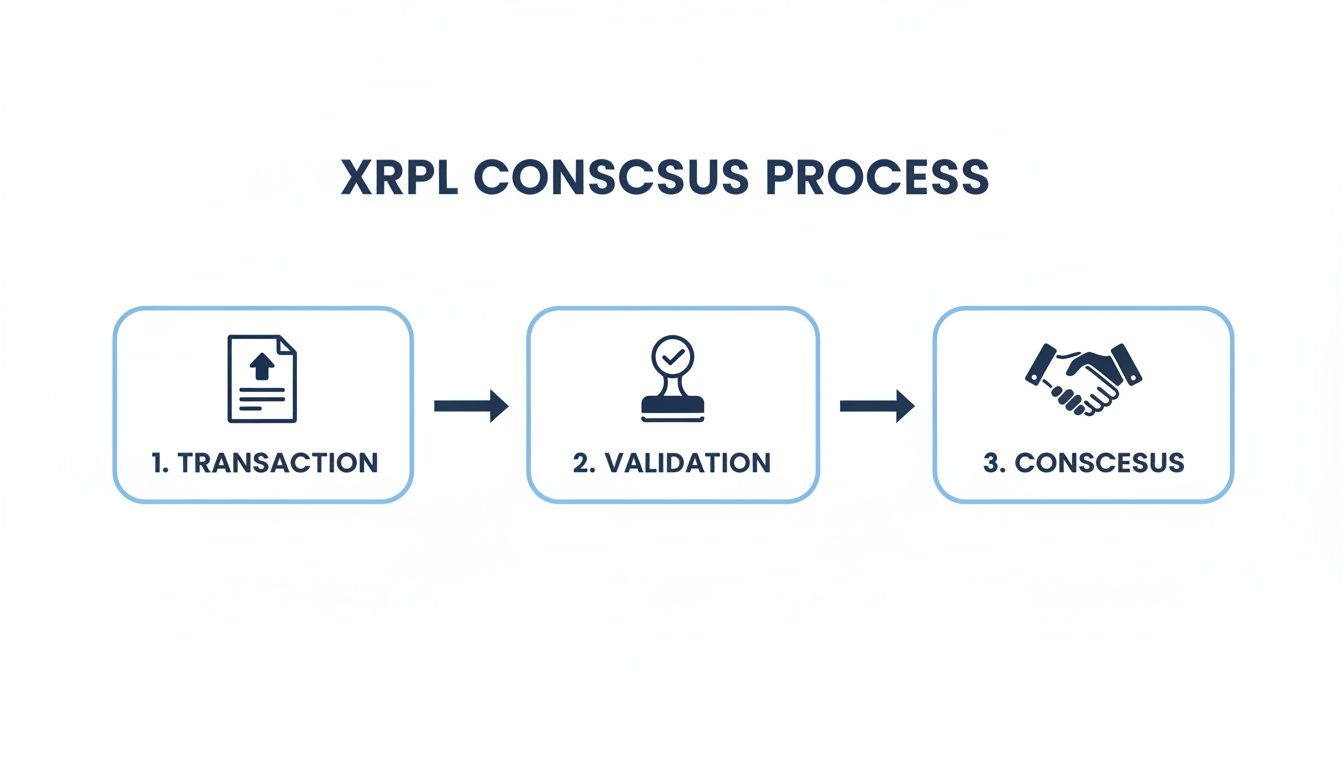

So, if traditional mining is out, how does the XRP Ledger actually work? It all comes down to a clever and incredibly efficient system designed to keep the network secure and lightning-fast. Instead of having miners compete against each other, the XRPL uses a cooperative process called the XRP Ledger Consensus Protocol.

This protocol is the engine that drives the network, and at its heart are independent servers known as validators. Forget the idea of miners chasing a block reward; validators are trusted participants whose entire job is to agree on which transactions are legitimate and in what order they should be recorded.

The Role of Validators

Think of validators as the guardians of the network’s integrity. Their role isn’t to solve complex puzzles but to compare notes and reach a consensus on the current state of the ledger.

It’s a surprisingly straightforward, multi-step dance:

- First, validators gather up all the pending transactions they see on the network and bundle them into a proposed list.

- Next, they share these lists with other trusted validators on their Unique Node List (UNL).

- Finally, they run through a rapid series of votes. For a transaction to be confirmed, it needs to get a “yes” from a supermajority—over 80%—of these trusted validators.

The entire thing wraps up in just 3-5 seconds. Once that threshold is met, a new ledger is “closed” and permanently recorded. It’s this collaborative approach that makes the energy-guzzling computations of Proof-of-Work completely unnecessary.

Key Takeaway: The XRP Ledger’s security and speed are built on cooperation, not competition. Validators work in concert to reach a consensus, verifying transactions almost instantly without the high energy costs or long confirmation times common in mining-based networks.

Built for Speed and Low Cost

This consensus mechanism was purpose-built for one thing: efficiency. It’s what allows Ripple to facilitate fast, cheap global payments. While events like Bitcoin’s halving on April 20, 2024, are all about managing scarcity up to its 21 million coin limit, XRP’s design is all about throughput and low fees.

We’re talking transaction costs as low as 0.0002 XRP. This rock-bottom cost structure has been a major factor in its adoption for remittances, particularly in the Asia Pacific and North America corridors. You can find more analysis on XRP’s specific market role from Grand View Research.

Getting your head around this system is important. It not only explains why searching for “how to mine Ripple” leads to a dead end but also points toward a legitimate way to support the network. While running a validator doesn’t come with a direct financial payout, it’s a meaningful way to contribute to the decentralization and robustness of the entire ecosystem—something we’ll get into later.

Alternative: Mine Other Coins and Trade for XRP

So, you’ve got the mining hardware but can’t point it directly at XRP. What’s the next best thing? The classic “mine-and-trade” strategy. It’s a popular workaround for a good reason: it lets you put your gear to use on a profitable Proof-of-Work (PoW) coin and then swap the spoils for the XRP you actually want.

This is essentially an indirect route to acquiring XRP. You’re leveraging the established mining ecosystem for coins like Bitcoin or Ethereum Classic to convert your electricity and computing power into XRP holdings. It’s a practical, hands-on approach that gives you full control over the process.

Step 1: Choose What to Mine

The first, and most important, decision is picking the right coin to mine. This isn’t a “set it and forget it” choice. The most profitable coin can shift weekly, or even daily, based on market fluctuations, network difficulty, and new hardware coming online. Your focus should be squarely on coins compatible with your hardware (GPU or ASIC) that promise a solid return.

For those running GPU rigs, a few consistent contenders usually pop up:

- Kaspa (KAS): A favorite in the GPU community, known for its unique blockDAG structure and fast transaction times.

- Ethereum Classic (ETC): After Ethereum’s move to Proof-of-Stake, ETC became a natural home for many GPU miners.

- Ravencoin (RVN): Specifically designed to be ASIC-resistant, which levels the playing field for anyone with a decent consumer-grade graphics card.

Don’t just guess, though. Your best friend here is a good online mining profitability calculator. These tools are indispensable. You plug in your hardware model, your electricity cost (a crucial variable!), and they crunch the numbers to show you real-time earnings estimates across dozens of different coins.

Step 2: Join a Mining Pool

Once you’ve picked your target, it’s time to join a mining pool. Unless you’re running a massive, warehouse-scale operation, going it alone (solo mining) is a bit like buying a single lottery ticket and expecting to win. The odds are just stacked against you.

A mining pool is a simple concept: you and thousands of other miners combine your computing power, or hashrate. By working together, the pool solves blocks much more frequently, and the rewards are then distributed among all participants based on their contribution. It turns a lottery into a steady, predictable trickle of income.

Finding a reliable pool is key to maximizing your efforts. Websites like MiningPoolStats are vital resources for this. You can compare pools by their total hashrate, fee structures, payout methods, and overall reputation in the community. If you’re just getting started with setting up the software and pointing your rig at a pool, this detailed guide on how to start crypto mining is a great primer.

Step 3: Swap Your Mined Coins for XRP

The final step is turning your hard-earned mining rewards into XRP. Once the payouts from your mining pool start hitting your wallet, you’ll need to move them to a cryptocurrency exchange to make the trade.

This part of the process requires careful attention to detail:

- Transfer: Send your mined coins (like ETC or KAS) from your personal wallet to your deposit address on a trusted exchange that lists both your mined coin and XRP.

- Trade: Execute a market trade to swap your mined coins for XRP.

- Withdraw: For security, withdraw your newly acquired XRP to a personal wallet that you control.

Just be meticulous. Always double- or triple-check wallet addresses before sending funds, and keep an eye on network and trading fees, as they can eat into your profits.

Running an XRP Ledger Validator

While you can’t mine XRP, you can get about as close as possible to the network’s core operations by running an XRP Ledger (XRPL) validator. This isn’t for the faint of heart, but it’s a powerful way to shift from being a passive holder to an active participant in the network’s health and security.

Let’s get one thing straight right away: running a validator is not a profit-making venture. There are no block rewards, no XRP payouts, and no direct financial compensation. The purpose here is purely ideological—to secure the network you’re invested in.

What Does a Validator Actually Do?

A validator is essentially a server running the XRPL software, constantly working to achieve consensus. Its job is to listen for new transactions, cross-reference them with other trusted validators, and cast a vote to confirm their legitimacy.

This whole process is what allows the network to agree on the state of the ledger every 3-5 seconds. It’s the engine room of the XRP Ledger, and its strength depends entirely on having a diverse, reliable, and geographically distributed set of these validators. More independent validators mean a more decentralized and resilient network.

Your motivation for running a validator shouldn’t be profit, but a desire to strengthen a network you believe in. It’s a contribution of resources and expertise to the community, helping maintain the integrity and speed of the XRP Ledger for everyone.

The Real-World Commitments Involved

Setting up a validator is a serious technical undertaking. It’s not a “set it and forget it” operation; it demands a real investment of time, resources, and technical know-how. You become personally responsible for keeping your validator secure, updated, and online.

Here’s a look at what you’re signing up for:

- Server Hardware: You’ll need a dedicated server, which for most people means a Virtual Private Server (VPS) from a cloud provider. The minimum specs are nothing to scoff at: think a multi-core CPU, at least 16 GB of RAM, and a speedy SSD with 50 GB of space to start.

- Technical Knowledge: This is non-negotiable. You need to be comfortable working with a Linux command line, understand server administration, and be well-versed in network security practices.

- Time and Maintenance: The job isn’t done after setup. You have to constantly monitor your server’s performance, apply software updates the moment they drop, and be ready to troubleshoot issues. A validator that’s frequently offline is eventually ignored by the network, rendering your efforts useless.

Ultimately, running a validator is the most direct way to support the XRPL in a way that feels analogous to mining. While it won’t add any XRP to your wallet, it gives you an unparalleled, firsthand view of the network’s inner workings and a tangible stake in its future success.

How to Buy XRP on a Reputable Exchange

Since you can’t mine XRP, the most common way people get it is by simply buying it. For anyone who wants to add XRP to their portfolio without the hassle of setting up hardware, purchasing it from a cryptocurrency exchange is the best path forward. It’s fast, accessible, and—if you’re careful—very secure.

The whole game here is about safety and efficiency. Picking the right exchange is your first and most important decision, as it dictates everything from your security to how much you’ll pay in fees.

Finding a Safe and Reliable Exchange

Let’s be clear: not all crypto exchanges are built the same. Your top priority has to be finding one that takes the security of your money and your personal data seriously. This is the bedrock of a good crypto experience.

When you’re vetting potential exchanges, here’s what you should be looking for:

- Rock-Solid Security: Non-negotiable features include mandatory Two-Factor Authentication (2FA). You also want to see that the exchange keeps the vast majority of its assets in cold storage (offline), which is a massive green light for their security practices.

- Clear and Low Fees: Exchanges charge fees to make money, and those fees can slowly chip away at your investment. Dig into their fee structure—some are better for frequent traders, others for large one-off purchases. Find a platform with competitive rates that match your plans.

- Community Reputation and Trust: Don’t just take the exchange’s word for it. See what actual users are saying online. A long track record of happy customers, good support, and compliance with financial regulations is a strong signal you’re in a safe place.

Expert Tip: I always tell people to run a small test transaction before moving any serious money. Deposit a small amount of cash, buy a little XRP, and then withdraw it to your own private wallet. This simple exercise lets you get a feel for the platform and confirms everything is working smoothly before you commit more funds.

Buying on an exchange is the most straightforward method, but you can also earn XRP through freelance platforms or online merchants that use it for payments. While less common, community airdrops are another potential avenue. These routes let you acquire XRP based on your skills or participation, not just a direct purchase.

Navigating Risks in the XRP Ecosystem

Venturing into any cryptocurrency means keeping your eyes wide open to the risks. The opportunities can be massive, but so are the potential pitfalls. When it comes to XRP, one of the most common and persistent dangers I see is the empty promise of “XRP cloud mining.”

Let’s be crystal clear: any platform claiming to let you rent hardware to mine a pre-mined coin like XRP is, without exception, a scam. It’s just not how the XRP Ledger works. These schemes are built to prey on newcomers who haven’t yet grasped the technical differences between consensus mechanisms. If you see a service promising guaranteed, high returns on XRP “mining,” run the other way.

Scams and Storage Security

Protecting your assets goes way beyond just spotting the obvious scams. The crypto market’s volatility is a risk you accept, but how you store your holdings is a risk you can—and must—control. This is where so many people, unfortunately, get it wrong.

Keep an eye out for these classic red flags that scream “scam”:

- Guaranteed high returns: Real crypto investing and trading involves market risk. Anyone promising guaranteed profits is lying.

- Vague company details: If you can’t find clear information on who runs the service or where they’re based, that’s a huge problem.

- Pressure to recruit others: Many of these operations are just pyramid schemes dressed up in crypto language, rewarding you for roping in new victims.

For anyone planning to hold XRP for the long term, leaving it on an exchange is a bad idea. You need to move your assets to a personal wallet where you—and only you—control the private keys. For serious security, a hardware wallet is the gold standard. These are physical devices that keep your keys completely offline, making them untouchable by online hackers.

Taxes and Financial Responsibility

Beyond scams and security, you absolutely have to think about the real-world financial side of things. Depending on where you live, nearly every transaction can be a taxable event. This includes selling your XRP, trading it for another crypto, or even converting a mined coin like Ethereum Classic into XRP.

This is why keeping detailed records is non-negotiable. You need to track the dates, amounts, and market values for all your transactions. Ignoring your tax obligations can lead to some painful penalties down the road. It might sound like a headache, but there are plenty of crypto tax software platforms out there that can make this a whole lot easier.

Key Takeaway: Being a responsible participant in the XRP ecosystem really comes down to vigilance. Protect your investment by using secure storage, learning to spot scams from a mile away, and staying on top of your local tax laws. A proactive mindset is the best defense for your hard-earned assets.

Frequently Asked Questions (FAQ)

1. Can you mine XRP with an ASIC?

No, you cannot mine XRP with an ASIC, GPU, or any other type of hardware. XRP is a pre-mined cryptocurrency, meaning its entire supply of 100 billion tokens was created at its launch. The network uses a consensus protocol, not mining, to validate transactions.

2. Is there any way to earn free XRP?

While there is no “XRP mining” to earn free coins, you can sometimes acquire XRP through other means like airdrops, participating in promotional campaigns on crypto exchanges, or earning it through freelance work on platforms that support XRP payments.

3. What is the difference between Ripple and XRP?

Ripple is the company that created the XRP Ledger and uses its technology for global payment solutions. XRP is the native digital asset of the XRP Ledger. Think of Ripple as the company and XRP as the cryptocurrency that powers the network.

4. How much XRP is left?

All 100 billion XRP were created at inception. However, the total supply is deflationary. A small amount of XRP is burned (permanently destroyed) as a transaction fee with every payment on the ledger. This means the total available supply is constantly, but very slowly, decreasing over time.

5. What are the best coins to mine and swap for XRP?

The “best” coin changes frequently based on market prices, network difficulty, and your specific hardware. Profitable GPU-mineable coins often include Ethereum Classic (ETC), Kaspa (KAS), and Ravencoin (RVN). Always use a real-time mining profitability calculator to determine the most profitable option for your setup before you begin.