Best Mining Pool for Beginners in 2026

Diving into cryptocurrency mining can feel like exploring a new frontier. You’ve got the hardware and the enthusiasm to earn crypto rewards, but one critical decision stands in your way: choosing a mining pool. For a newcomer, this choice is everything. A good pool simplifies a complex process, provides a stable income, and offers the support you need to start strong. On the flip side, the wrong pool can lead to frustration, unpredictable earnings, and confusion. This guide is here to clear that fog.

Our goal is to give you a clear, actionable roadmap for selecting the best mining pool for beginners. We’ll break down the most important factors you need to consider, making sure you understand them in plain English.

- Payout Models: We’ll explain the difference between systems like FPPS (Full Pay-Per-Share) and PPLNS (Pay-Per-Last-N-Shares) and what they mean for your wallet.

- Fee Structures: You’ll learn how much of your earnings go to the pool operator and how to spot a fair deal.

- User Interface (UI): A clean, intuitive dashboard is crucial for monitoring your hardware without getting overwhelmed.

- Minimum Payouts: This determines how often you can actually access your earned crypto.

We’ll evaluate leading platforms like NiceHash, F2Pool, and ViaBTC, providing direct links, screenshots, and easy-to-follow summaries for each. By the end, you’ll have the confidence to pick a platform that fits your hardware, goals, and technical skill level, ensuring your entry into crypto mining is both successful and rewarding.

1. NEOPool

NEOPool is a newer, engineering-first Bitcoin mining pool positioned around efficiency, low-latency infrastructure, and straightforward operations for miners who want predictable payouts without a complicated setup. It markets itself as an “advanced” pool built on deep mining expertise, with a focus on optimizing how work is distributed and how ASIC miners perform over time. For beginners, that positioning matters: instead of juggling coin selection or profit-switching, you connect your ASIC to a Bitcoin-focused pool and measure results in simple, repeatable metrics like accepted shares, effective hashrate, and daily payouts.

Another beginner-friendly element is accessibility. Third-party coverage of NEOPool highlights a low minimum withdrawal threshold (0.001 BTC) and daily, automatic payouts, which can make it easier for small and mid-size miners to “feel” progress without waiting weeks for a payout. The same coverage also claims “no hidden fees,” which is attractive, but it’s still smart to confirm the exact fee policy and payout terms inside the official NEOPool dashboard before moving significant hashrate.

Key Features and Payout Structure

NEOPool’s core promise is operational efficiency: it emphasizes infrastructure choices designed to reduce latency and improve share acceptance, and it highlights proprietary optimization methods intended to enhance overall mining performance. In practical terms, that means the pool is trying to compete on “effective hashrate” and stability rather than just brand recognition. If the pool delivers lower stale/rejected shares for your location, the difference can show up directly in more consistent daily revenue.

- Daily payouts: Reported as daily and automatic, which helps beginners track earnings with a predictable cadence.

- Low minimum payout: Reported minimum withdrawal threshold of 0.001 BTC, which is relatively beginner-friendly.

- Performance focus: NEOPool highlights proprietary optimization methods and efficiency-oriented mining operations.

- Fee clarity claim: Third-party coverage describes “no hidden fees,” but exact fees/payout rules should be verified directly in the pool interface.

Practical Tips for Effective Use

When testing NEOPool as a beginner, start with a controlled trial instead of moving everything at once. Point one miner (or a small portion of your farm) to NEOPool for 24–48 hours and compare three numbers against your current baseline: (1) stale/reject rate, (2) effective hashrate on the pool dashboard, and (3) the consistency of daily payouts. If the pool performs better on acceptance rate and effective hashrate, that usually translates into smoother earnings even if headline fee differences between pools look small.

Also treat any KYC requirements as a variable rather than an assumption. Some pools and platforms may require identity verification for certain withdrawal features or higher limits, so it’s worth checking the NEOPool account settings and withdrawal rules early—before you accumulate a balance you can’t easily move.

Conclusion: NEOPool is a solid alternative to “one-click marketplace” mining for beginners who want to mine Bitcoin directly, track results with clear daily payout cycles, and prioritize efficient infrastructure. Its best fit is for miners who prefer measuring performance (latency, acceptance rate, effective hashrate) and are willing to verify fee and withdrawal terms inside the platform before scaling up.

Official Website: https://neopool.com/

2. EMCD

EMCD is a multi-coin mining pool and “all-in-one” ecosystem that combines pool mining with a wallet and additional tools designed to simplify day-to-day operations for miners. On its official site, EMCD highlights a fixed pool fee of up to 1.5%, an FPPS payout model for Bitcoin, and “free coin withdrawals,” which together aim to make earnings more predictable and easier to manage—especially for newer miners who don’t want to fight payout variance from day one. Unlike hashrate marketplaces, EMCD is a traditional pool: you connect your ASICs directly and earn mining rewards based on the pool’s payout system.

For beginners, EMCD’s appeal is that it tries to remove friction after setup: daily payouts, a clear fee policy, and an integrated environment where rewards can land and then be managed without immediately jumping between unrelated third-party services. If the goal is to learn “classic pool mining” with stable accounting and predictable payout timing, this is a straightforward alternative to larger legacy pools.

Key Features and Payout Structure

On Bitcoin, EMCD states it uses FPPS, which typically means miners are paid a stable share-based income that includes both block subsidy and transaction fees under the pool’s method. EMCD also emphasizes a fixed fee “up to 1.5%” for BTC pool mining, which can be easier for beginners to model in a simple profitability spreadsheet. In its Help Center, EMCD explains that earnings are “фиксated” on a 24-hour cycle (00:00–00:00 UTC), and payouts are made daily within a scheduled time window.

- Payout model (BTC): FPPS.

- Pool fee (BTC): Fixed fee “up to 1.5%” (as stated by EMCD).

- Payout frequency: Daily payouts (processed within a set window).

- Minimum payout: EMCD markets daily payouts “with no fees from 0.001 BTC” (positioning it as beginner-friendly for smaller miners).

- Global stratum endpoints: EMCD provides regional stratum URLs (Russia/Europe/Kazakhstan/China/America) for BTC, which helps reduce latency and stale shares.

Practical Tips for Effective Use

When setting up EMCD for Bitcoin, choose the closest regional stratum endpoint first and fill in backup URLs so your miner automatically fails over if the primary endpoint has issues. EMCD’s own setup guide lists region-specific BTC stratum URLs (for example, Russia, Europe, Kazakhstan, China, and America), which is a simple way for beginners to reduce rejects without advanced networking work. After that, run a one-week baseline test (rather than a few hours) and track effective hashrate and reject rate, because small differences in share acceptance can matter as much as fee differences over time.

Also pay attention to payout timing and thresholds. EMCD explains that payouts depend on whether your configured minimum payout threshold has been reached, and balances can roll over if the minimum isn’t met—so beginners should set a realistic threshold that matches their hashrate and expected daily production. If you plan to use “free” withdrawals, review the wallet/payout rules early so you understand timing constraints and avoid surprises when you need to move funds quickly.

Conclusion: EMCD is a strong beginner-friendly replacement for a legacy multi-coin pool when the priority is predictable Bitcoin payouts (FPPS), a clearly stated fee cap (up to 1.5%), and a structured daily payout routine. It’s best for miners who want a traditional pool experience with regional stratum options and an integrated environment for receiving and managing rewards.

Official Website: https://emcd.io/

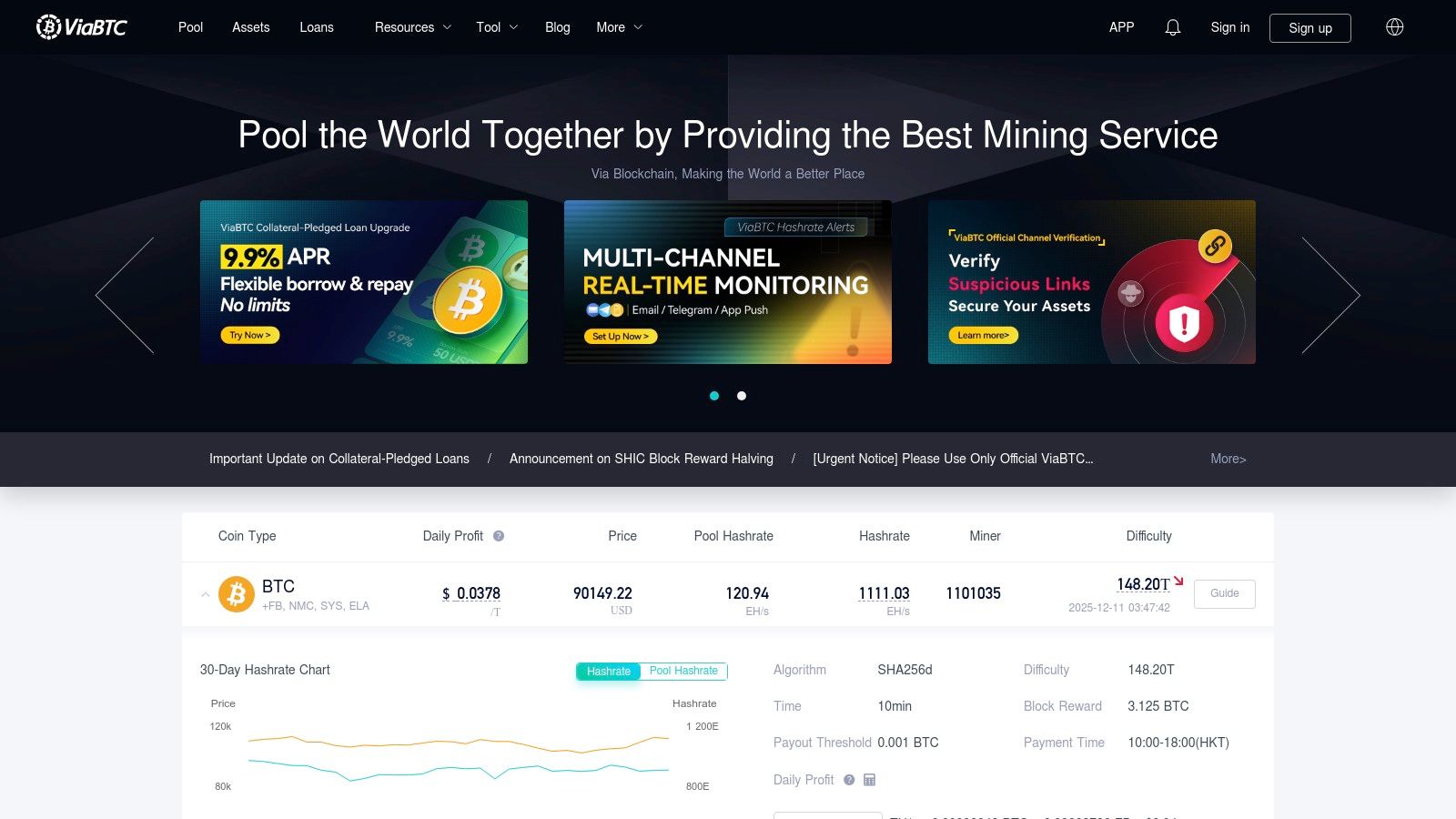

3. ViaBTC

ViaBTC stands out as a highly versatile and transparent mining pool, making it a great choice for beginners who want to learn about different payout systems. Unlike platforms that lock you into one payment model, ViaBTC offers a choice between PPS+, PPLNS, and SOLO for many of its coins. This flexibility allows newcomers to experiment, perhaps starting with predictable payments and moving to other models as they gain confidence.

The platform’s focus on transparency and education is a huge benefit for anyone new to mining. ViaBTC has a detailed help center and frequently posts updates, which builds trust and keeps miners informed. This commitment to clear communication helps demystify the mining process, making it one of the best mining pool for beginners who value guidance and predictability.

Key Features and Payout Structure

ViaBTC’s core strength is its adaptable ecosystem, managed through a clean web interface and a functional mobile app. The platform supports a wide range of cryptocurrencies, letting miners easily diversify. The most important feature for new users is the clear choice of payout methods.

This ability to choose is a powerful educational tool. A beginner can start with the low-risk PPS+ method for guaranteed income and later explore PPLNS to see firsthand how pool luck affects earnings.

- Payout Frequency: Automatic daily payouts are processed once you meet the minimum threshold, which you can set yourself.

- Withdrawal Options: You can withdraw to an external wallet or use the built-in ViaWallet and exchange for fee-free internal transfers. To get started, you can explore this detailed overview of how to join a mining pool.

- Fees: Fees are competitive but change depending on the coin and payout method (for example, PPS+ usually has higher fees than PPLNS). Always check the current fee schedule for your specific setup.

Pros and Cons for Beginners

Pros:

- Payout Flexibility: Offering PPS+, PPLNS, and SOLO lets you choose a model that fits your comfort level.

- Strong Educational Resources: The mature support center helps new miners build their knowledge.

- Transparent Operations: The pool is upfront about its status and any delays, creating a reliable environment.

Cons:

- Variable Fees: The fees aren’t uniform, so you need to check the specific rates for your coin and payout choice.

- Occasional Delays: While they are transparent about them, payout delays for certain coins have occurred in the past.

- Data-Rich Interface: The amount of data and options might feel a bit overwhelming at first glance.

Conclusion: For beginners who want more control and are eager to learn the nuances of mining rewards, ViaBTC provides an excellent and supportive environment to grow.

Official Website: https://www.viabtc.com

4. SpiderPool

SpiderPool is a large, ASIC-focused mining pool that targets miners who want strong global connectivity and clear payout options for Bitcoin. Its main beginner-friendly advantage is that it offers two familiar payout choices for BTC—FPPS for predictable income and PPLNS for lower fees and more variance—so miners can pick the model that best matches their cash-flow needs. It also publishes straightforward pool rules and fee tables in its support center, which helps reduce confusion when you’re comparing pools for the first time.

Unlike profit-switching services, SpiderPool is a traditional pool: you point your miner to a stratum endpoint, submit shares, and get paid based on the chosen settlement method. The pool provides region-based stratum servers (Asia, Europe, Africa, and others) plus SSL/TLS connection options, which can improve stability and security—especially useful if you’re setting up your first ASIC and want fewer rejected shares due to latency.

Key Features and Payout Structure

For Bitcoin, SpiderPool documents two payout modes with different fee levels: PPLNS (listed as 2%, with a “0% promotion” shown in the fee table at times) and FPPS (listed as 4%). SpiderPool also states a default minimum payout of 0.005 BTC and daily payments during a published UTC time window, which is simple for beginners to understand and track.

- Flexible payout models: BTC supports PPLNS and FPPS, letting you choose between lower fees (more variance) and higher-fee predictability.

- Clear fee schedule: SpiderPool documents BTC fees as PPLNS 2% and FPPS 4% (with promotions sometimes shown for PPLNS).

- Global stratum endpoints + SSL: Region-based TCP endpoints and SSL/TLS endpoints are listed publicly, helping miners reduce latency and improve connection security.

- Daily payouts + threshold: Default BTC payout threshold is 0.005 BTC, with daily payouts during a published time window.

Practical Tips for Effective Use

When configuring SpiderPool, start by selecting the closest regional endpoint and enabling a backup server to reduce downtime if your primary endpoint has issues. SpiderPool publishes separate TCP and SSL/TLS connection strings per region (for example, btc-eu, btc-as, btc-af), so beginners can improve share acceptance without any advanced networking work. After setup, watch your rejected/stale share rate for the first 24–48 hours—if it’s higher than expected, switch to a different nearby endpoint or try SSL/TLS to stabilize the connection.

For payout strategy, FPPS is typically the simplest model for beginners who want steady daily accounting (even at a higher fee), while PPLNS can make sense if you’re comfortable with variance and want a lower fee structure. SpiderPool’s own documentation makes it easy to compare these two modes by listing both fees and payout rules in one place.

Conclusion: SpiderPool is a strong replacement for a profit-switching beginner option if your goal is to learn “classic” Bitcoin pool mining with clear documented fees, daily payouts, and globally distributed stratum infrastructure. It’s best for ASIC miners who want the choice between FPPS stability and PPLNS lower-fee variance, and who value having official connection details and rules published in a single support hub.

Official Website: https://www.spiderpool.com/

5. Trustpool

Trustpool is a traditional cryptocurrency mining pool designed to be simple enough for newcomers while still offering the core features ASIC miners expect: a clear payout scheme, a fixed pool fee, and straightforward stratum setup. On its Bitcoin page, Trustpool explicitly markets a fixed 1% pool fee and positions itself around “stable payouts” and reliable infrastructure, which makes it a practical replacement for a more brand-heavy legacy option when your audience is focused on ease of use. In other words, this is a classic pool experience: you point your ASIC to the pool’s stratum address, submit shares, and get paid according to the pool’s published rules.

For beginners, the most helpful thing Trustpool does is explain basic pool concepts directly on its website (what hashrate means, what “Rejected” shares are, and how pool payouts work). That kind of built-in education can reduce setup mistakes and make the first week of mining far less confusing—especially if the reader is moving from “plug-and-play” tools to direct pool mining for the first time.

Key Features and Payout Structure

Trustpool states it operates under PPS+, which it describes as a combined reward scheme: the fixed block reward portion is distributed via PPS (per share), while transaction fees included in the block are distributed via PPLNS. The pool also documents a daily payout window and explains that miners must reach their selected payout threshold before the cutoff time for that day’s payout cycle. For Bitcoin specifically, Trustpool lists multiple stratum+tcp endpoints (including ports 3333, 25, and 443), which can be handy for beginners dealing with ISP/firewall restrictions.

- Payout scheme: PPS+ (PPS for the fixed block reward + PPLNS for transaction fees, as described by Trustpool).

- Pool fee: Fixed 1% (automatically deducted; the balance shown already excludes the fee, according to Trustpool).

- Payout timing: Once per day between 05:00 and 13:00 (UTC+3), and only after reaching the threshold you set.

- Minimum payout: Trustpool states 0.001 for “all coins” (and 1 for DOGE).

- Stratum endpoints (BTC): stratum+tcp://btc.trustpool.cc:3333, :25, and :443.

Practical Tips for Effective Use

When setting up Trustpool for Bitcoin, start by using the primary stratum endpoint and keep at least one alternate port (25 or 443) as a backup option—this can help if your network blocks standard mining ports. Trustpool publicly lists BTC stratum endpoints with multiple ports, which is a simple “beginner safety net” against connectivity issues. After you start mining, monitor the “Rejected” share rate in your miner and on the pool dashboard; Trustpool’s own explanation makes it clear that late or incorrect solutions are marked as rejected, which usually points to latency, unstable internet, or an incorrect miner configuration.

Also set your payout threshold with the daily schedule in mind. Trustpool notes you need to reach your threshold before 5:00 am (UTC+3) to be included in that day’s payout run, so a too-high threshold can delay your first payout and make mining feel “stuck” even when your rig is working correctly. For beginners, using a low threshold early (and increasing it later if desired) is often the simplest way to validate everything end-to-end: mining → accounting → payout.

Conclusion: Trustpool is a beginner-friendly alternative for direct Bitcoin pool mining thanks to its clear PPS+ payout description, fixed 1% fee, and publicly listed stratum endpoints (including multiple ports). It’s best for new ASIC miners who want predictable day-to-day operations, simple setup, and a pool that explains the basics right on the official site.

Official Website: https://trustpool.cc

6. Luxor

Luxor stands out as a highly transparent and predictable mining pool, especially appealing to miners based in the United States. It operates a traditional model focused primarily on Bitcoin, but its key differentiator is a commitment to clear, simple fee structures and a stable payout system. This approach removes much of the financial guesswork from mining, making it a strong choice for beginners who prioritize consistency and straightforward earnings.

Instead of complex, variable fees, Luxor has a clear, published policy. This transparency, combined with its specialized firmware offerings like LuxOS, provides a complete ecosystem for miners looking to optimize their hardware. For newcomers, this means less time spent deciphering profitability and more time running a stable operation, positioning it as one of the best mining pool for beginners who value a predictable financial model.

Key Features and Payout Structure

Luxor’s core strength is its Full-Pay-Per-Share (FPPS) payout model. With FPPS, miners are paid for every valid share they submit, whether the pool finds a block or not. This payment includes both the block subsidy and transaction fees, which smooths out income variance significantly. This stability is a major plus for anyone just starting.

The platform also offers LuxOS, a custom firmware for ASIC miners that can enhance performance. Miners who use LuxOS can often get a rebate on their pool fees, creating an incentive to use Luxor’s integrated solution for greater profitability.

- Payout Frequency: Payouts are made daily once the minimum threshold is met.

- Payout Model: The pool uses a Full-Pay-Per-Share (FPPS) model, ensuring consistent and predictable daily revenue.

- Fees: Luxor charges a transparent, published BTC pool fee (e.g., 2.5% FPPS) and a flat on-chain payout transaction fee, ensuring no hidden costs.

Pros and Cons for Beginners

Pros:

- Transparent Fees: The clearly published fees make it easy for beginners to calculate their expected earnings.

- Predictable Payouts: The FPPS model eliminates luck, providing stable daily income based on your hashrate.

- US-Operated: Offers reliability and regulatory clarity for miners in North America.

Cons:

- Higher Headline Fee: The standard pool fee may appear higher than some competitors who use less inclusive payout models.

- ASIC-Centric: Its advanced tools like LuxOS are tailored for ASIC miners, making it less relevant for GPU beginners.

- Advanced for Hobbyists: The detailed analytics might be more than a casual hobbyist with a single gaming PC needs.

Conclusion: For beginners operating ASIC hardware who want to eliminate income volatility and work with a transparent, US-based operator, Luxor provides an excellent and reliable platform.

Official Website: https://www.luxor.tech

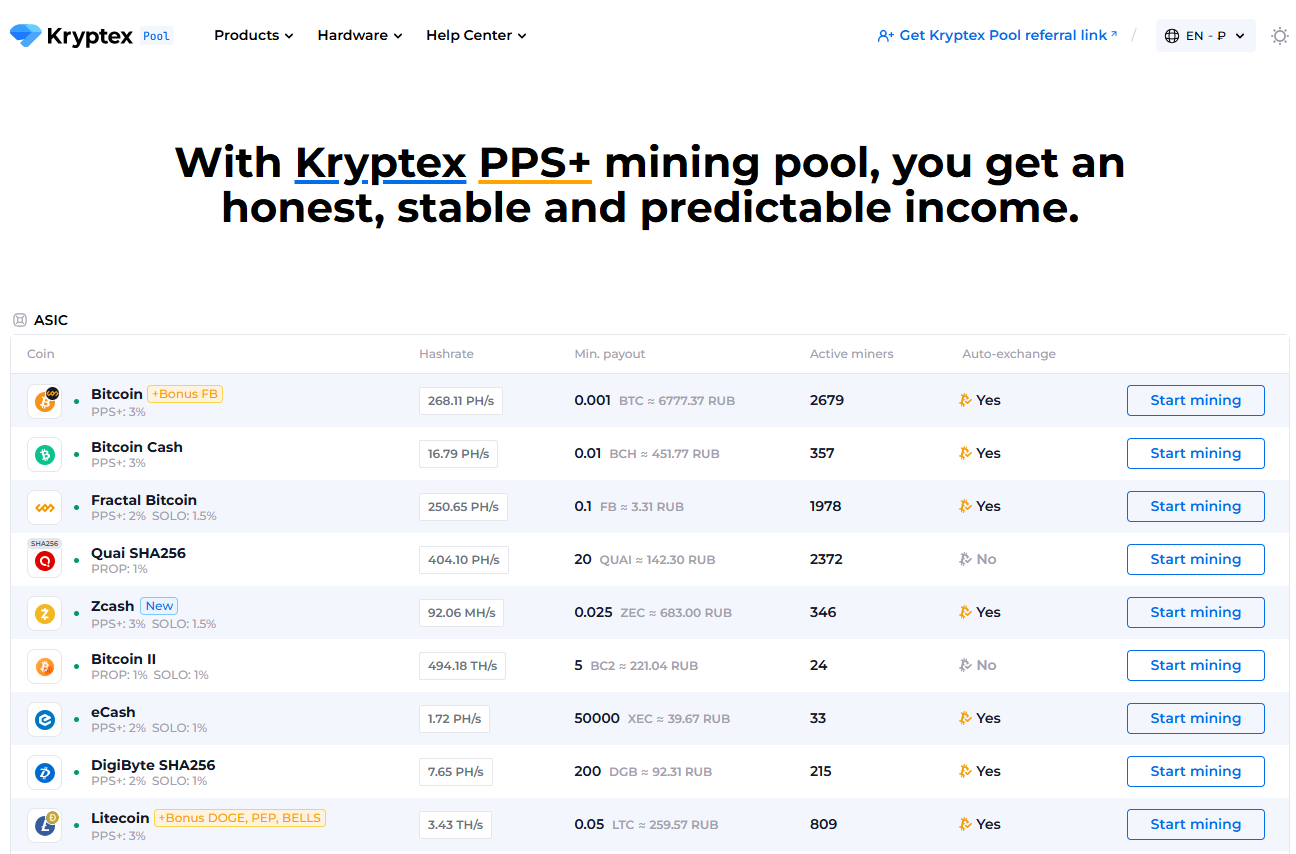

7. Kryptex Pool

Kryptex Pool is a straightforward alternative-coin mining pool that focuses on predictable payouts and an easy onboarding flow—especially useful for beginners who want to mine altcoins without spending days comparing dozens of small pools. The platform positions itself around PPS+ (a stability-focused payout approach) and emphasizes that you get “honest and predictable income” rather than waiting on pool luck in a classic PPLNS-only setup. It also highlights broad compatibility (popular miners, HiveOS/RaveOS, GPUs/ASICs/NiceHash), which makes it a practical “plug-in and start” option if your audience is experimenting with different rigs and coins.

Another strong reason to feature Kryptex Pool instead of an aggregator tool is its altcoin coverage. Kryptex Pool explicitly lists multiple non-Bitcoin coins on the pool (for example Ethereum PoW, Ethereum Classic, Ravencoin, Ergo, Monero, and Kaspa), so it works well in a “beginners exploring altcoins” section where the goal is to get paid regularly and learn the basics of pool mining with minimal friction.

Key Features and Payout Structure

Kryptex Pool states it uses the PPS+ payout scheme and frames this as a more stable alternative to reward systems that depend heavily on block-finding luck. Payouts are automated: once your balance reaches the minimum payout threshold, the payment is sent automatically to your wallet, and you can adjust the payout amount in the “Settings” area (Payment Threshold). This is beginner-friendly because it turns mining into a simple routine: mine → reach threshold → receive payout, without having to manually request withdrawals.

- Altcoin-friendly selection: Kryptex Pool lists support for coins such as Ethereum PoW, Ethereum Classic, Ravencoin, Ergo, Monero, and Kaspa.

- Payout model: PPS+ (positioned as stable/predictable payouts).

- Automatic payouts: Payments are made automatically once the minimum threshold is reached.

- Custom payout threshold: You can change your payout amount via Settings → Payment Threshold.

- Beginner setup support: The pool provides connection instructions/tutorial content and is built to work with common miner setups.

Practical Tips for Effective Use

If you’re using Kryptex Pool primarily for altcoins, start by choosing one coin and running a 3–7 day test to compare effective hashrate and payout regularity against your current pool. Kryptex Pool’s own positioning is that PPS+ helps keep income stable, so the best way to validate it is to compare daily results rather than judging by a few hours of mining. Also, set a conservative payout threshold early on so you can confirm the full flow (mining → threshold → payout) quickly before you scale the rig count or switch coins.

Be careful about wallet correctness. Kryptex Pool explicitly warns that payouts can only go to the address you mined to, and that sending a coin to the wrong wallet type (for example, ETH to an ETC wallet) can result in a permanent loss. For beginners, that means mining to a personal wallet you control (not an exchange deposit address) and double-checking the coin/network before you paste any address into your miner config.

Conclusion: Kryptex Pool is a strong “altcoin-first” replacement for an aggregator section because it’s designed to make mining simple: PPS+ positioning for stable earnings, automatic payouts, and a clear way to set payout thresholds. It’s best for beginners who want to mine popular altcoins, get paid on a predictable schedule, and avoid the complexity of researching dozens of smaller pools.

Official Website: https://pool.kryptex.com

Top 7 Mining Pools for Beginners Comparison (Updated)

To make things even clearer, here is a table summarizing our top picks.

| Pool / Tool | Ease of Use | Best For | Payout Model | Key Advantage |

|---|---|---|---|---|

| NEOPool | ★★★★☆ | Beginners who want to mine BTC directly (ASIC) and measure performance | FPPS | Engineering-first pool with a focus on efficiency metrics and frequent settlements |

| EMCD | ★★★★☆ | Beginners learning “classic” pool mining with stable BTC accounting | FPPS | Clear daily payout routine + regional stratum options |

| ViaBTC | ★★★★☆ | Learners who want payout model choices | PPS+ / PPLNS (and SOLO on some coins) | Flexibility to choose risk vs. reward |

| SpiderPool | ★★★☆☆ | ASIC miners who want global endpoints and a choice of payout modes | FPPS / PPLNS | Global infrastructure + documented payout options |

| Trustpool | ★★★☆☆ | New ASIC miners who want a simple, classic BTC pool | PPS+ | Fixed-fee simplicity + multiple stratum ports (useful behind strict networks) |

| Luxor | ★★★☆☆ | ASIC miners who value predictability | FPPS | Transparent fees and stable income model |

| Kryptex Pool | ★★★★☆ | Beginners exploring altcoins (GPU/ASIC depending on coin) | PPS+ (positioned for stability) | Altcoin-friendly pool with automatic payouts and a simple threshold system |

Making Your Final Choice: The Best Pool Is the One That Fits You

We’ve covered a lot of ground, from direct Bitcoin pools like NEOPool and EMCD to altcoin-focused options like Kryptex Pool. It’s clear that the search for the best mining pool for beginners doesn’t lead to a single answer. Instead, it leads to a personal decision that must align with your hardware, goals, and technical comfort level.

The “best” pool is simply the one that’s best for you.

Recapping the Core Decision Factors

Before you commit, run your top choices through this final checklist:

- Your hardware: Are you using a gaming PC (GPU) or a dedicated ASIC miner?

- GPU miners: If you’re mainly mining altcoins with GPUs, Kryptex Pool is a simple starting point thanks to its altcoin coverage and automatic payouts.

- ASIC miners: If you’re mining Bitcoin with ASICs, pools like NEOPool, EMCD, Trustpool, SpiderPool, ViaBTC, and Luxor are all relevant—your best match depends on payout preference and how much control you want.

- Your payout preferences: How do you want to get paid?

- For maximum stability: FPPS pools tend to be the simplest for beginners tracking daily income (e.g., EMCD, Luxor, and typically NEOPool; SpiderPool also offers FPPS as an option).

- For more “risk vs. reward” flexibility: ViaBTC is a strong learning platform because it offers multiple payout methods depending on the coin.

- For classic PPS+ simplicity: Trustpool can be appealing if you want a straightforward model and easy stratum setup.

- Your technical comfort level: How much setup are you willing to do?

- For “set it and monitor it”: EMCD and Trustpool are relatively straightforward once you paste the stratum URL and wallet/worker details.

- For more control and experimentation: ViaBTC (payout options) and SpiderPool (FPPS vs. PPLNS choice + regional endpoints) give you more knobs to turn.

If you want, the next step can be updating the “Your Actionable Next Steps” section to match the same pool lineup (NEOPool → EMCD → ViaBTC → SpiderPool → Trustpool → Luxor → Kryptex Pool) and making sure all internal links still match the new flow.

Your Actionable Next Steps

It’s time to move from analysis to action. Here’s how:

- Pick Your “Starter” Pool: Choose one pool from our list that seems like the best fit. Don’t worry, it’s not a permanent decision.

- Follow the Setup Guide: Use the pool’s official documentation to get your account and hardware configured.

- Mine for a Week: Let your hardware run for at least a week. This will give you enough time to see a few payout cycles and get a feel for the platform.

- Review and Re-evaluate: After your trial, check your results. Were the payouts as expected? Was the dashboard easy to use?

- Switch if Needed: Switching pools is easy—it only takes a minute to change the address in your mining software. If your first choice isn’t working out, try the next one on your list.

This process of testing and measuring is the key to finding the perfect home for your hashrate. The crypto world is always changing, so stay curious, stay informed, and happy hashing!

Frequently Asked Questions (FAQ)

Q1: Can I mine cryptocurrency on my phone?

While technically possible with certain apps, mining on a smartphone is highly impractical and not profitable. The processing power is far too low to compete, and the strain can permanently damage your phone’s battery and components. It is not recommended.

Q2: What is the most profitable crypto to mine for a beginner?

Profitability changes constantly based on coin price, network difficulty, and your hardware’s efficiency. For beginners with a gaming PC (GPU), profit-switching pools like NiceHash or Prohashing are often best, as they automatically mine the most profitable coin for you at any given moment.

Q3: How much can I earn mining with a single GPU?

Earnings depend heavily on your specific GPU model (e.g., an NVIDIA RTX 4090 vs. an older RTX 2060), your electricity cost, and the current crypto market conditions. You can use online mining profitability calculators to get a rough estimate by entering your GPU model and electricity rate. Expect modest returns, not a get-rich-quick scheme.

Q4: Do I need a special computer for mining?

You can start mining on most modern gaming PCs with a dedicated graphics card (GPU). For more serious, large-scale mining (especially for Bitcoin), miners use specialized hardware called ASICs (Application-Specific Integrated Circuits), which are designed for one purpose: to mine as efficiently as possible.

Q5: Is solo mining better than pool mining for a beginner?

No, solo mining is not recommended for beginners. When you mine solo, you are competing against the entire global network to find a block by yourself. The chances of this are astronomically low with beginner hardware, meaning you could go months or even years without earning anything. Pool mining combines your power with others, ensuring you receive small, regular payouts for your contribution.