7 Best BTC Mining Pool Options for Maximum Profit in 2026

Choosing the right Bitcoin mining pool is a critical decision that directly impacts your profitability and the consistency of your rewards. The difference between a well-suited pool and a poor fit can translate into significant variances in daily earnings, especially when you factor in fees, payout models, and network latency. For miners—from individual hobbyists to large-scale farm operators—selecting the optimal pool isn’t just a preference; it’s a core component of a successful mining strategy. This guide is designed to eliminate the guesswork from that process.

We’ll provide a data-driven analysis of the top contenders, helping you find the best BTC mining pool for your specific hardware and operational goals. This is not a surface-level overview. Instead, we dive into the essential metrics that define a pool’s performance, including its hashrate share, fee structure, and payout threshold. We will compare the most common payout systems, like Full Pay-Per-Share (FPPS) and Pay-Per-Last-N-Shares (PPLNS), explaining how each model affects your income stability and potential returns.

This comprehensive roundup presents a clear, comparative look at the leading pools of 2026. Each entry includes at-a-glance metrics, direct links, and a concise breakdown of its primary advantages and disadvantages. We identify which pools are best for specific use cases, such as those ideal for smaller ASICs, those built for institutional-scale farms, and those offering the lowest fees. By the end of this article, you will have the analytical tools and specific information needed to connect your mining operation to a pool that maximizes your hashrate’s value.

1. MiningPoolStats

Before you commit your valuable hashrate to a pool, doing your homework is non-negotiable. MiningPoolStats isn’t a mining pool itself; instead, it’s an indispensable aggregator and analytics platform. Think of it as the crucial first step in selecting the best BTC mining pool for your operation. It consolidates live, critical data from dozens of Bitcoin pools into a single, comprehensive dashboard, saving you countless hours of manual research.

This platform provides an at-a-glance, comparative view of the entire Bitcoin mining ecosystem. You can quickly sort and filter pools based on hashrate dominance, fee structures, and payout models, allowing for an objective, data-driven shortlisting process. This is particularly valuable for identifying pools that align with your specific financial goals, whether that’s minimizing fees or ensuring the most frequent payouts.

Key Features and User Experience

MiningPoolStats truly excels in its data presentation and usability. The interface is clean and focused, presenting complex information in a digestible format. Better yet, there are no access requirements or fees; the platform is completely free to use.

Here’s a breakdown of its core features:

- Live Data Consolidation: The site displays real-time hashrate distribution, recent blocks found by each pool, and their respective market share. This helps you gauge a pool’s consistency and recent luck.

- Payout Model & Fee Comparison: It clearly lists the payout scheme (e.g., FPPS, PPLNS, SOLO) and the associated fee for each pool. This is arguably its most powerful feature, as it allows for a direct comparison of the financial models that will impact your bottom line. For a deeper dive into these concepts, you can explore their guide on what a mining pool is.

- Direct Pool Links: Each listing includes a direct link to the pool’s official website and connection instructions, streamlining the transition from research to implementation.

Practical Tips for Effective Use

To get the most value from MiningPoolStats, start by filtering the Bitcoin pool list by your preferred payout model. If you prioritize predictable daily income, focus on FPPS pools. If you’re comfortable with more variance for potentially higher long-term rewards, analyze the top PPLNS options.

Always use the platform as your primary research tool but perform a final check on the official pool website before pointing your miners to a new address.

Key Takeaway: While MiningPoolStats provides an exceptional overview, pool operators can change fees or payout minimums without notice. Always cross-reference the data on the pool’s official documentation before connecting your ASICs.

Pros & Cons

| Pros | Cons |

|---|---|

| Consolidates data from top BTC pools, saving significant research time. | Data is from a third-party source; always verify on the official pool site. |

| Excellent for comparing payout models and fees side-by-side. | May not reflect real-time, user-specific fee discounts or promotions. |

| Free to access with no registration required. | Does not provide uptime statistics or latency data. |

Website: https://miningpoolstats.net/coins/bitcoin/

2. Foundry USA Pool

For large-scale and institutional miners operating in North America, Foundry USA Pool has established itself as a dominant force. This U.S.-based pool prioritizes regulatory compliance, enterprise-grade security, and predictable revenue streams, making it a compelling choice for professional operations. Its focus on providing a stable, high-performance infrastructure has catapulted it to the top of the hashrate leaderboards, solidifying its reputation as one of the best BTC mining pool options for serious miners.

Unlike many competitors that cater to a broad, anonymous user base, Foundry is tailored for registered businesses and larger operations that require a formal KYC/AML (Know Your Customer/Anti-Money Laundering) onboarding process. This institutional focus translates into robust security features, dedicated support, and tooling designed to manage significant hashrate. The pool’s commitment to the FPPS (Full Pay-Per-Share) model ensures miners receive consistent, predictable daily payouts regardless of the pool’s luck in finding blocks—a critical feature for financial planning and operational stability.

Key Features and User Experience

Foundry’s platform is engineered for reliability and professional management. The user interface is clean, data-rich, and provides the tools farm operators need to monitor performance, manage sub-accounts, and streamline payouts. Onboarding is a formal process, reflecting their institutional client base.

Here are the standout features:

- Predictable FPPS Payouts: Miners earn a steady income based on their contributed hashrate. Daily payouts are credited around 01:00 UTC with automated withdrawal windows, simplifying cash flow management.

- Enterprise-Grade Security & Compliance: As a U.S.-based entity, Foundry operates with SOC 1 and SOC 2 compliance. Features like address whitelisting, role-based access controls, and approval workflows are standard, meeting the stringent requirements of corporate clients.

- Tiered Fee Structure: Fees are not a one-size-fits-all flat rate. Instead, they are determined by a miner’s quarterly average hashrate, with terms negotiated directly. This model rewards larger, consistent miners with more competitive rates.

Practical Tips for Effective Use

Foundry is best suited for established mining operations rather than hobbyists. Before engaging, make sure you can meet the KYC/AML requirements for your business entity. Prospective miners should be prepared to contact Foundry’s sales team to discuss their hashrate and negotiate a fee structure that aligns with their operational scale.

For those new to the technical side of connecting hardware, it’s beneficial to review the general process. You can find detailed steps on how to join a mining pool to understand the fundamentals of configuring your ASICs.

Key Takeaway: Foundry’s strength lies in its institutional focus and U.S.-based operations. It offers unparalleled compliance and stability for large miners but isn’t designed for small, anonymous participants due to its mandatory KYC process and negotiated fee structure.

Pros & Cons

| Pros | Cons |

|---|---|

| Stable and predictable daily revenue with the FPPS payout model. | Onboarding requires a full KYC/AML process, making it unsuitable for anonymous miners. |

| U.S.-based operations provide regulatory certainty and robust security. | Fee structure is negotiated and tiered, not a simple public flat rate. |

| Enterprise-level tooling and API access for large-scale farm management. | Primarily geared towards institutional or very large-scale mining operations. |

Website: https://www.foundryusapool.com/

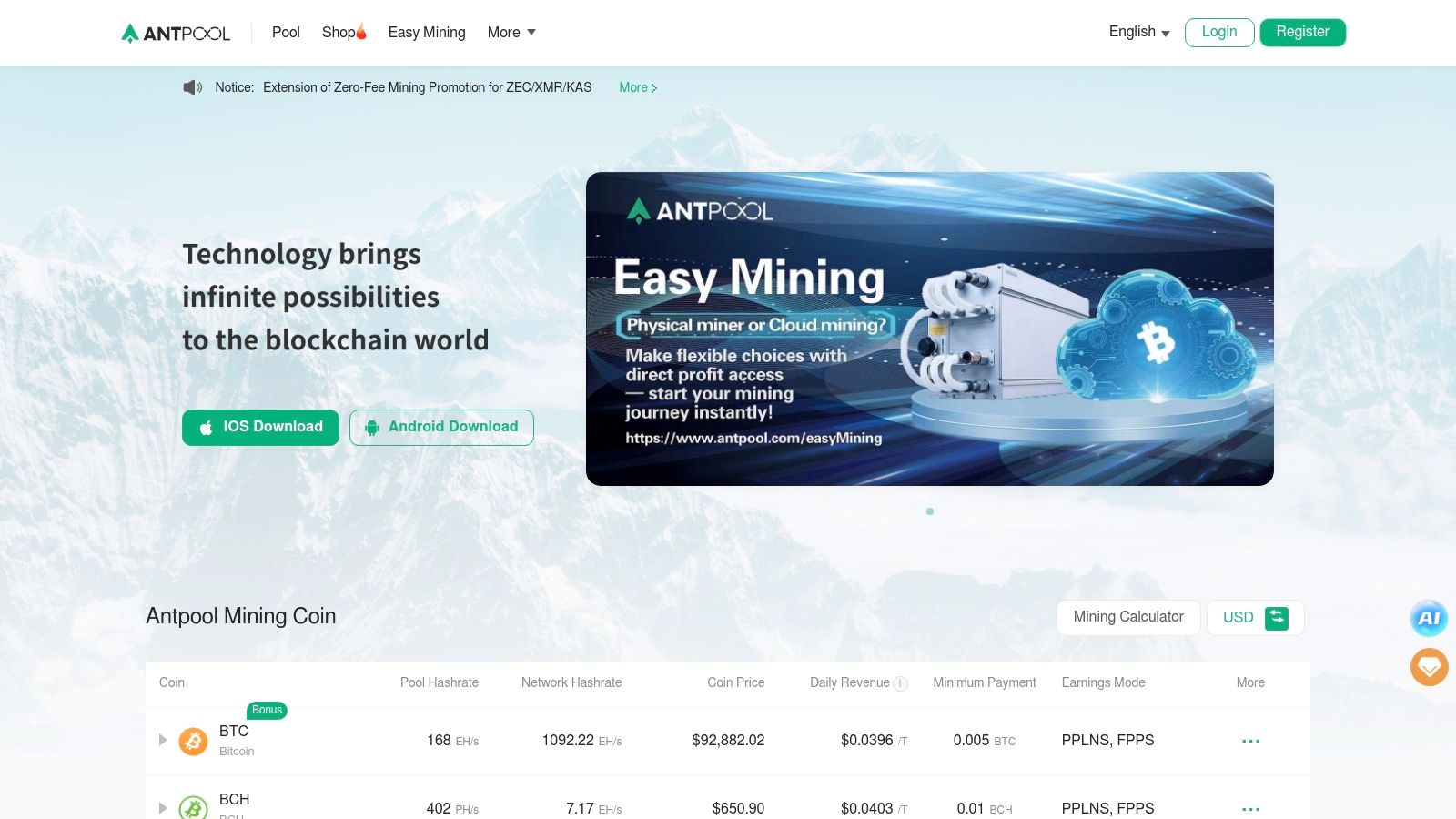

3. Antpool

As one of the industry’s pioneering and largest Bitcoin mining pools, Antpool stands as a pillar of the global hashrate network. Operated by hardware manufacturing giant Bitmain, it offers a robust, feature-rich platform that caters to a wide spectrum of miners, from individual hobbyists with a single ASIC to large-scale institutional farm operators. Its long-standing reputation and deep integration with Bitmain hardware make it a top contender for anyone seeking a stable and versatile mining experience.

The platform’s primary strength lies in its flexibility and scale. By offering multiple payout models, it allows miners to choose a reward structure that best fits their risk tolerance and financial strategy. This adaptability, combined with a global network of servers, ensures that it remains a competitive option for finding the best BTC mining pool regardless of the miner’s location or operational size.

Key Features and User Experience

Antpool provides a mature and well-organized user interface that simplifies hashrate management and performance monitoring. While the fee structure can require logging in to see specific rates, the platform’s overall tooling is comprehensive. Creating an account is free, and the setup process is straightforward for those familiar with ASIC configuration.

Here’s what makes Antpool a solid choice:

- Multiple Payout Modes: Miners can select from various reward systems, including FPPS (Full Pay-Per-Share), PPS+ (Pay-Per-Share Plus), and PPLNS (Pay-Per-Last-N-Shares). This choice allows you to balance between predictable income (FPPS) and potentially higher but more variable rewards (PPLNS).

- Global Server Infrastructure: Antpool operates nodes worldwide, and its connection system can automatically route miners to the nearest, lowest-latency server. This is critical for minimizing stale shares and maximizing hashing efficiency.

- Configurable Payout Thresholds: Users can set their own minimum BTC payout amount, offering control over the frequency of withdrawals to their personal wallets. Payouts are typically processed daily once the configured threshold is met.

Practical Tips for Effective Use

For new miners, starting with the FPPS model is recommended as it provides the most predictable daily revenue, making it easier to calculate your return on investment. If you own Bitmain Antminers, check for any special promotions or optimized firmware that might offer benefits when connected to Antpool.

Always log into your account to verify the current fee for your chosen payout model, as this can vary and may not be prominently displayed on public-facing pages.

Key Takeaway: Antpool’s connection to Bitmain provides a tightly integrated ecosystem, but its fee transparency can be less direct than some competitors. The platform’s true value is unlocked by choosing the right payout model for your specific operation and leveraging its global server network.

Pros & Cons

| Pros | Cons |

|---|---|

| Large, established pool with mature tooling and high stability. | Exact fee percentages are not always clear without an account. |

| Flexible payout modes (FPPS, PPS+, PPLNS) suit different risk profiles. | Fee structure and rates can differ based on payout mode and account. |

| Global server network optimizes latency for international miners. | As a large pool, its hashrate contributes to network centralization. |

Website: https://www.antpool.com/

4. Neopool

NEOPool positions itself as an “advanced mining technologies” pool, with a strong emphasis on infrastructure efficiency, automation, and performance-oriented tooling for miners who care about stable operations and monitoring. It highlights a product-driven approach (dashboard + API) and frames its value around reducing latency and improving mining efficiency through pool-side optimizations rather than marketing gimmicks. In practice, this makes it a relevant option to consider for miners who want a modern pool experience and are comfortable validating the key numbers (fees, payout method, thresholds) before committing hashpower.

NEOPool promotes a data-centric, operator-friendly experience with a focus on technical performance and integrations. It explicitly mentions user-friendly API access and tooling intended to work well for hashrate aggregators and larger operations that need reporting and automation. The pool also advertises proprietary optimization methods (including block template/building optimizations and dynamic share difficulty adjustments) designed to keep miners’ connections efficient and submissions stable.

Key Features and User Experience

F2Pool’s interface is data-rich yet straightforward, providing miners with all the necessary tools to monitor their operations effectively. The platform features detailed dashboards, hashrate charts, and transparent revenue calculators. All services are accessible after a simple registration process.

Key features include:

- Performance focus: Pool-side optimizations and dynamic difficulty tuning to keep shares flowing smoothly.

- Latency reduction: Emphasis on connecting miners through efficient local infrastructure to minimize stale/rejected shares.

- Automation-ready: API and integration-friendly tooling for monitoring and external dashboards.

- Premium path: A “Premium” / VIP-style application route for larger miners seeking custom conditions and potentially dedicated connectivity.

Practical Tips for Effective Use

Before switching production hashrate, it’s worth doing a structured test: point a portion of ASICs to NEOPool for 24–48 hours and compare (1) stale/reject rate, (2) effective poolside hashrate vs local hashrate, and (3) payout consistency against a control pool. Validate the exact payout scheme, pool fee, minimum payout/thresholds, and available stratum endpoints for your region directly in NEOPool’s official documentation or account area, since those parameters are what ultimately determine real profitability. If operating at scale (or managing multiple locations), ask about premium connectivity or tailored terms only after the baseline test confirms strong acceptance rates and stable performance.

Key Takeaway: NEOPool’s main differentiator is its “engineering-first” positioning—latency and efficiency optimizations plus API-driven usability—making it best suited for miners who value operational control and are willing to verify the pool’s exact payout terms before scaling up.

Pros & Cons

| Pros | Cons |

|---|---|

| Strong performance narrative (latency/efficiency optimizations, dynamic difficulty). | Critical comparison metrics (exact fees, payout model, thresholds) must be confirmed directly from official pool sources before committing significant hashrate. |

| API and integration-friendly approach for monitoring and automation. | Premium route suggests the best terms may be targeted at larger operators, not casual miners. |

| Premium option for larger miners seeking tailored conditions. |

Website: https://neopool.com/

5. ViaBTC

ViaBTC has cemented its position as a top-tier global mining pool by offering a versatile and feature-rich environment that caters to a wide spectrum of miners. It stands out by providing multiple payout models, integrated financial services, and the value-add of merged mining, making it a strong contender for the best BTC mining pool for those seeking flexibility and additional revenue streams. The platform is well-regarded for its stability, clear documentation, and consistent performance, attracting both individual miners and larger-scale operations.

This pool distinguishes itself with a comprehensive suite of tools designed to enhance the mining experience. From a robust mobile application for on-the-go monitoring to detailed profit accounting, ViaBTC provides the infrastructure necessary for miners to manage their operations efficiently. Its global server deployment ensures low latency for users across different geographic regions, a critical factor for maximizing hash submission and potential earnings.

Key Features and User Experience

ViaBTC’s user interface is clean, professional, and packed with data, presenting miners with all the necessary metrics to track performance. The platform offers a choice between its default PPS+ model, which guarantees a steady income from both block rewards and transaction fees, and a lower-fee PPLNS option for those who prefer a model tied more closely to the pool’s luck.

Here’s what sets ViaBTC apart:

- Flexible Payout Models: Miners can choose their preferred payout scheme, with PPS+ offered at a 4% fee and PPLNS at a 2% fee. This allows users to balance their risk tolerance with their desire for predictable income.

- Merged Mining: A key advantage of ViaBTC is its support for merged mining, allowing users to mine Namecoin (NMC) and Syscoin (SYS) simultaneously with Bitcoin at no extra hashrate cost, providing an additional source of revenue.

- Low Payout Thresholds: The pool maintains a low minimum payout of 0.001 BTC, making it accessible for miners with smaller hashrate contributions who want to receive their earnings frequently.

- Comprehensive Tooling: ViaBTC provides a suite of valuable utilities, including a mobile app for monitoring, an auto-conversion tool for mined assets, and hourly profit accounting for transparent earnings tracking.

Practical Tips for Effective Use

To maximize your returns on ViaBTC, evaluate the merged mining options. The extra income from NMC and SYS can effectively lower your overall operational costs, offsetting the higher PPS+ fee. Use the mobile app to set up alerts for worker downtime, ensuring you can react quickly to any issues and minimize hashrate loss.

Also, consider the timing of payouts, which are processed daily based on Hong Kong Time (HKT). This might be an important logistical consideration depending on your location and when you prefer to manage your funds.

Key Takeaway: ViaBTC’s primary appeal lies in its flexibility and added-value features. The choice between PPS+ and PPLNS, combined with the bonus revenue from merged mining, allows miners to tailor their strategy to their specific financial goals and risk appetite.

Pros & Cons

| Pros | Cons |

|---|---|

| Flexible payout options (PPS+, PPLNS) cater to different risk profiles. | PPS+ fee (4%) is higher than some competitors in the market. |

| Merged mining provides an additional, no-cost revenue stream. | Payouts are based on the HKT time zone, which may be inconvenient for some users. |

| Low payout threshold (0.001 BTC) and globally distributed nodes. | The comprehensive feature set might feel overwhelming for absolute beginners. |

Website: https://www.viabtc.com/

6. Luxor Mining

For miners prioritizing compliance, transparent operations, and enterprise-grade tools, Luxor Mining is a standout option. As a U.S.-based entity, it provides a level of regulatory clarity and support that is increasingly sought after by North American miners, from individual prosumers to large-scale farm operators. Luxor’s focus on clear documentation and predictable financial models makes it one of the best BTC mining pool choices for those who value stability and professional-grade infrastructure.

This pool is built around a Full-Pay-Per-Share (FPPS) model, which guarantees miners a steady, predictable income based on their submitted hashrate, regardless of whether the pool finds a block. This approach eliminates the payout variance associated with PPLNS pools, appealing directly to miners who require consistent cash flow for operational planning.

Key Features and User Experience

Luxor’s platform is engineered for clarity and control, offering a clean dashboard and powerful APIs for advanced users. The user experience is geared towards data-driven decision-making, providing detailed analytics on hashrate, revenue, and worker performance. Access to the pool is straightforward, with clear setup guides for a wide range of ASIC models.

Here are Luxor’s core advantages:

- Transparent Fee Structure: Luxor operates on a public 2.5% FPPS fee. The minimum payout is set at 0.001 BTC, with a fixed withdrawal fee of 0.000075 BTC for each transaction, ensuring cost predictability.

- LuxOS Firmware: Miners can install Luxor’s custom ASIC firmware, LuxOS, which can improve hashrate efficiency and stability. A key incentive is that using LuxOS provides a rebate on the pool fee, directly increasing profitability.

- Enterprise Tooling: The pool provides robust APIs and enterprise-level dashboards designed for managing large fleets of miners. This makes it an ideal solution for farm operators needing to monitor and optimize their entire operation programmatically.

- U.S. Operations: Being based in the United States, Luxor offers a degree of operational and regulatory certainty that is highly valued by compliance-minded individuals and institutions.

Practical Tips for Effective Use

To get the most out of Luxor, evaluate whether installing LuxOS is a good fit for your ASICs. The potential hashrate boost combined with the pool fee rebate can significantly enhance your mining revenue over time.

Additionally, take advantage of the detailed analytics dashboard to monitor your worker performance closely. Identify any underperforming machines quickly to maintain optimal operational efficiency and maximize your earnings under the FPPS model.

Key Takeaway: Luxor is tailored for miners who treat their operation like a business. Its predictable FPPS payouts, transparent fees, and advanced management tools are designed for maximizing operational efficiency and ensuring financial clarity.

Pros & Cons

| Pros | Cons |

|---|---|

| U.S.-based operations provide regulatory clarity and support. | The standard 2.5% FPPS fee may be higher than some competitors. |

| Clear, predictable FPPS payouts and transparent fee policies. | Fixed withdrawal fee can be inefficient for very small or frequent payouts. |

| Optional LuxOS firmware offers fee rebates and performance tuning. | Primarily focused on Bitcoin, with fewer altcoin options than other pools. |

Website: https://www.luxor.tech/

7. Binance Pool

For miners deeply integrated into the world’s largest crypto exchange ecosystem, Binance Pool offers an unparalleled level of convenience. This isn’t just a standalone mining service; it’s a financial hub that directly connects a miner’s hashrate to their trading, staking, and treasury management activities. By depositing rewards directly into a user’s Binance account, it eliminates the need for external transfers, saving on both time and transaction fees.

This platform is particularly attractive for global miners who already use Binance for their crypto operations. The direct integration allows for immediate conversion of mined BTC into stablecoins or other assets, providing a seamless workflow from hash to liquidation. While it may not compete on having the absolute lowest fees, its value proposition is the powerful combination of a competitive FPPS model with the vast financial tooling of the Binance exchange, making it a strong candidate for the best BTC mining pool for ecosystem-focused miners.

Key Features and User Experience

Binance Pool’s user interface is clean and integrated directly within the main Binance website and app, offering a familiar experience for existing users. The setup process is straightforward, and performance dashboards provide clear insights into hashrate, worker status, and daily earnings. Access is tied to having a verified Binance account, which is a key requirement.

Let’s look at the key benefits:

- Direct Exchange Payout: Earnings are credited daily directly to a user’s Binance Funding Wallet. This removes withdrawal fees and delays associated with transferring from a traditional pool to an exchange.

- FPPS Payout Model: The pool operates on a Full Pay-Per-Share (FPPS) model, providing stable and predictable daily income regardless of the pool’s luck in finding blocks. The standard fee is typically around 2.5%, though this can vary.

- Smart Pool & Multi-Coin Support: Beyond Bitcoin, Binance supports numerous other PoW coins and offers a “Smart Pool” feature that automatically switches a miner’s hashrate to the most profitable coin, with payouts still settled in BTC.

Practical Tips for Effective Use

To leverage Binance Pool effectively, miners should activate the auto-transfer function to move daily earnings from the Funding Wallet to the Spot Wallet for trading or other activities. If you operate ASICs capable of mining different SHA-256 algorithms, explore the Smart Pool to potentially increase your BTC-denominated earnings by letting the system auto-optimize for profitability.

Be aware that U.S. residents are a critical exception. The global Binance.com platform is not accessible to them, and its U.S. counterpart, Binance.US, does not offer a mining pool service.

Key Takeaway: The primary advantage of Binance Pool is its deep integration with the exchange. If you are not an active Binance user or are located in a restricted jurisdiction like the U.S., the core benefits are significantly diminished, and other pools may offer a more suitable solution.

Pros & Cons

| Pros | Cons |

|---|---|

| Seamless payout into the Binance ecosystem for easy treasury management. | Not available to U.S. residents; Binance.US does not offer a mining pool. |

| FPPS model provides stable and predictable daily revenue. | Pool fees (around 2.5%) are not the lowest on the market. |

| Smart Pool feature can auto-optimize for the most profitable coin. | Requires a fully verified Binance account to use the service. |

Website: https://pool.binance.com/

Top 7 Bitcoin Mining Pools Comparison

To help you visualize the differences, here is a quick comparison table summarizing the key aspects of each pool.

| Pool Name | Payout Model(s) | Standard Fee | Key Advantage | Best For |

|---|---|---|---|---|

| MiningPoolStats | N/A (Aggregator) | N/A | Centralized data for comparison | All miners during the research phase |

| Foundry USA Pool | FPPS | Negotiated (Tiered) | U.S. compliance & stability | Large-scale & institutional miners |

| Antpool | FPPS, PPS+, PPLNS | Varies (2.5% – 4%) | Payout flexibility & global servers | Miners wanting choice & stability |

| NEOPool | FPPS | 0% (claims “no hidden fees”) | Efficiency focus + daily payouts + low minimum payout (0.001 BTC) | Miners prioritizing efficiency metrics and frequent settlements |

| ViaBTC | PPS+, PPLNS | 4% (PPS+), 2% (PPLNS) | Merged mining & financial tools | Miners seeking extra revenue streams |

| Luxor Mining | FPPS | 2.5% (Rebates avail.) | Transparency & enterprise tools | Compliance-focused prosumers & farms |

| Binance Pool | FPPS | ~2.5% | Seamless exchange integration | Existing (non-U.S.) Binance users |

Final Verdict: Selecting Your Ideal Mining Partner for 2026

Navigating the landscape of Bitcoin mining pools has evolved from a simple choice based on hashrate to a complex strategic decision. The analysis of top contenders like Foundry USA, Antpool, F2Pool, and others reveals a clear trend: specialization is key. There is no single, universally “best btc mining pool”; instead, there is a pool that is best suited for your specific operational profile, risk tolerance, and geographic location. Your final selection is a delicate balance of hashrate stability, fee structures, payout models, and value-added services.

Making an informed decision requires moving beyond surface-level metrics. While a pool’s total hashrate indicates its current block-finding prowess, it doesn’t tell the whole story. Factors like server latency, user interface sophistication, customer support responsiveness, and transparency in reporting are critical differentiators that directly impact your long-term profitability and operational ease.

Synthesizing the Data: Key Takeaways for Your Decision

Our deep dive into the leading pools highlights several critical takeaways that should guide your selection process. Each pool has carved out a distinct niche, catering to different segments of the global mining community.

- For North American miners prioritizing compliance and stability: Foundry USA Pool remains the undisputed leader. Its focus on regulatory adherence and institutional-grade infrastructure provides a secure and predictable environment, making it the default choice for large-scale operations in the region.

- For global miners seeking feature-rich ecosystems: Antpool and ViaBTC offer comprehensive platforms that go beyond simple BTC mining. Their flexible payout options and integrated financial services cater to miners who value a one-stop-shop experience.

- For miners focused on maximizing revenue through transparency and merged mining: Neopool continues to be a top contender. Its long-standing reputation, coupled with the potential for bonus earnings from merged mining, makes it an attractive option for those looking to squeeze every bit of value from their hashrate.

- For prosumers and small to mid-sized farms demanding advanced tools: Luxor Mining strikes an excellent balance. Its transparent fee structure and sophisticated analytics tools empower miners to manage risk and optimize their strategy effectively.

- For miners integrated into a larger crypto ecosystem: Binance Pool offers unparalleled convenience for users already active on the Binance exchange. The seamless integration allows for instant transfers and access to financial products, though availability is restricted.

Your Actionable Roadmap to Choosing a Pool

Selecting the right mining partner is an active, not a passive, process. Before committing your valuable hashrate, follow these critical steps to ensure you’ve made the optimal choice for your operation.

- Start with Data Aggregation: Your first and most crucial step is to consult a real-time data aggregator like MiningPoolStats. Use it to verify the current hashrate distribution, recent block findings, and reported fee structures. This provides an unbiased, up-to-the-minute snapshot of the market.

- Define Your Priorities: Are you optimizing for the lowest possible fees, the most stable payouts (FPPS), or the potential for higher rewards with more variance (PPLNS)? Is regulatory compliance your top concern? Clearly define your top three priorities.

- Conduct a Latency Test: Before migrating your entire fleet of ASICs, connect a single machine to your top two or three candidate pools. Run it for at least 24 hours and monitor the network latency (ping) and the rate of stale or rejected shares. Lower latency directly translates to higher earnings.

- Evaluate the User Experience: Log into the dashboard of your shortlisted pools. Assess the quality of their reporting tools. Can you easily track hashrate, monitor worker status, and analyze payout history? A clunky interface can become a significant operational headache.

Ultimately, the best btc mining pool is the one that aligns perfectly with your operational goals and technical requirements. By leveraging objective data, defining your strategy, and conducting practical tests, you can forge a partnership that maximizes your profitability and supports your growth for years to come.

Frequently Asked Questions (FAQ)

1. What is the difference between FPPS and PPLNS payout models?

FPPS (Full Pay-Per-Share) provides a fixed, guaranteed payout for every share you submit, regardless of whether the pool finds a block. It offers predictable, stable income. PPLNS (Pay-Per-Last-N-Shares), on the other hand, pays miners a portion of the actual block reward when the pool finds a block. This means your income can fluctuate with the pool’s luck—potentially higher rewards during lucky streaks but lower during unlucky ones. FPPS is better for predictable cash flow, while PPLNS can sometimes yield higher returns over the long term.

2. Can I mine Bitcoin with a GPU in 2026?

Technically, yes, but it is not profitable. Bitcoin’s network difficulty is so high that it requires specialized hardware called ASICs (Application-Specific Integrated Circuits). Attempting to mine BTC with a GPU will consume a significant amount of electricity for virtually zero return. GPUs are better suited for mining other cryptocurrencies.

3. Do I need to pay taxes on Bitcoin mining rewards?

In most jurisdictions, including the United States, mined cryptocurrency is treated as taxable income. The fair market value of the crypto at the time it was mined is considered income. It’s crucial to consult with a tax professional who understands cryptocurrency to ensure you remain compliant with local regulations.

4. What is a “stale share” and how can I reduce them?

A stale share is a valid share of work that your miner submits to the pool after the pool has already found a block and moved on to the next one. It’s essentially “too late” and doesn’t count toward your earnings. The primary cause is network latency between your miner and the pool’s server. To reduce stale shares, choose a pool with servers located geographically close to you to minimize this delay.

5. Is it safe to give a mining pool my wallet address?

Yes, it is safe. A mining pool only needs your public wallet address to send you your earnings. This address is like a bank account number—someone can deposit funds into it, but they cannot use it to withdraw funds. Never share your private keys, seed phrase, or wallet password with anyone, including a mining pool.