6 Tools to Find Most Profitable Cryptos to Mine in 2026

In the fast-paced world of cryptocurrency mining, profitability is a moving target. What topped the charts yesterday might be obsolete today due to fluctuating coin prices, network difficulty adjustments, and new hardware releases. Simply owning a powerful GPU or ASIC isn’t enough; maximizing your returns requires a smart, data-driven approach to consistently find the most profitable cryptos to mine.

This guide is designed to take the guesswork out of the equation and arm you with the best tools for building a smarter mining operation in 2026. We’ll go beyond simple advice and provide a complete roundup of the best resources for analyzing real-time data, comparing hardware performance, and selecting the best mining pools. Our goal is simple: to help you make informed decisions that turn your hardware’s raw power into a predictable and sustainable revenue stream.

Throughout this article, we’ll break down seven essential platforms, complete with screenshots and direct links to get you started immediately. By the end, you will know exactly how to:

- Calculate real-time profitability based on your specific hardware and electricity costs.

- Identify top-performing mining pools with reliable payouts and fair fee structures.

- Compare the revenue potential of different algorithms and coins for your GPU or ASIC.

- Analyze network metrics like difficulty and hashrate to anticipate future shifts in profitability.

This isn’t a theoretical overview; it’s an actionable playbook. We provide the specific steps, direct platform comparisons, and practical insights you need to turn your mining setup—whether a single rig or a large-scale farm—into a finely tuned, profit-generating machine.

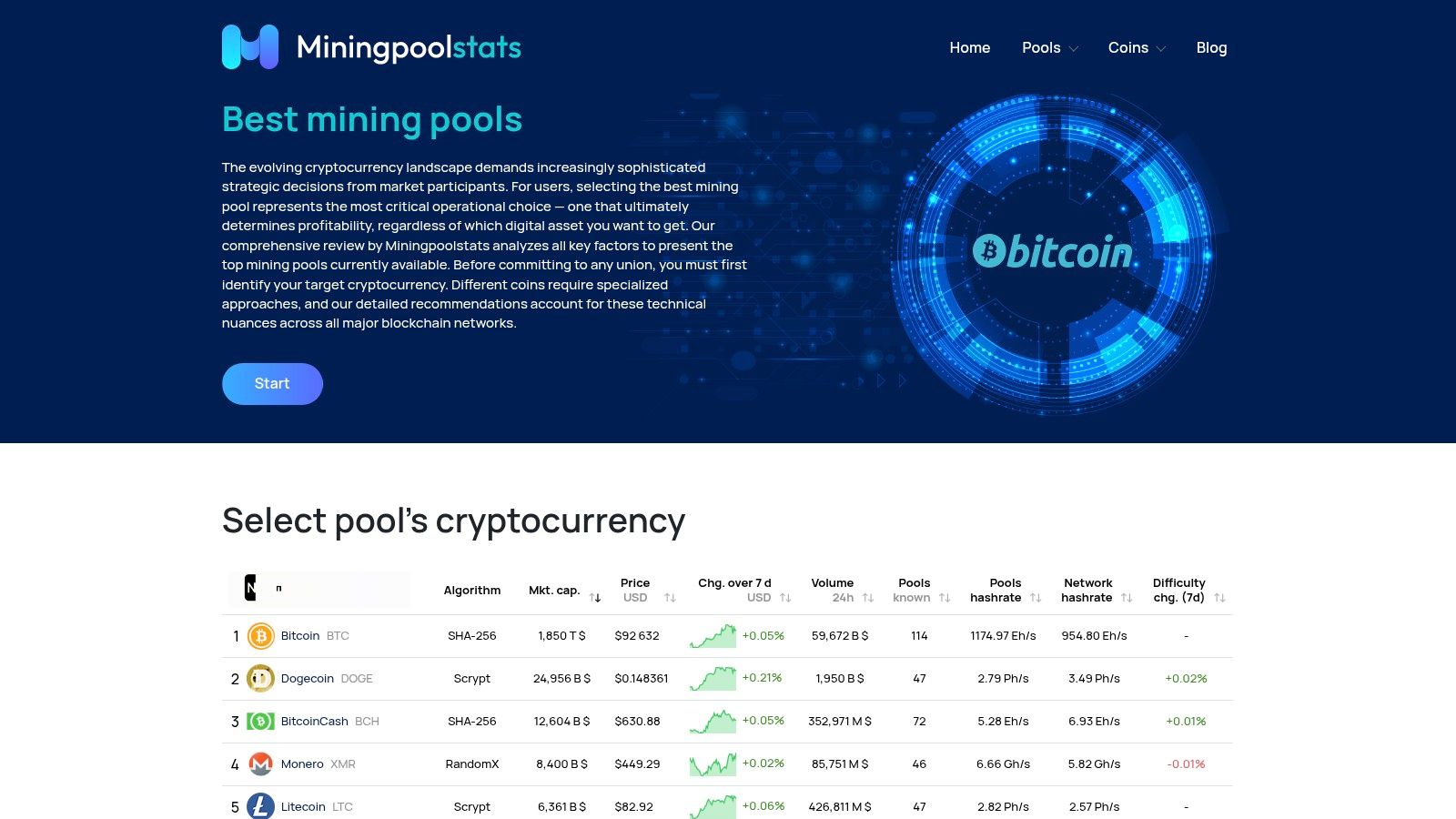

1. MiningPoolStats

Finding one of the most profitable cryptos to mine is only the first step. The second, equally crucial decision is choosing the right mining pool. This choice directly impacts your payout stability, net earnings, and overall efficiency. MiningPoolStats is an indispensable platform that acts like a buyer’s guide for miners, demystifying the complex world of mining pools by providing transparent, real-time data so you can make decisions based on facts, not guesswork.

The platform’s main strength is its comprehensive, side-by-side comparisons of pools across Bitcoin and a huge number of altcoins. It gathers critical operational data, allowing you to filter and sort pools based on what matters most to your goals and hardware.

Key Features and Strategic Advantages

MiningPoolStats stands out by turning raw data into actionable intelligence. It doesn’t just list numbers; it gives you the context needed to understand the trade-offs between different pools.

- Data-Driven Pool Comparison: The site provides a detailed breakdown of pool metrics, including real-time hashrate, network share, fee structures, and minimum payout thresholds. This lets you evaluate providers like Foundry USA, Antpool, F2Pool, and ViaBTC on a level playing field.

- Payout Model Analysis: One of its most valuable features is the clear explanation of different payout schemes. The platform helps you understand the stability of Pay-Per-Share (PPS) versus the potentially higher but more variable rewards of Pay-Per-Last-N-Shares (PPLNS). This is critical for matching your risk tolerance with your payout strategy.

- Editorial Rankings and Insights: MiningPoolStats publishes annual editorial rankings (like its 2025/2026 lists) that score pools on fees, coin support, payout reliability, user experience, and security. This curated content saves you hours of research.

- Operational Intelligence: The platform also shows vital details like server locations (for better latency), mobile app availability, and support for features like merged mining. It consolidates community feedback and highlights long-established pools to signal reliability.

In summary: The real value of MiningPoolStats isn’t just the data it shows, but how it empowers you to act. By comparing a low-fee pool with a zero-fee withdrawal option, a miner can precisely calculate the net profitability difference for their specific operation.

Practical Use Cases and Implementation

Whether you’re a single-GPU hobbyist or managing a large farm, the platform offers tailored benefits. Newcomers can use the step-by-step guides on switching pools and understanding tax basics. Meanwhile, professionals can use the detailed metrics to match their hardware with pools that offer the best uptime and stability. For a deeper dive into the fundamentals, you can learn more about what a mining pool is and how it works.

Access and Pricing

MiningPoolStats is a free-to-use resource. There are no subscriptions or access fees. All financial transactions occur directly with the pool operator you choose to join.

Pros & Cons

| Pros | Cons |

|---|---|

| Comprehensive Comparisons: Data-driven metrics across Bitcoin and major altcoins, covering hashrate, fees, payout types, and uptime. | Third-Party Resource: As a comparison site, it does not operate pools directly; all terms are set by the pool operators. |

| Actionable Editorial Guidance: Curated rankings explain the trade-offs between stability (PPS/FPPS) and upside potential (PPLNS). | Data Dependency: Relies on pool-reported metrics, which could have rare reporting lags. Due diligence on newer pools is still recommended. |

| Operational Signals: Provides practical details like server locations, mobile apps, and merged-mining support for operational planning. | |

| Educational Content: Offers no-nonsense guides for beginners on switching pools, hardware requirements, and tax basics. | |

| Credibility Focused: Highlights long-running, trusted pools and consolidates independent community feedback to build user confidence. |

The Bottom Line: By centralizing and interpreting key performance indicators, MiningPoolStats removes the guesswork from pool selection, making it a foundational tool for anyone serious about maximizing their search for the most profitable cryptos to mine.

Website: https://miningpoolstats.net

2. WhatToMine

WhatToMine is an essential, long-standing dashboard in the crypto mining community and often the first stop for miners looking to quickly check profitability. Its main job is to answer the question: “What is the most profitable crypto to mine right now with my specific hardware?” The platform pulls live network data, crypto prices, and your hardware specs to generate a ranked list of mineable coins, making it indispensable for both GPU and ASIC miners.

The user experience is straightforward. You simply select your hardware (like an NVIDIA RTX 4090 or Bitmain Antminer L7), enter your electricity cost, and the platform calculates estimated revenue, power costs, and profit over 24 hours for dozens of coins. This quick comparison is its biggest strength, allowing for rapid decision-making in a market where profitability can shift by the hour.

Key Features and Usage

WhatToMine’s interface is built for speed. You can input hashrates for specific algorithms like Ethash or KAWPOW if you know your hardware’s performance, or you can let the site use its pre-loaded profiles for popular GPUs and ASICs.

- Hardware-Specific Calculations: The platform maintains a large database of hashrates for most common mining hardware.

- Algorithm Filtering: You can focus on specific algorithms, which is useful if your hardware is optimized for certain types of computations.

- Real-Time Data: It uses current difficulty, block rewards, and exchange rates to provide up-to-the-minute estimates.

- Historical Profitability: You can see trends over 24 hours, 3 days, and 7 days to get a sense of a coin’s stability.

Pro Tip: Always factor in a small margin of error with WhatToMine’s estimates. Actual earnings can differ due to pool luck, fees, and real-world power consumption. Use it as a guide, not an exact forecast.

Pros and Cons of WhatToMine

As a free platform, its accessibility is a major plus, but it’s important to be aware of its limitations.

| Pros | Cons |

|---|---|

| Excellent Breadth: Covers a wide variety of altcoins and algorithms. | Estimates Are Volatile: Profitability can change rapidly with price swings. |

| User-Friendly: Simple interface for quick profitability checks. | No Pool Metrics: Does not provide data on mining pool reliability or fees. |

| Frequently Updated: Hardware profiles and coin data are kept current. | Actual Earnings Vary: Pool-specific factors can alter real-world results. |

| Completely Free: No subscription or access fees required. | UI is Dated: The interface is functional but lacks modern design elements. |

The Bottom Line: WhatToMine excels at identifying potential opportunities, making it the perfect starting point in your search for the most profitable cryptos to mine. For a deeper look at how these calculators work, you can learn more about the mechanics behind a crypto mining profitability calculator. After finding a promising coin here, your next step should be researching a quality mining pool.

Website: https://whattomine.com

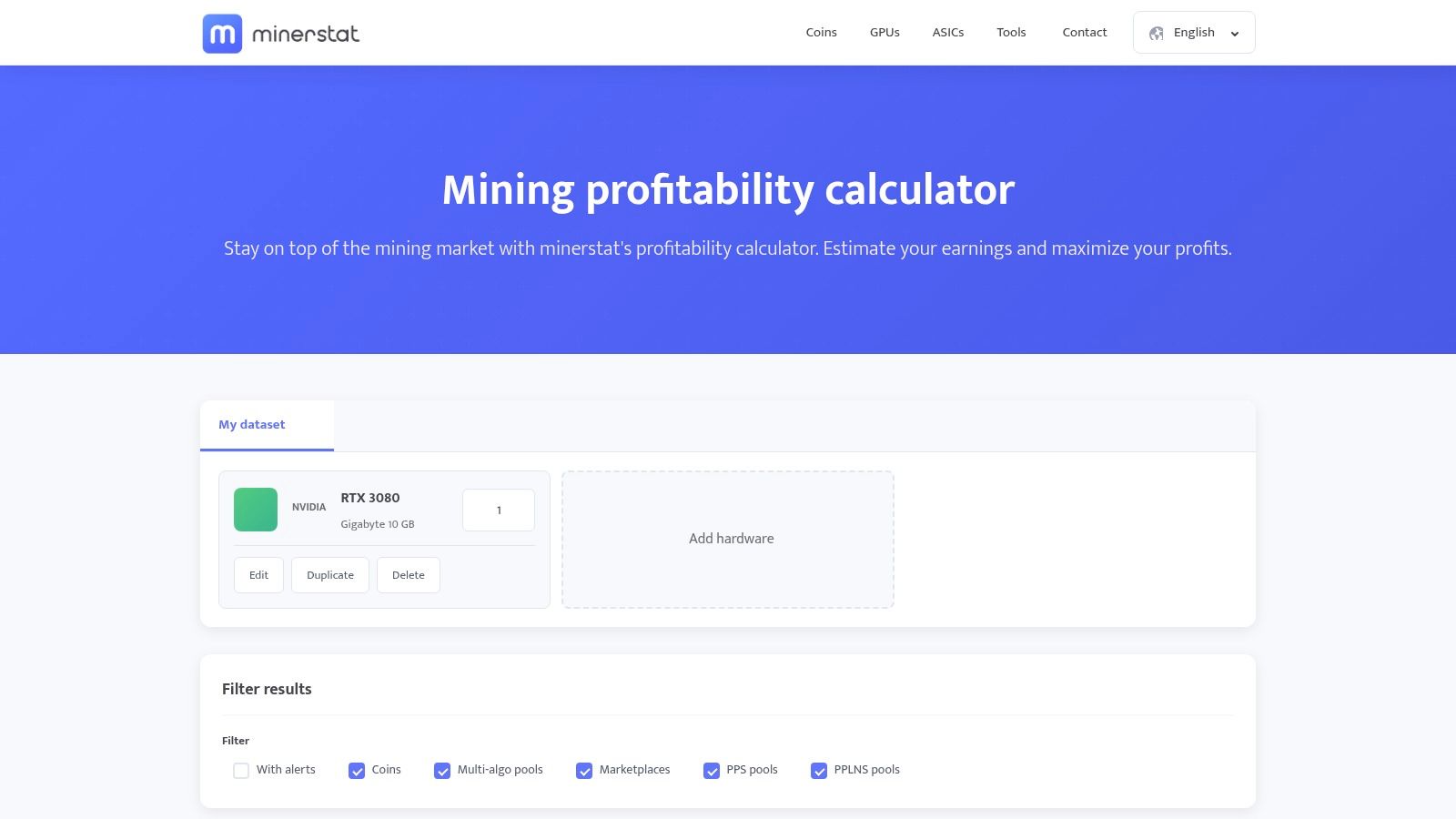

3. Minerstat

Minerstat takes the standard profitability calculator and integrates it into a complete mining management system. Designed for both hobbyists and professional farm operators, it goes beyond simple snapshots of profitability. Its strength lies in providing detailed, data-driven insights that help miners make more stable and informed decisions about which are the most profitable cryptos to mine over different timeframes.

The platform allows you to build detailed profiles of your rigs, apply precise electricity costs, and compare coins, pools, and even hashrate marketplaces. Unlike calculators that only show current profitability, Minerstat offers multiple averaging windows (e.g., 3-hour, 24-hour), which smooths out the volatility of short-term price spikes and offers a more realistic profit forecast. This analytical depth is what sets it apart for serious miners.

Key Features and Usage

Minerstat’s calculator is engineered for precision. You can select hardware from a huge list or input custom hashrates and power consumption for a personalized calculation.

- Adjustable Averaging Windows: Select from current, 3h, 6h, 12h, or 24h data to analyze profitability. This feature helps filter out market noise and identify coins with sustained profitability.

- Advanced Filtering: You can filter results by multi-algorithm pools, marketplace payout types (PPS/PPLNS), and view detailed coin-specific pages with historical data.

- Hardware Benchmarking: Provides hashrate guidance and includes free benchmarking tools to help you understand your hardware’s potential performance on various algorithms.

- Ecosystem Integration: The calculator is part of Minerstat’s broader software suite, which includes remote monitoring, rig management, and automated profit-switching.

Pro Tip: Use the 24-hour average profitability view on Minerstat to check a coin’s stability. A coin that is profitable over a full day is often a more reliable choice than one that experiences a brief, volatile spike.

Pros and Cons of Minerstat

While its advanced features are a major draw, they can be a bit much for newcomers. The platform’s full potential is best realized when used with its management software.

| Pros | Cons |

|---|---|

| Nuanced Time-Window Analysis: Reduces the impact of short-term volatility. | Can Be Complex: The depth of options may overwhelm beginners. |

| Excellent Hardware Database: Detailed profiles for GPUs and ASICs. | Best With Full Suite: Some advanced features are tied to the Minerstat OS. |

| Full Ecosystem Integration: Connects calculations to fleet management tools. | Free Version is Limited: Full functionality requires a subscription plan. |

| Actionable Data: Filters help miners choose specific pools and payout models. | UI Can Feel Dense: The interface is data-heavy and less intuitive than simpler tools. |

The Bottom Line: Minerstat is the perfect tool for miners who have moved beyond basic “what-if” scenarios and need a platform that connects profitability analysis directly to operational management. By allowing you to vet the most profitable cryptos to mine with historical context, it empowers you to build more resilient mining strategies.

Website: https://minerstat.com/mining-calculator

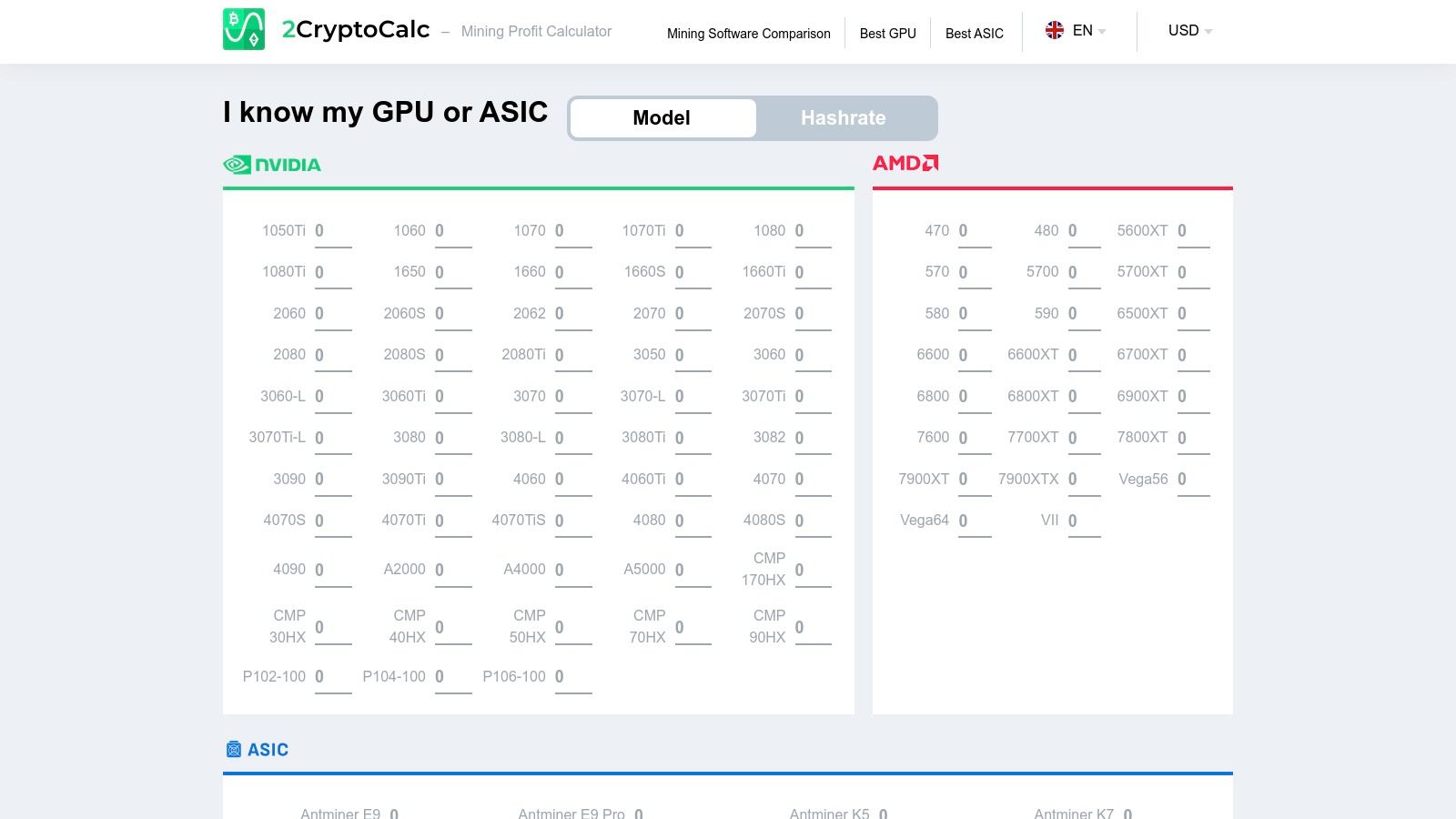

4. 2CryptoCalc

Developed by the team behind the popular 2Miners pool, 2CryptoCalc is a sleek profitability calculator with unique features for modern GPU miners. While it performs the essential function of estimating mining profits, its key difference is its integrated approach. It offers direct comparisons between traditional pool mining, solo mining, and renting out your hashpower on platforms like NiceHash. This makes it a great tool for miners who are evaluating different ways to earn.

The user experience is clean and easy to follow, especially for beginners. You can select your GPU model directly, and the platform prefills hashrate and power consumption data based on the 2Miners team’s extensive testing. This simplifies the initial setup and provides a more realistic estimate than generic manufacturer specs, helping you quickly find the most profitable cryptos to mine with your hardware.

Key Features and Usage

2CryptoCalc’s design focuses on helping you make choices. Instead of just showing potential revenue, it helps you decide how to use your hashrate for the best returns.

- GPU Model-First Approach: The calculator is built around specific GPU models, making it very intuitive. Just select your card, enter your electricity cost, and see a list of profitable coins.

- Solo Mining Probability: A standout feature is its solo mining calculator. It estimates how long it would take to find a block when mining solo, giving you a realistic look at the high-risk, high-reward nature of solo mining.

- NiceHash Profitability Comparison: The tool directly compares the estimated earnings from pool mining a coin versus renting out your hashrate on NiceHash, giving you a clear data point to inform your strategy.

- Data from a Live Pool: Since the data comes from the 2Miners pool, the performance figures are based on thousands of real-world mining rigs, adding a layer of accuracy.

Pro Tip: Use the NiceHash comparison feature to your advantage. If the rental market on NiceHash is paying a premium for your algorithm, it can sometimes be more profitable and predictable to rent out your hashpower than to mine a volatile altcoin directly.

Pros and Cons of 2CryptoCalc

As a free tool from a major pool, it’s very useful, but its focus is naturally aligned with its own ecosystem.

| Pros | Cons |

|---|---|

| Approachability: Excellent for newcomers with a GPU-first workflow. | Ecosystem Bias: Naturally emphasizes coins and data relevant to the 2Miners pool. |

| Strategy-Oriented: Compares pool, solo, and rental profitability. | Estimates Are Volatile: As with any calculator, profits change with market conditions. |

| Realistic Hashrate Data: Uses data from a large, active mining pool. | Fewer ASIC Options: The primary focus is on GPU mining, with less emphasis on ASICs. |

| Completely Free: No cost or login is required to use the service. | Less Coin Variety: May not list as many niche coins as broader calculators. |

The Bottom Line: 2CryptoCalc excels at providing a practical, multi-faceted view of profitability. It doesn’t just tell you what to mine; it helps you decide how to mine. After using it to identify a promising coin and strategy, you can move forward with confidence, whether that means joining a pool or exploring the hashpower rental market.

Website: https://2cryptocalc.com

5. NiceHash

NiceHash operates as a unique hashpower brokerage, setting it apart from traditional mining pools and calculators. It’s a live marketplace where you can either sell your hardware’s computing power (hashrate) to others or buy hashrate to direct at a mining pool of your choice. This model offers an alternative path to profitability, allowing you to either earn a steady income paid in Bitcoin or to speculate on emerging coins without owning specialized hardware.

For sellers, the platform is incredibly simple. You connect your GPU or ASIC rig using NiceHash’s software, which automatically mines the most profitable algorithm at any given moment. In return, you get consistent payouts in Bitcoin, removing the complexity of coin-switching and wallet management. For buyers, it’s a way to instantly acquire massive amounts of hashrate to mine a specific coin, which is useful for targeting new networks or taking advantage of short-term profit spikes.

Key Features and Usage

NiceHash’s marketplace provides distinct tools for both buyers and sellers. The profitability calculator helps sellers estimate their earnings, while the marketplace interface gives buyers detailed control over their orders.

- Sell Hashing Power: Users can easily connect their hardware via the NiceHash Miner software. The system automatically benchmarks the hardware and switches algorithms to maximize earnings, which are then paid out in BTC.

- Buy Hashing Power: Buyers can place orders for hashrate on dozens of algorithms (like Scrypt, SHA256, KAWPOW). They set their price, the amount of hashrate, and point it to a compatible mining pool.

- Profitability Calculator: Similar to other calculators, it provides earnings estimates for a wide range of GPUs and ASICs based on recent marketplace data.

- EasyMining Packages: For a simplified experience, users can buy solo mining packages, giving them a chance to find a block without a complex setup.

Pro Tip: When buying hashrate on NiceHash, watch the order book closely. Setting a bid slightly above the current lowest price can ensure your order gets filled quickly, which is crucial for capitalizing on brief windows of high profitability.

Pros and Cons of NiceHash

As a marketplace, NiceHash offers flexibility that direct mining doesn’t, but this comes with its own set of trade-offs and fees.

| Pros | Cons |

|---|---|

| Excellent Flexibility: Buy or sell hashrate on demand for many algorithms. | Marketplace Dynamics: Fees and bid/ask spreads can reduce margins compared to direct mining. |

| Consistent BTC Payouts: Sellers avoid altcoin volatility by earning in Bitcoin. | Estimates Are Historical: The calculator shows past earnings, which do not guarantee future results. |

| Deep Liquidity: One of the largest sources of on-demand hashrate. | Requires KYC: Certain features and withdrawal limits may require identity verification. |

| User-Friendly for Sellers: “Set and forget” software is ideal for beginners. | Buyer Complexity: Buying hashrate effectively requires understanding of pools and market timing. |

The Bottom Line: NiceHash is a powerful platform for both hands-off miners seeking stable BTC income and strategic buyers looking to target specific cryptocurrencies. For those new to the process, exploring a comprehensive guide on how to start crypto mining can provide clarity. Ultimately, NiceHash provides a unique and powerful way to engage with the crypto mining economy.

Website: https://www.nicehash.com

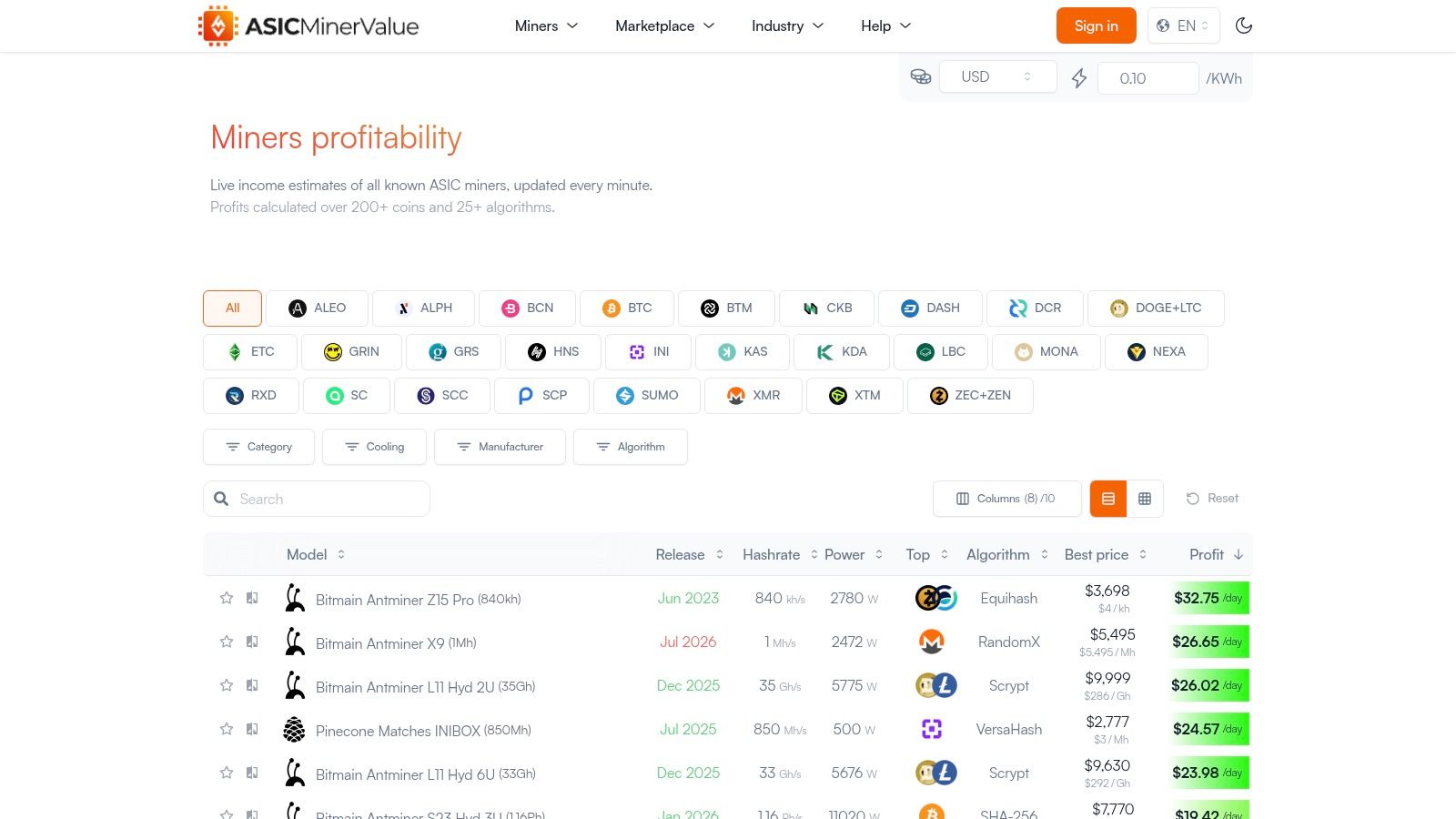

6. ASIC Miner Value

ASIC Miner Value serves a crucial, specific niche in the crypto mining world: it helps you evaluate the profitability of hardware before you buy it. While other calculators focus on the coins, this platform centers on the Application-Specific Integrated Circuit (ASIC) miners themselves. It functions as a comprehensive catalog, ranking available ASICs by their live daily income and profit, providing an essential financial check for anyone considering an investment in specialized mining equipment.

The user experience is built around data comparison. You can immediately see a list of miners from manufacturers like Bitmain and Iceriver, sorted by profitability. Each entry details the model, release date, hashrate, power consumption, and the most profitable coin it can mine. This allows prospective buyers to quickly assess if an ASIC makes financial sense based on current market conditions and their electricity costs.

Key Features and Usage

ASIC Miner Value is designed to guide investment decisions by presenting clear financial metrics for each piece of hardware. Its layout is straightforward, prioritizing data over complex navigation.

- Live Profitability Rankings: The homepage displays a real-time ranked list of ASIC miners, updated frequently to reflect changes in coin prices and network difficulty.

- Per-Model Specifications: Clicking on any miner reveals detailed specs, including algorithm, hashrate, power draw, and efficiency (Joules/TH), which are critical for calculating operational costs.

- Marketplace Aggregation: A key feature is its marketplace page, which compiles listings from various third-party vendors, allowing you to compare prices and check the availability of specific models.

- ROI Snapshots: The platform provides a quick return on investment (ROI) estimate, helping you understand how long it might take for the hardware to pay for itself under current conditions.

Pro Tip: Treat the vendor links on ASIC Miner Value as a starting point, not a final endorsement. Always conduct thorough due diligence on any third-party seller before making a purchase. Check reviews, shipping policies, and warranty terms independently.

Pros and Cons of ASIC Miner Value

As a free research tool, its value is immense for hardware planning. However, its reliance on dynamic market data and third-party sellers comes with inherent risks.

| Pros | Cons |

|---|---|

| Excellent for Pre-Purchase Research: Provides a clear ROI view before investing in hardware. | Profit Figures Are Estimates: Live data is volatile and can change rapidly. |

| Aggregates Vendor Pricing: Simplifies the process of finding and comparing sellers. | Third-Party Vendor Risk: Does not vet or guarantee the reliability of listed sellers. |

| Detailed Hardware Specs: All necessary technical data is in one convenient place. | Focus is Limited to ASICs: Not useful for GPU miners or those exploring CPU-mineable coins. |

| Completely Free: No fees or subscriptions required to access the data. | ROI Doesn’t Factor in Halvings: Future network events that impact rewards aren’t included. |

The Bottom Line: ASIC Miner Value excels at answering the hardware side of the profitability equation, making it an indispensable resource for anyone looking to enter or scale up their ASIC mining operations. By using it with a coin profitability calculator, you can develop a comprehensive strategy to find the most profitable cryptos to mine with the most efficient hardware.

Website: https://www.asicminervalue.com

Most Profitable Crypto Mining — Top 7 Tool Comparison

Deciding which tool to use depends on what you’re trying to achieve. Are you picking a coin, choosing a pool, or buying new hardware? This table summarizes the best use case for each platform.

| Tool | Best For | Key Advantage | Implementation |

|---|---|---|---|

| WhatToMine | Quickly finding the most profitable coin right now | Real-time coin rankings for GPUs and ASICs | Low |

| Minerstat | Building a stable, long-term mining strategy | Time-window averaging to smooth out volatility | Medium |

| 2CryptoCalc | Deciding how to mine (pool, solo, or rent) | Compares profitability of different mining methods | Low |

| MiningPoolStats | Choosing the best mining pool for your coin | Comprehensive data on fees, payouts, and reliability | Low |

| NiceHash | Earning BTC without holding altcoins, or buying hashrate | Flexible marketplace for buying and selling hashpower | Medium |

| ASIC Miner Value | Researching new ASIC hardware before buying | Live profitability rankings and ROI estimates for ASICs | Low |

Putting It All Together: Your Path to Smarter Mining

The quest to find the most profitable cryptos to mine is a continuous cycle of analysis, adaptation, and optimization. As we’ve covered, profitability is a fluid metric, always influenced by market volatility, network difficulty, and hardware efficiency. The difference between a thriving mining operation and a depreciating asset often comes down to the quality of your data and the agility of your strategy.

The tools we have explored—from profitability calculators like WhatToMine to hardware analysts like ASIC Miner Value—are the pillars of this strategy. They provide the real-time data needed to make informed decisions. However, raw numbers only tell half the story. The true art of profitable mining lies in translating that data into a resilient and efficient operational plan.

From Data Points to Strategic Decisions

Sustained profitability requires moving beyond a simple “what’s hot today” mindset. It involves building a framework that can handle market swings and technical challenges. This is where a holistic approach, using multiple tools, becomes essential.

Here’s a simple workflow:

- Initial Analysis: Start with calculators like WhatToMine or 2CryptoCalc. Input your hardware, your electricity cost, and get a ranked list of potentially profitable coins.

- Hardware ROI: If you’re considering new equipment, use ASIC Miner Value. It helps project the long-term return on investment for specific ASIC models.

- Pool Selection: This is a critical step. A coin’s theoretical profitability is meaningless if your mining pool is unreliable. Use MiningPoolStats to vet your top coin candidates. Analyze pool hashrates, fees, and server locations to find a stable partner.

- Continuous Monitoring: The crypto market never sleeps. Use platforms like Minerstat or the NiceHash Profitability Calculator to track your performance and get alerts when profitability shifts, allowing you to switch coins proactively.

Key Takeaway: Profitability is a two-part equation. First, identify the what (the most profitable coin for your hardware right now). Second, optimize the how (the most reliable and efficient pool to mine it through). Neglecting the second part invalidates the first.

Actionable Next Steps for Maximizing Your Mining Returns

With this framework, your path forward is clear.

- Benchmark Your Current Operation: Before making any changes, run your existing setup through these tools. Establish a baseline for your current daily profit and costs. This gives you a metric to measure improvements against.

- Identify Your Top 3 Alternatives: Use WhatToMine and MiningPoolStats to identify the top three most profitable alternatives to your current coin. For each one, vet at least two high-quality mining pools.

- Conduct a 7-Day Test: If you can, switch a portion of your hashrate to your top alternative for one week. Track the actual payouts versus the projected earnings. This real-world test accounts for factors that calculators can miss.

- Develop a Switching Protocol: Don’t switch coins on a whim. Define clear triggers for when you will re-evaluate your choice. For example, you might decide to switch if an alternative coin remains 15% more profitable than your current one for more than 48 consecutive hours. This ensures your decisions are strategic, not reactionary.

Ultimately, mastering crypto mining is about transforming information into action. The tools and strategies outlined here are your blueprint for building a smarter, more resilient, and more profitable mining enterprise.

Frequently Asked Questions (FAQ)

1. What is the most profitable crypto to mine with a GPU in 2026?

The “most profitable” GPU-mineable crypto changes frequently based on market price and network difficulty. As of late 2025, coins using algorithms like KAWPOW (e.g., Ravencoin), Autolykos2 (e.g., Ergo), and various privacy coins often top the profitability charts for GPUs. However, it’s crucial to use a real-time calculator like WhatToMine to get current data for your specific graphics card (like an NVIDIA RTX 4090 or AMD RX 7900 XTX).

2. Is crypto mining still profitable with high electricity costs?

Yes, but it requires careful planning. Profitability is a direct function of three main factors: hashrate, electricity cost, and crypto price. If your electricity cost is high (e.g., above $0.15/kWh), you must focus on:

- Highly efficient hardware: Use modern ASICs or GPUs with a good hashrate-to-wattage ratio.

- Mining efficient coins: Some algorithms are less power-intensive than others.

- Joining low-fee pools: Use MiningPoolStats to find pools with fees under 1% to maximize your take-home earnings.

3. Can I mine crypto without my own hardware?

Yes, this is known as cloud mining or hashrate rental. A platform like NiceHash allows you to buy computing power from other miners and direct it to a mining pool of your choice. This lets you mine for a specific period without investing in expensive hardware, but you must carefully calculate the cost of the hashrate against the potential mining rewards to ensure profitability.

4. What is the difference between solo mining and pool mining?

- Pool Mining: You combine your hashrate with thousands of other miners. The pool works together to find blocks, and rewards are distributed among all participants based on their contributed processing power. This provides smaller, but consistent and predictable payouts.

- Solo Mining: You use your own hardware to try and find a block all by yourself. If you succeed, you get the entire block reward and transaction fees (which can be substantial). However, the chances of finding a block are extremely low unless you have a massive amount of hashrate. It’s a high-risk, high-reward strategy. Tools like 2CryptoCalc can help estimate your chances of success.

5. How often should I check which crypto is most profitable to mine?

For a serious miner, it’s wise to check profitability daily. For more casual miners, a weekly check-in is sufficient. The key is to avoid “chasing” small, temporary spikes. A good strategy is to use a tool like Minerstat and look at 24-hour or 3-day profitability averages. Only consider switching if a different coin shows sustained higher profitability over a couple of days.