Is Crypto Mining Still Profitable?

So, is crypto mining still a viable way to make money? The short answer is yes, absolutely. But let’s be crystal clear: the golden era of firing up your home PC and striking digital gold is long gone.

Profitability in today’s market is a game of razor-thin margins, where success is reserved for the most efficient and well-planned operations. For anyone looking to get started, the entire venture boils down to a single, critical calculation: can you get your hands on powerful, efficient hardware while keeping your electricity bill from spiraling out of control? If the answer is no, then the dream of profitable mining will likely remain just that—a dream.

The Modern Crypto Mining Landscape

Forget the romantic image of a lone prospector with a digital pickaxe. Today’s mining world is a highly competitive, industrial-scale business. The core principle hasn’t changed—you’re still using powerful computers to solve complex cryptographic puzzles, which in turn validate transactions and secure the network. For this vital work, successful miners are rewarded with newly created crypto.

What has changed is the sheer scale and intensity of the competition. The environment has matured dramatically, pushing the barrier to entry much higher. Profit is no longer a given; it’s dictated by a handful of critical factors that separate the successful from those who are simply burning cash.

Key Profitability Drivers Today

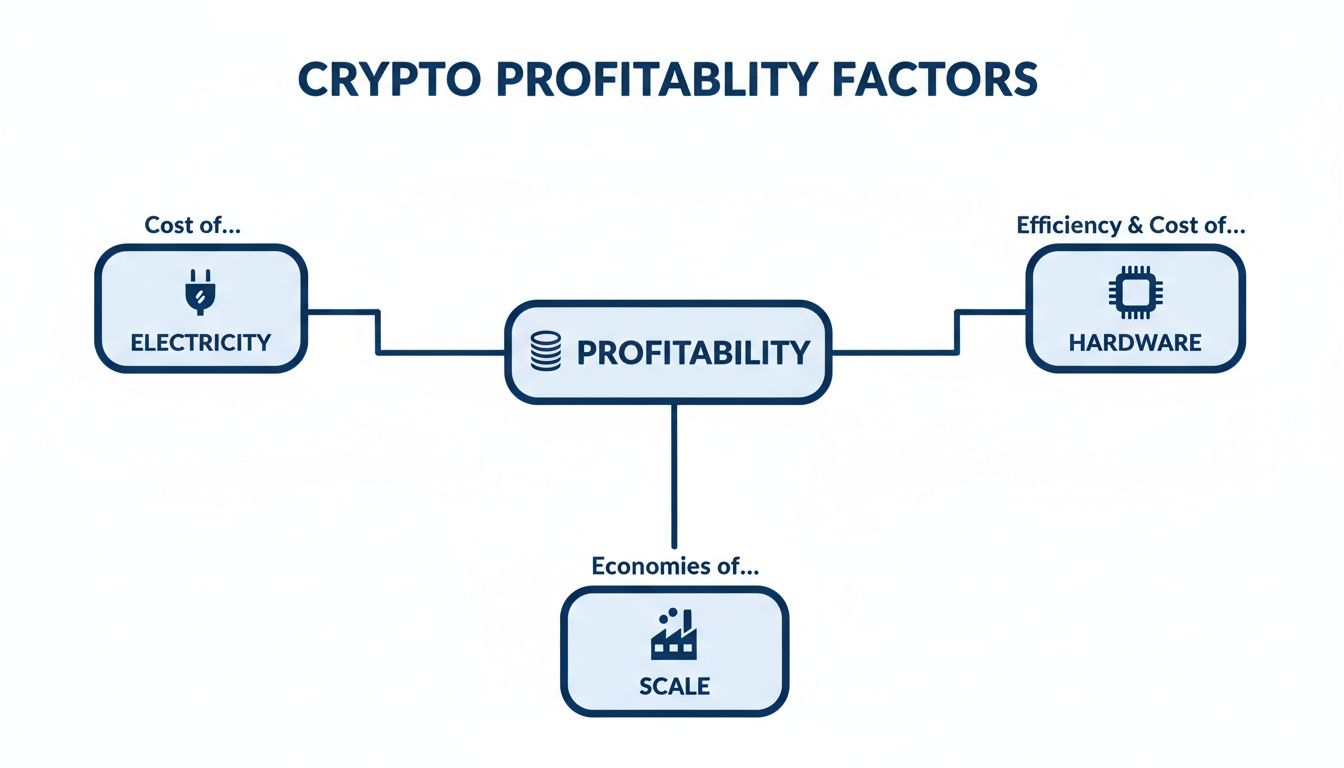

To succeed in mining now, you have to think like a business owner, obsessing over every cost and maximizing every bit of output. The entire profitability formula boils down to a few key variables.

Here’s what you need to master:

- Electricity Cost: This is, without a doubt, the single biggest ongoing expense. A miner with access to cheap power at $0.05 per kilowatt-hour (kWh) has a monumental advantage over someone paying a standard residential rate of $0.12/kWh or more.

- Hardware Efficiency: The conversation has shifted from raw hashing power to efficiency. The new gold standard is measured in joules per terahash (J/TH). A more efficient machine simply produces more hashes for every watt of power it consumes, which flows directly to your bottom line.

- Scale of Operation: Size matters. Large mining farms can negotiate bulk discounts on hardware and secure cheaper electricity contracts, creating an economic moat that’s nearly impossible for a small-time hobbyist to cross.

In summary: The question isn’t really, “Is crypto mining profitable?” The real question you need to ask is, “Can I mine crypto profitably with my specific resources and costs?” The answer is deeply personal and requires an honest look at your situation.

Before we dive deeper, let’s put the key profitability variables side-by-side to see how they stack up.

Profitability Factors at a Glance

This table offers a quick snapshot of what a winning setup looks like compared to one that’s likely to struggle.

| Factor | High Profitability Scenario | Low Profitability Scenario |

|---|---|---|

| Electricity Cost | Below $0.07/kWh | Above $0.12/kWh |

| Hardware Efficiency | New-generation ASICs (e.g., Antminer S21) | Older-generation ASICs or GPUs |

| Network Difficulty | Stable or low | High and rapidly increasing |

| Crypto Price | High and bullish market trend | Low and bearish market trend |

| Operational Scale | Large-scale farm with >100 units | Small home setup with 1-2 units |

As you can see, the path to profit requires getting as many of these factors in the “High Profitability” column as possible. The takeaway is clear: success in modern mining is about controlling your environment and costs.

The professionalization of this space is reflected in the market numbers. Crypto mining is a massive, multi-billion-dollar industry. Recent analysis shows the market generated roughly USD 4.18 billion in 2024 and is on track to hit USD 8.23 billion by 2030. You can find more details in this report on the projected growth of the crypto mining market.

This growth tells an important story: while the industry as a whole is expanding, the profits are becoming more concentrated, making it that much harder for the little guy to get a profitable slice of the pie.

Deconstructing The Crypto Mining Profit Equation

To really get to the bottom of whether crypto mining is still profitable, you have to start thinking like a business owner, not a speculator. Profitability isn’t a lottery ticket; it’s the cold, hard result of a simple but unforgiving formula. Every mining operation, whether it’s one rig in a garage or a massive data center, lives and dies by this math.

The core equation looks easy enough: (Mining Rewards + Transaction Fees) – (Operating Costs) = Net Profit. The real trick—and where most people trip up—is in fully grasping the weight and complexity of those operating costs.

Think of it like running a small coffee shop. Your revenue comes from the coffee you sell (your mining rewards). But to make that coffee, you have costs: rent, wages, the power for the espresso machine, and the beans themselves. If your expenses are higher than your sales, you don’t have a business; you have an expensive hobby. Crypto mining is exactly the same.

Your Revenue Streams Mining Crypto

On the revenue side of things, miners pull in cash from two main sources. They might seem straightforward, but their value can swing dramatically with the market.

- Block Rewards: This is the big prize. When a miner successfully adds a new block to the blockchain, the network pays them out with a set amount of new coins. For Bitcoin, this reward famously gets cut in half every four years during the “halving.”

- Transaction Fees: Miners also collect all the small fees users pay to get their transactions processed quickly and included in a block. When the network gets really busy, these fees can add up to a serious chunk of change, sometimes even rivaling the block reward itself.

Together, these two streams make up your gross income. But that’s just the top-line figure. It’s dangerously incomplete until you start subtracting all the money you had to spend to earn it.

The Three Pillars of Mining Expenses

This is the part of the equation that makes or breaks you. Your expenses are constantly working against your revenue, and getting them under control is the single most important part of building a profitable operation.

The image below breaks down the three cost centers that every aspiring miner absolutely must master.

As you can see, if you can’t get a handle on your power, hardware, and operational costs, turning a profit becomes a long shot.

Let’s dig into each one:

- Electricity Costs: This is, without a doubt, your biggest and most relentless ongoing expense. A powerful ASIC miner is a power-hungry beast that runs 24/7. The gap between paying a residential rate of $0.12/kWh versus securing an industrial rate of $0.05/kWh is often the entire profit margin. You can see just how much location matters in this analysis of the average Bitcoin mining cost by country.

- Hardware Costs: This is your big upfront ticket into the game. A top-tier ASIC or GPU rig will set you back thousands of dollars. And it’s not a one-and-done purchase, either. Hardware has a shelf life. As newer, more efficient models hit the market, your rig becomes less competitive, and its ability to turn a profit slowly fades.

- Mining Pool Fees: Unless you’re running a warehouse full of machines, you’ll need to join a mining pool to get a steady, predictable income. These pools take a cut, usually 1-2.5% of your earnings, for their service. It might not sound like much, but it’s a direct slice off the top of your revenue.

Key Takeaway: Gross mining revenue is a vanity metric. The only number that truly matters is your net profit after you’ve paid for power, accounted for hardware depreciation, and subtracted your pool fees. Mastering your expenses is the true secret to profitable mining.

How The Bitcoin Halving Squeezes Miner Earnings

One of the most predictable, yet brutal, forces affecting mining profitability is the Bitcoin halving. This isn’t some random market event; it’s a pre-programmed shockwave baked into Bitcoin’s code that occurs roughly every four years. Its purpose is to control the supply of new bitcoins, but for miners, it’s an economic reckoning.

Imagine you own a business and know that on a specific date, your total revenue will be permanently slashed in half overnight. That’s the reality of a halving. The reward for mining a block of transactions gets cut by 50%. This creates an intense “profitability squeeze” that forces every mining operation, big or small, to adapt or shut down.

This event is the ultimate filter. Inefficient miners—those with high electricity bills or older, less powerful hardware—often find their operations are no longer profitable the moment the halving hits. The ones who survive are those who have obsessively optimized everything, from securing rock-bottom power costs to deploying the latest, most energy-efficient machines.

The Brutal Math of the 2024 Halving

We just witnessed this firsthand with the April 2024 halving. While Bitcoin mining as a whole remained profitable, this event triggered the most severe profitability squeeze in the network’s history. The block reward dropped from 6.25 BTC to just 3.125 BTC. Instantly, the number of new bitcoins created each day was capped at about 450 BTC, and it will stay that way until the next halving in 2028. You can see a full breakdown of the impact in this deep dive into the post-halving mining economy.

But the revenue shock was only half the story. It was amplified by soaring competition. At the same time, the global Bitcoin hashrate—a measure of the total computing power securing the network—blasted past the 1 zettahash per second (1 ZH/s) mark. So not only was the reward pie cut in half, but more miners than ever were fighting for a smaller piece.

Key Takeaway: The halving creates a survival-of-the-fittest dynamic. It ruthlessly punishes inefficiency and rewards meticulous, long-term planning, making it a pivotal event in the crypto mining profitability cycle.

Hashprice: The Ultimate Health Metric

To make sense of this tough environment, professional miners live and die by a metric called hashprice. Think of it as the daily paycheck for a set amount of mining power, typically measured in dollars per terahash per second per day ($/TH/s/day).

Hashprice is a brilliant little number because it combines three critical variables into one:

- Bitcoin Price: How much the crypto is worth on the open market.

- Block Reward: How many new coins are issued in each block.

- Network Difficulty: How much competition is on the network.

When a halving happens, the “Block Reward” part of that equation gets chopped in half, causing the hashprice to tank. A miner’s biggest expense—electricity—doesn’t change, but their potential income is suddenly much lower. If their cost to run their machines is higher than the hashprice, they’re officially losing money.

This table shows just how fast a profitable operation can turn into a money pit.

| Metric | Pre-Halving Scenario | Post-Halving Scenario |

|---|---|---|

| Block Reward | 6.25 BTC | 3.125 BTC |

| Example Hashprice | $0.10 /TH/s/day | $0.05 /TH/s/day |

| Miner’s Daily Gross Revenue | $10.00 | $5.00 |

| Miner’s Daily Electricity Cost | $6.00 | $6.00 |

| Daily Net Profit | $4.00 | -$1.00 (Loss) |

This simple example reveals the stark reality: a once-profitable miner is instantly in the red. For anyone trying to answer “is crypto mining still profitable?”, understanding the relentless pressure of the halving and its direct impact on hashprice is absolutely essential. It proves that in the world of mining, keeping costs low isn’t just a good idea—it’s the only way to survive.

Calculating Your Real-World Hardware ROI

Let’s shift from the theory of market forces to the practical reality every miner faces: what’s my actual return on investment (ROI)? It’s all too easy to look at the advertised daily earnings of a new ASIC miner and get excited, but those gross numbers are practically fiction until you subtract your single biggest operational cost: electricity.

This is where the dream of easy crypto riches slams into the hard math of running a business. Your real-world profit isn’t determined by what your rig can earn, but by what you get to keep after paying to run it 24/7.

The Payback Period: Your True North

In the professional mining world, nobody talks about just daily profit. The metric that truly matters is the payback period—the exact amount of time it takes for your hardware to generate enough net profit to cover its original price tag. A shorter payback period means you start pocketing pure profit sooner, slashing your risk if the market suddenly tanks.

To get that payback period down, serious miners are obsessed with two variables:

- Power Costs (USD/kWh): The cheaper your electricity, the more profit you keep each day. It’s that simple. A lower rate directly accelerates your journey to ROI.

- Hardware Efficiency (J/TH): This measures how many hashes a miner can produce for every watt of power it consumes. A more efficient machine is a more profitable machine, full stop.

This relentless focus on efficiency is everything. For example, some of the latest SHA-256 miners might advertise gross earnings of roughly $17.95 per day. That sounds great, but it’s before the power bill. As we’re about to see, that number can shrink dramatically.

How Electricity Devours Your Earnings

Let’s walk through a real-world calculation to see just how much of a difference your power rate makes. We’ll use a hypothetical but realistic modern ASIC miner as our example.

- Upfront Hardware Cost: $5,000

- Hashrate: 350 TH/s

- Power Consumption: 5,250 Watts (or 5.25 kW)

- Gross Daily Earnings (at current hashprice): ~$17.50

Now, let’s plug in two very different electricity rates—one representing cheap industrial power and the other a more common residential rate.

Sample ASIC Daily Profit Calculation

This table shows how quickly a profitable operation can become a money pit based on a single variable.

| Metric | Low Electricity Cost ($0.05/kWh) | High Electricity Cost ($0.12/kWh) |

|---|---|---|

| Gross Daily Revenue | $17.50 | $17.50 |

| Daily Power Usage | 126 kWh (5.25 kW * 24h) | 126 kWh (5.25 kW * 24h) |

| Daily Electricity Cost | $6.30 (126 kWh * $0.05) | $15.12 (126 kWh * $0.12) |

| Net Daily Profit | $11.20 | $2.38 |

| Hardware Payback Period | ~446 Days ($5,000 / $11.20) | ~2,101 Days ($5,000 / $2.38) |

The numbers don’t lie. The very same machine goes from a reasonable 15-month payback period to an absurd five-and-a-half-year slog. At the higher residential rate, the miner’s impressive gross earnings are almost completely erased by the cost to run it.

The conclusion is simple: you can’t trust the advertised earnings figures. They’re only half the equation. To figure out if mining makes sense for you, you must run your own numbers. Our crypto mining profitability calculator is a great place to start—just plug in your hardware specs and local electricity rate to get a realistic forecast.

Why Your Mining Pool Choice Matters

You’ve done the math on your hardware ROI and wrestled with your electricity costs. Now comes the final, critical piece of the profitability puzzle: deciding where to point your machine. Choosing a mining pool isn’t just a technical footnote; it’s a strategic decision that directly shapes how much you earn and how often you get paid.

Think of it this way: going it alone (solo mining) is like buying a single lottery ticket for a massive jackpot. The potential prize is huge, but the odds of actually winning are astronomically slim. You could run your hardware for years without ever finding a block.

Mining pools fix this. They let thousands of miners combine their computational power, or hashrate, to solve blocks together. It’s like a lottery syndicate where everyone chips in for tickets. The group wins far more frequently, and the prize is split based on each person’s contribution. This simple idea transforms mining from a high-stakes gamble into a source of predictable, steady income. If you want to dive deeper into the mechanics, you can learn more about what a mining pool is and how they operate.

But here’s the catch: not all pools are created equal. The biggest difference between them comes down to their payout models, which dictate exactly how you get paid for your work.

Understanding Payout Models

The payout model a pool uses is all about risk. Some offer guaranteed payments that act like an insurance policy against bad luck, while others give you a shot at higher rewards but with more volatility. The right one for you depends entirely on your appetite for risk.

Let’s break down the most common systems:

Pay-Per-Share (PPS) and its variations (PPS+, FPPS): This model is straightforward. The pool pays you a fixed amount for every valid “share” your miner submits, whether the pool finds a block or not. The pool assumes all the risk of mining luck. This is the go-to option for miners who need predictable, stable income.

Pay-Per-Last-N-Shares (PPLNS): With PPLNS, you only get paid when the pool actually finds a block. Your payout is calculated based on the shares you contributed during a specific time window just before the block was found. This means more variance—you’ll have slow days if the pool gets unlucky—but it often leads to higher payouts over the long haul because you also get a share of the transaction fees.

Key Takeaway: The choice between PPS+ and PPLNS is a classic trade-off: stability versus potential. PPS+ gives you a guaranteed paycheck. PPLNS gives you a stake in the pool’s good fortune (and its bad).

Comparing Payout Structures

Seeing these models side-by-side really clarifies the decision.

| Payout Model | Income Stability | Miner Risk Level | Potential Long-Term Reward | Best For |

|---|---|---|---|---|

| PPS+ / FPPS | Very High & Predictable | Low | Good, but Capped | Miners who prioritize consistent cash flow. |

| PPLNS | Variable & Less Predictable | Moderate | Potentially Higher | Miners willing to accept some volatility for better overall returns. |

Beyond the payout model, other factors are just as crucial. A pool’s reliability and uptime are paramount. Every minute a pool is down is a minute your expensive hardware is sitting idle, burning electricity without earning you a dime.

Likewise, a pool’s total hashrate can be a good sign of its stability and consistency in finding blocks. By carefully weighing all these factors, you can pull one of the most important levers in your quest for mining profitability.

FAQ: Common Questions About Mining Profitability

We’ve walked through the mechanics of profitable crypto mining, but a few practical questions always come up. Here are answers to some of the most common ones.

Is it still profitable to mine crypto at home?

For most people, mining crypto like Bitcoin profitably at home is no longer realistic. The combination of high residential electricity rates (often over $0.12/kWh) and the upfront cost of a new-generation ASIC miner makes it nearly impossible to compete with large-scale industrial farms. Unless you have access to exceptionally cheap or free power, home mining is more likely to be an expensive hobby than a profitable venture.

Can I mine crypto with a GPU in 2024?

While GPU mining for Bitcoin is completely obsolete, it is still technically possible to mine certain altcoins that are designed to be “ASIC-resistant.” However, profitability is extremely challenging and depends on a perfect storm of factors:

- Ultra-low electricity costs: Your power rate must be very competitive.

- Choosing the right coin: You need to find a niche coin where GPU mining is still dominant.

- Market timing: The value of these altcoins can be highly volatile, and a price crash can erase profits overnight.

In short, GPU mining is more of an educational pursuit than a reliable income source in today’s market.

What is the minimum investment to start Bitcoin mining?

A realistic minimum investment for a potentially profitable Bitcoin mining operation involves two key components:

- Hardware: A new-generation, efficient ASIC miner, which can cost anywhere from $2,000 to over $10,000.

- Power: Access to an electricity contract at or below $0.07/kWh.

Without both of these, even the best hardware will struggle to turn a profit. The true barrier to entry is no longer just the cost of the machine, but the cost of the energy to run it.

How do taxes work for crypto mining?

In most jurisdictions, including the US, mined crypto is treated as taxable income. This is a critical point that new miners often overlook. Generally, the process works like this:

- Income Tax: The fair market value of the crypto at the time it is mined is considered income and must be reported on your taxes.

- Capital Gains Tax: If you later sell or trade that crypto for a profit, you will owe capital gains tax on the increase in value.

It is essential to keep meticulous records of your mining rewards and operating expenses (like electricity costs, which may be deductible). Always consult with a tax professional who is experienced with cryptocurrency to ensure you remain compliant.

Is cloud mining a good alternative?

Cloud mining, where you rent hashing power from a large data center, often sounds like an easy alternative but is fraught with risks. Most contracts are structured to favor the provider, and high fees can quickly erode any potential profits. The space is also rife with scams. For the vast majority of people, buying and holding the cryptocurrency directly is a simpler and often more profitable strategy than engaging in cloud mining. Proceed with extreme caution.