Antminer S19 XP Review

The Antminer S19 XP isn’t just another Bitcoin miner; it’s a machine built around a perfect marriage of raw hashing power and remarkable energy efficiency. For any serious miner, profitability hinges on getting the most hash for the least amount of electricity, and that’s exactly where the S19 XP shines. It represents a significant step up from what came before it, making it a go-to choice for operations focused on long-term returns.

In short, the S19 XP’s design is all about maximizing your income while minimizing your biggest operational cost: power.

A Generational Leap In Bitcoin Mining

When the S19 XP first hit the scene, it wasn’t a minor tune-up; it was a fundamental shift in mining hardware. To really get why, you have to understand what an ASIC (Application-Specific Integrated Circuit) miner actually does. It’s a hyper-specialized computer designed to do one thing and one thing only: rapidly guess solutions to the complex math problems that secure the Bitcoin network.

The faster your machine can guess (its hashrate), and the less power it pulls from the wall while doing so (its efficiency), the more profitable your operation is. The S19 XP nailed both, delivering more hashing power while sipping less electricity. It was like trading in a classic muscle car for a modern performance EV—you get more speed and acceleration, but with a much lower energy bill.

What Makes the S19 XP a Powerhouse?

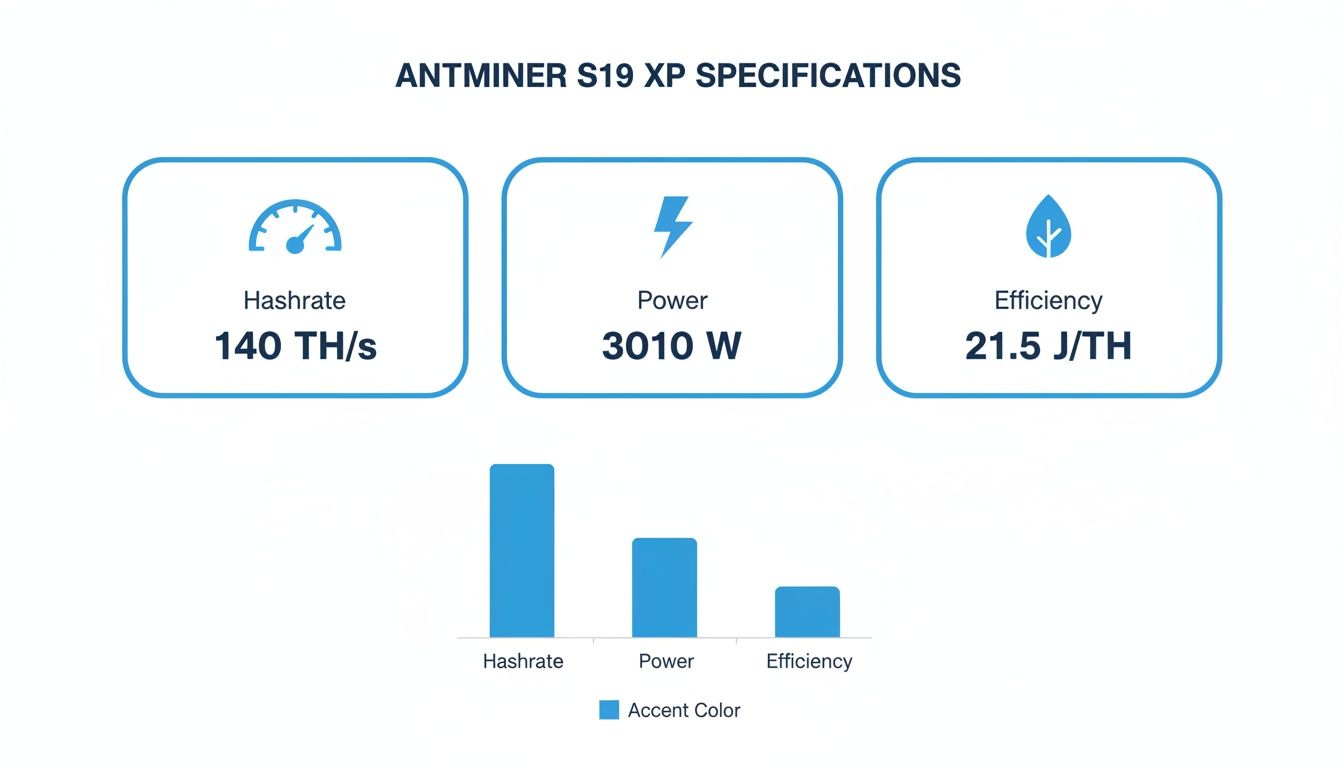

Any miner’s worth comes down to two numbers, and the S19 XP pushed both to new levels:

- Serious Hashrate: This is the engine of the miner—its raw calculation speed. A higher hashrate directly translates to a greater probability of solving a block and earning those coveted Bitcoin rewards.

- Top-Tier Energy Efficiency: This is the miner’s fuel economy, measured in Joules per Terahash (J/TH). Just like with miles per gallon, a lower J/TH number is what you want. It means you’re spending less on electricity for every bit of hashing power you produce.

When Bitmain rolled out the Antminer S19 XP in late 2021, it wasn’t just another model. It was a clear line in the sand, cutting energy consumption per terahash by a massive 27% compared to the S19 Pro, which was the top dog at the time.

While the S19 Pro was impressive, clocking in at around 110 TH/s at 29.5 J/TH, the S19 XP blew past it. It brought efficiency down to an incredible 21.5 J/TH while pushing hashrates into the 125–140 TH/s range. You can dig into a more technical look at this S19 XP efficiency jump on Bixbit.

Antminer S19 XP vs S19 Pro: At-a-Glance Comparison

To truly appreciate the S19 XP’s impact, putting it head-to-head with its predecessor, the still-very-capable S19 Pro, makes the difference crystal clear. The table below lays out the raw numbers that defined this generational upgrade.

| Specification | Antminer S19 XP | Antminer S19 Pro |

|---|---|---|

| Typical Hashrate | ~140 TH/s | ~110 TH/s |

| Power Consumption | ~3010W | ~3250W |

| Energy Efficiency | ~21.5 J/TH | ~29.5 J/TH |

| Generational Leap | Significant | Baseline |

As you can see, the S19 XP not only produces significantly more hashes per second but does so while consuming less power. This combination of higher output and lower operating cost is precisely what gives it a powerful competitive edge and makes it a smarter long-term investment.

Cracking Open the S19 XP: What the Specs Really Mean

When you get your hands on an Antminer S19 XP, the first thing you’ll look at are the specs on the box. But those numbers aren’t just for show—they’re the core of what makes this machine a powerhouse and directly dictate how much money it can make you.

Let’s break down the three key stats that define the S19 XP’s performance.

- Hashrate: The S19 XP churns out between 134 and 141 terahashes per second (TH/s). Think of this as the machine’s raw speed. It’s performing trillions of calculations every single second, and a higher number here directly boosts your odds of solving a block and earning Bitcoin.

- Power Consumption: This model pulls about 3010 watts from the outlet. This is your biggest ongoing cost, the electricity bill you’ll pay every month to keep the machine running.

- Energy Efficiency: The real game-changer is its efficiency rating of 21.5 Joules per Terahash (J/TH). This number connects the first two, telling you exactly how much work you get for every watt you pay for.

Why Efficiency is Everything

That J/TH number is the most important metric of all. Think of it like a car’s miles per gallon. You wouldn’t buy a muscle car without knowing how much gas it guzzles, and you shouldn’t run an ASIC without obsessing over its J/TH. Lower is always better. It means the miner is more effective at turning raw electricity into profitable hashrate.

The Antminer S19 XP’s 21.5 J/TH efficiency is its secret weapon. It means the machine uses far less power to produce a single terahash compared to older models. This single spec is what ensures its longevity, protecting your profits when electricity costs spike or the market takes a downturn.

This incredible efficiency is what gives the S19 XP its staying power. A cheaper, less efficient miner might look appealing upfront, but its higher power draw will relentlessly eat into your profits day after day. The S19 XP, on the other hand, is built for the long haul.

From the Spec Sheet to the Real World

The numbers Bitmain prints on the box are based on ideal lab conditions. Out in the real world, things are a bit messier. A few key factors will cause your actual hashrate and efficiency to fluctuate. Here’s a quick look at how the manufacturer’s specs translate into what matters for your mining operation.

| Performance Metric | Manufacturer Specification | What It Means for You |

|---|---|---|

| Hashrate | 134-141 TH/s | The raw horsepower of your mining operation, determining your earning potential. |

| Power Draw | ~3010W | Your main operational cost, directly impacting your daily profitability. |

| Efficiency | 21.5 J/TH | The miner’s “fuel economy,” which dictates how cost-effective your hashrate is. |

To get the most out of your hardware, you need to manage the variables that can impact these numbers.

- Ambient Temperature: ASICs throw off an incredible amount of heat. If your facility gets too warm, the miner will automatically slow itself down to avoid overheating. This “thermal throttling” will directly lower your effective hashrate.

- Firmware: Bitmain periodically pushes out firmware updates. These aren’t just for show; they can genuinely improve stability, patch security holes, and sometimes even squeeze out a bit more performance. Sticking with the latest stable version is almost always a good idea.

- The Silicon Lottery: Not all chips are created equal. Tiny, microscopic variations happen during manufacturing, meaning two S19 XPs from different batches might perform just slightly differently, even under the exact same conditions.

In conclusion, while the official specs provide an excellent baseline, your real-world performance will depend on your ability to maintain an optimal environment. By keeping a close eye on cooling and staying on top of firmware, you can make sure your S19 XP is running as close to its peak potential as possible and turning those impressive specs into consistent profit.

Calculating Your Real-World Profitability and ROI

Specs on paper are one thing, but what really matters is how the Antminer S19 XP performs in the real world. Can it actually turn that electricity into profit? The answer lies in balancing its raw power against the costs of running it, and that’s where the S19 XP’s efficiency gives it a serious edge.

The whole game is about turning watts into satoshis. A miner’s profitability isn’t just about how much crypto it earns, but how little it costs to do so. This is where the S19 XP’s design shines, acting as a buffer against the volatile crypto market.

Think of it this way: the massive hashrate is your revenue engine, the power draw is your biggest operating cost, and the efficiency rating is the gear ratio connecting them. The S19 XP has a very favorable gear ratio.

The Core Factors Shaping Your Earnings

To get a realistic idea of your potential returns, you have to plug in your own numbers. Even a small change in one of these variables can dramatically alter your daily profits.

Here are the key factors to consider:

- Initial Hardware Cost: This is the first number you need to overcome. The price you pay for the miner sets the starting line for your Return on Investment (ROI) calculation. A good deal on hardware means you’ll break even that much faster.

- Electricity Rate: This is the big one—your largest, most consistent operational expense. The gap between a cheap power rate ($0.05/kWh) and a standard one ($0.10/kWh) can be the difference between a healthy profit and shutting down completely.

- Bitcoin Price: Your revenue is pegged directly to Bitcoin’s market value. When BTC is soaring, almost any miner can make money. When the market dips, only the most efficient machines stay profitable.

- Network Difficulty: You’re competing with every other miner on the planet. As more hashrate joins the network, the puzzles get harder to solve. This means your S19 XP will earn slightly less Bitcoin over time for the same amount of work.

The S19 XP’s killer feature is its 21.5 J/TH efficiency. It acts as a shield. When the Bitcoin price drops or the network difficulty spikes, your lower power cost per terahash keeps you in the game long after less efficient models have to be unplugged.

Modeling Your Return on Investment

Let’s look at some real numbers. The economics of the S19 XP are incredibly sensitive to your power cost. For instance, running a 3,010 W miner at $0.07/kWh costs you about $151.60 per month in electricity alone. Profitability is possible, but the margins are tight.

Drop that rate to a more competitive $0.03/kWh, and suddenly your monthly profit could jump to between $80–$100. This is why serious miners obsess over finding cheap power. Based on market conditions in 2023, ROI models showed the S19 XP had a projected payback period of roughly 501–563 days.

Of course, your results will vary. The only way to know for sure is to run the numbers yourself. Using a good crypto mining profitability calculator is a must. It lets you input your exact hardware cost, electricity rate, and pool fees to get a clear, personalized estimate of your potential ROI.

Ultimately, there’s no fixed timeline for getting your money back on an Antminer S19 XP. But thanks to its best-in-class efficiency, it almost always offers a faster payback period than its competitors, making it a far more durable investment for any serious mining operation.

Choosing the Right Mining Pool to Maximize Your S19 XP’s Earnings

Hooking up a powerhouse like the Antminer S19 XP to just any mining pool is like putting cheap tires on a brand-new race car. You’ve got the horsepower, but without the right connection to the road, you’re leaving performance on the table. The miner provides the raw hashrate, but the pool you choose is what turns that power into consistent, predictable income.

Think of it this way: solo mining is like trying to win a massive lottery by yourself. A mining pool is a cooperative where you and thousands of other miners pool your hashrate together. Your collective power dramatically increases the chances of finding a block and earning the Bitcoin reward. When the pool wins, everyone gets a slice of the prize proportional to the work they put in.

Understanding How You Get Paid: Payout Models

The way a pool distributes those winnings is crucial. It’s not just about finding blocks; it’s about how the rewards are calculated and paid out to you. This directly affects how stable and predictable your revenue will be.

If you want to get into the nitty-gritty, you can learn more about how a mining pool works in our dedicated guide. For now, let’s cut to the chase and look at the three main payout structures you’ll encounter.

| Payout Model | How it Works | Best For |

|---|---|---|

| FPPS (Full Pay-Per-Share) | Pays for every share submitted, plus a cut of transaction fees. Payout is guaranteed regardless of pool luck. | Miners seeking maximum stability and predictable daily income. |

| PPLNS (Pay-Per-Last-N-Shares) | Pays out only when the pool finds a block, based on your recent share contributions. | Miners who are okay with higher variance for potentially higher rewards during lucky streaks. |

| PPS+ (Pay-Per-Share Plus) | A hybrid that guarantees a base payment for shares and adds a bonus from transaction fees. | Miners looking for a good balance between the stability of PPS and the upside of transaction fees. |

The Bottom Line: For a high-performance machine like the Antminer S19 XP, consistency is king. You’re running a serious operation, not playing the lottery. That’s why an FPPS or PPS+ model is almost always the right call. These structures smooth out the volatility of mining luck, giving you a reliable daily income that you can actually build a financial forecast around.

What to Look For in a Mining Pool

Beyond the payout model, a few other critical factors separate a great pool from a mediocre one. Don’t get tunnel vision on just one feature; it’s the combination that counts. Here’s what to check:

- Pool Fees: Every pool takes a cut, usually between 1% and 4%. While a lower fee is attractive, don’t choose a pool on fees alone. A reliable pool with a 2% fee and great uptime will always earn you more than a shaky pool with a 1% fee that’s constantly down.

- Server Latency (Ping): Your miner has to constantly communicate with the pool’s server. A high latency (or “ping”) can cause “stale” shares—work that is submitted too late. Stale shares are rejected, and that’s money straight out of your pocket. Choose a pool with a server located physically close to you.

- Uptime and Reliability: This one is non-negotiable. If the pool’s servers go down, your miners are sitting idle and earning you absolutely nothing. Look for pools with a proven history of rock-solid uptime, ideally 99.9% or higher.

- Reputation and Hashrate: Bigger isn’t always better, but established pools with a significant share of the network hashrate tend to find blocks more regularly, leading to smoother payouts. A long-standing reputation also usually means they have their security and support dialed in.

Setup, Cooling, and Long-Term Maintenance

Getting an Antminer S19 XP is one thing; keeping it running profitably for years is another game entirely. Proper setup, meticulous cooling, and a consistent maintenance schedule are the pillars that protect your investment from costly failures. Think of your miner less like a simple appliance and more like a high-performance engine—it needs the right environment and regular tune-ups to stay at peak performance.

The initial setup itself isn’t overly complicated, but you have to get the details right. After unboxing, the first order of business is placement. Once it’s physically in place and connected, you’ll need to point it to your mining pool. This involves finding the miner’s IP address on your network, opening it in a web browser, and plugging in your pool’s stratum URL and worker details.

Creating the Ideal Operating Environment

Let’s be clear: the single most critical factor for your Antminer’s health and performance is its environment. These machines kick out a tremendous amount of heat, and if you don’t manage it properly, you’re on the fast track to a very expensive paperweight.

The goal is to provide a cool, dry, and clean space.

- Temperature Control: Bitmain specifies an optimal operating temperature range, usually between 5°C and 40°C (41°F and 104°F). Pushing past that upper limit will cause the miner to automatically throttle its performance, which means your earnings take a nosedive.

- Airflow Management: Good ventilation is non-negotiable. You need a dedicated path for cool air to come into the intake fans and a separate path for the hot exhaust to be vented away from the unit. A common rookie mistake is letting that hot air recirculate, which quickly creates an oven effect.

- Dust and Debris: Dust is the silent killer of ASICs. It clogs up heatsinks and acts like an insulator, trapping heat. Over time, that buildup will cause components to overheat and fail prematurely.

The core principle of S19 XP maintenance is proactive prevention. An hour spent cleaning and optimizing your setup each month can save you from days of downtime and hundreds of dollars in repair costs.

The importance of optimized maintenance is exactly why large-scale operations take it so seriously. When a company like Marathon Digital Holdings announced a record-breaking purchase of S19 XP units back in late 2021, they were planning a massive deployment that would ultimately make up a huge slice of the entire Bitcoin network. A rollout that big pushes network difficulty up for everyone, making it even more vital for every miner—big or small—to run at peak efficiency. You can read more about that landmark deal in Marathon’s press release.

A Practical Long-Term Maintenance Checklist

Consistency is everything. A simple, repeatable maintenance routine is your best defense against unexpected problems. It helps you spot small issues before they spiral into big, expensive ones.

| Task Frequency | Action Item | Purpose |

|---|---|---|

| Weekly | Monitor Dashboard | Check for hashrate drops, high chip temperatures, or fan errors. |

| Monthly | Clean Air Intakes | Use compressed air to blow dust out of the intake fan guards and any filters. |

| Quarterly | Inspect Power Cords | Check that all power connections are tight and show no signs of burning or discoloration. |

| Bi-Annually | Deep Clean Heatsinks | Power down the miner, open it up, and carefully clean dust from the internal heatsinks. |

By sticking to a straightforward schedule like this, you can ensure your Antminer S19 XP remains a productive workhorse, reliably delivering the hashrate you paid for while minimizing the risk of a sudden breakdown.

So, Is the Antminer S19 XP Still a Smart Investment?

After breaking down the specs, performance, and real-world costs, we land on the big question: should you buy an Antminer S19 XP right now? The short answer is yes, but it’s a strategic yes—one that requires looking beyond tomorrow’s payout.

The real story of the S19 XP isn’t just its impressive hashrate. It’s the machine’s incredible energy efficiency. Clocking in at 21.5 J/TH, it set a new standard for converting raw electricity into Bitcoin. This isn’t some abstract number; it’s the core economic engine that gives it a massive advantage in a notoriously volatile industry.

Playing the Long Game

Think of Bitcoin mining as a marathon, not a sprint. The upfront cost of an S19 XP is steep, but that initial investment buys you something priceless: endurance.

As the network difficulty continues its relentless climb and prices swing wildly, less efficient miners are the first to get knocked out. Their power bills start to exceed their earnings, forcing them to shut down. The S19 XP, on the other hand, just keeps on hashing, staying in the black long after its competitors have gone dark.

This is the entire investment case for the machine. Its ability to squeeze more Bitcoin out of every single dollar spent on power is a critical competitive edge. It acts as a financial shock absorber, protecting your margins during bear markets and amplifying your gains when things are booming.

The Antminer S19 XP’s greatest asset is its resilience. The initial price tag is a serious consideration, but its power to stay profitable through tough market conditions makes it a durable, workhorse machine for any serious mining operation focused on the long haul.

Ultimately, buying an S19 XP is a bet on superior engineering. You’re paying a premium for a piece of hardware designed to survive the brutal economics of the Bitcoin network. Whether you’re scaling up a home setup or managing an industrial farm, if your goal is sustainable, long-term profit, the S19 XP remains one of the smartest buys you can make.

Common Questions Answered

Diving into the world of ASIC miners always brings up a few questions. Let’s tackle some of the most common ones about the Antminer S19 XP to help you get a clearer picture.

What really sets the S19 XP apart from older models?

It all comes down to one thing: raw efficiency. The S19 XP runs at an impressive 21.5 Joules per Terahash (J/TH). Compare that to the S19 Pro’s 29.5 J/TH, and the difference is massive. In practical terms, it generates the same hashing power while sipping far less electricity.

This efficiency directly impacts your bottom line. Lowering your daily power consumption is the single biggest lever you can pull to increase profit margins. It makes your entire operation more durable, especially when Bitcoin’s price dips or the network difficulty skyrockets.

Just how much does my electricity rate matter?

Honestly, it’s everything. Your electricity cost is the make-or-break variable in the profitability game. Thanks to its efficiency, the Antminer S19 XP can stay in the black at higher power rates than older machines could ever dream of.

But don’t get complacent. The gap between paying $0.05/kWh and $0.10/kWh can be the difference between a thriving business and just spinning your wheels. Always run the numbers with your actual, all-in electricity rate before you even think about buying a miner.

What kind of environment does an S19 XP need to thrive?

Think cool and clean. These two factors are non-negotiable. The S19 XP is a beast that throws off a tremendous amount of heat, and it needs to stay within its happy place, usually between 5-40°C (41-104°F). Get too hot, and you’ll see performance throttle, or worse, cause permanent damage to the hashboards.

Rule of Thumb: A cool, dry, and dust-free space isn’t just a recommendation; it’s a requirement for keeping your investment running long-term. This means having a serious ventilation plan to get hot air out and a strategy to keep dust from clogging everything up.

Dust is the silent killer of ASICs. It insulates components, traps heat, and leads to premature failure. If you want your machine to last, you have to give it a clean home.

Is running an Antminer S19 XP at home a realistic idea?

For most people, the answer is a hard no. It’s technically possible, but the challenges are significant and it’s generally a bad idea for a standard home environment. Here’s why:

- Serious Power: The S19 XP needs a 240V circuit. Most homes aren’t wired for that in convenient places, so you’re looking at hiring an electrician right out of the gate.

- The Noise: We’re not talking about a loud computer fan. This machine screams at about 75 dB, which is like having a powerful vacuum cleaner running 24/7. It’s unbearable in a living space.

- The Heat: This isn’t just a little extra warmth; it’s a space heater on steroids. It will quickly overwhelm a home’s A/C system and turn any normal-sized room into a sauna.

The Antminer S19 XP was built for an industrial setting—a data center or a properly outfitted garage with the right power, ventilation, and soundproofing. It’s simply not a residential-friendly piece of equipment.