ASIC Mining Rigs

At its core, an ASIC mining rig is a purpose-built computer designed to do one thing and one thing only: mine cryptocurrency. Unlike your desktop PC or even a powerful gaming computer, which are jacks-of-all-trades, an ASIC is a master of one. It’s engineered from the silicon up to solve a very specific type of cryptographic problem with brutal speed and efficiency. This specialization makes it the undisputed champion for mining popular digital currencies like Bitcoin.

In short, if you’re serious about mining a major cryptocurrency, an ASIC is the only tool for the job.

Understanding the Power of Specialization

So, what exactly is an Application-Specific Integrated Circuit (ASIC)? The name says it all. It’s a piece of hardware built to execute a single, repetitive task perfectly.

Let’s use an analogy. Think of a Graphics Processing Unit (GPU) as a skilled locksmith with a huge ring of master keys. That locksmith can probably get into any lock you put in front of them, but they’ll need some time to fiddle around, find the right tool, and figure out the specific mechanism.

An ASIC, in contrast, is like a key that was custom-molded for one single lock. It’s completely useless for any other lock on the planet. But for that one specific lock, it works instantly, flawlessly, every single time. This single-minded focus is what gives ASIC mining rigs their incredible advantage in both performance and power efficiency.

Before we dive deeper, it’s helpful to see how ASICs stack up against the hardware they replaced. Here’s a quick rundown.

ASIC vs GPU Mining at a Glance

The table below breaks down the key differences between these two types of mining hardware.

| Attribute | ASIC Mining Rigs | GPU Mining Rigs |

|---|---|---|

| Primary Function | Single-algorithm cryptocurrency mining | General-purpose computing, graphics, and multi-algorithm mining |

| Performance | Extremely high hash rate for a specific algorithm | Moderate hash rate, flexible across different algorithms |

| Power Efficiency | Very high; designed to maximize hashes per watt | Lower efficiency; not optimized for a single task |

| Cost | High initial investment for a single-purpose device | Lower entry cost; components can be repurposed or resold |

| Flexibility | None. Locked to one algorithm (e.g., SHA-256 for Bitcoin) | High. Can switch to mine different cryptocurrencies as profitability changes |

| Ideal For | Serious miners focused on a dominant, stable coin like Bitcoin | Hobbyists or miners wanting to explore newer or alternative coins |

As you can see, the main trade-off is power versus flexibility. ASICs deliver unmatched performance for a specific job, while GPUs offer the freedom to switch between different coins.

Why Specialization Translates to Profitability

This focused design completely changed the game for crypto mining. Because an ASIC is so good at its one job, it uses far less electricity than general-purpose hardware like a GPU or CPU to achieve the same result. This is a huge deal, since electricity is almost always the biggest ongoing cost for any mining operation.

The market reflects this reality. ASIC miners now dominate the crypto mining hardware space, pushing GPUs to the sidelines for major coins like Bitcoin. The numbers don’t lie: the ASIC market is projected to hit USD 8.68 billion globally by 2025. This dominance is also clear when you look at actual mining results. A single, top-of-the-line ASIC in a pool of 100 rigs can mine 1 BTC in about 33-37 days. A high-end GPU would take over 40 years to do the same thing. You can find more insights about the crypto hardware market on DataInsightsMarket.

An ASIC’s efficiency isn’t just about raw speed. It’s about the number of ‘guesses’ it can make per watt of power it pulls from the wall. This metric, Joules per Terahash (J/TH), is the true benchmark for a miner’s long-term profitability.

This specialization creates a permanent bond between the hardware and a specific mining algorithm. What does that mean in practice?

- A SHA-256 ASIC is built only for cryptocurrencies using that algorithm, like Bitcoin (BTC) and Bitcoin Cash (BCH).

- A Scrypt ASIC is designed for coins like Litecoin (LTC) and Dogecoin (DOGE).

- An Ethash ASIC was used for Ethereum before its big change and now works on coins like Ethereum Classic (ETC).

This direct link is a fundamental concept to grasp. It means that choosing the right ASIC mining rig is a strategic decision that starts with deciding which cryptocurrency you want to mine.

Decoding the Metrics That Matter Most

When you first start looking at ASIC miners, the spec sheets can feel like an intimidating wall of technical jargon. The good news is that you only need to master three core metrics to understand what really drives a machine’s performance and, ultimately, its ability to make you money. Get these down, and you can evaluate any miner like a pro.

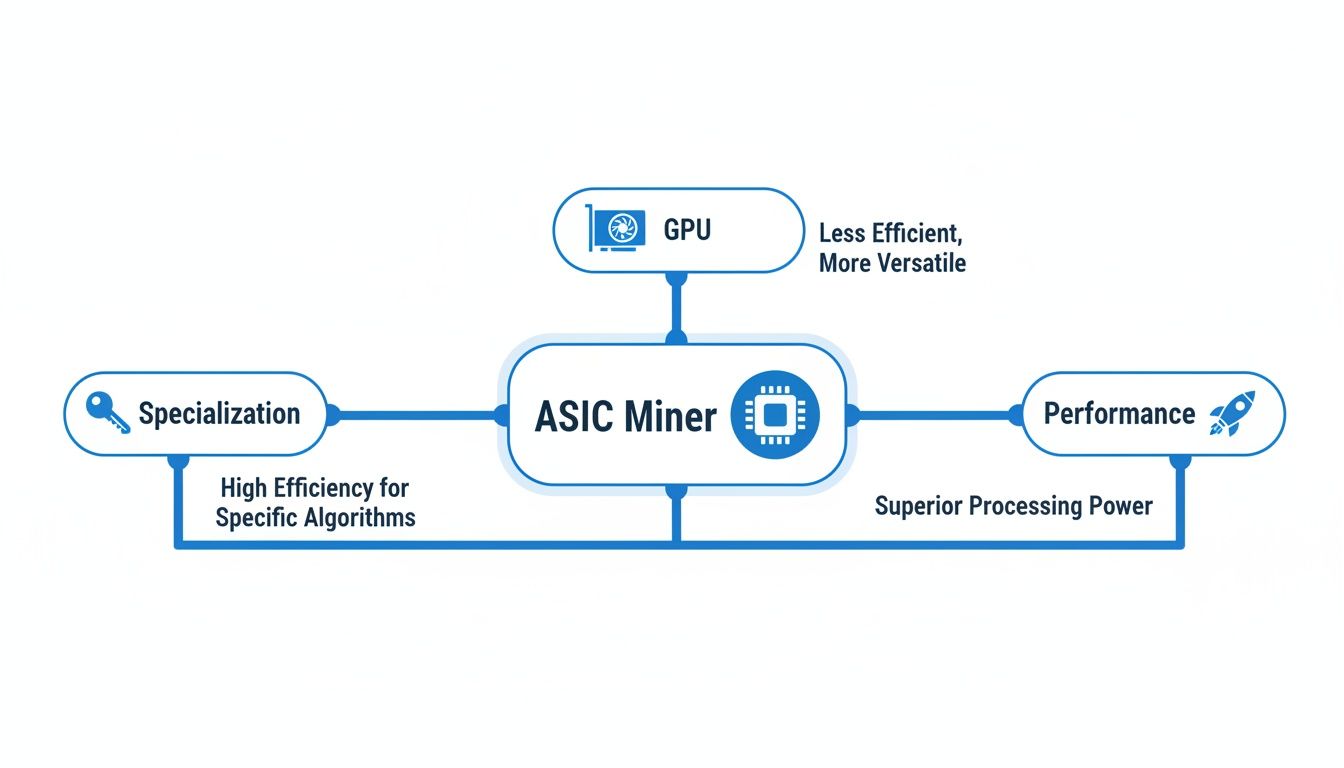

This diagram helps visualize why an ASIC is so different from general-purpose hardware like a gaming GPU. It’s all about focus.

As you can see, an ASIC’s power isn’t just about being faster; it’s about being purpose-built for one job, which allows it to achieve performance that other hardware can’t touch. Let’s break down the three numbers you need to know.

1. Hash Rate: The Engine of Your Miner

First up is the one everyone talks about: hash rate. Measured in terahashes per second (TH/s), you can think of this as the raw horsepower of your miner. It’s a measure of how many cryptographic “guesses” the machine can make every single second as it tries to solve the puzzle to win the next block reward.

A higher hash rate means you’re firing off more attempts in the global mining lottery. For instance, a rig rated at 200 TH/s is churning through a mind-boggling 200 trillion calculations per second. This number is what directly determines your slice of the pie when it comes to a mining pool’s payouts.

2. Power Consumption: The Cost of Operation

Next is power consumption, a much simpler metric measured in watts (W). This is exactly what it sounds like: how much electricity the miner sucks from the wall to do its job. This figure is your single biggest ongoing expense and will show up right on your power bill.

A machine that pulls 3,500W will use 3.5 kilowatt-hours (kWh) for every hour it’s humming away. Multiply that by your local electricity rate—say, $0.10 per kWh—and you’ve turned a technical spec into a real-world cost. Overlooking power consumption is the fastest way to turn a profitable venture into an expensive hobby.

The most powerful ASIC miner on the planet is worthless if its electricity costs are higher than the value of the crypto it mines. Profitability is always a two-sided coin: revenue from your hash rate versus expenses from your power draw.

3. Efficiency: The Ultimate Measure of Profitability

This brings us to the most important metric of them all: efficiency. Measured in joules per terahash (J/TH), this single number brilliantly combines the first two. It tells you exactly how much energy the machine needs to produce one terahash of computing power. Simply put, the lower the J/TH, the better.

Think of it like a car’s fuel economy. A muscle car and a hybrid sedan can both drive at 60 MPH (the hash rate), but the hybrid uses a fraction of the gas (the power). In the world of ASIC mining rigs, efficiency is king. It dictates how long a machine can remain profitable as the network’s mining difficulty inevitably climbs over time. To get a feel for how these numbers play out in the real world, it’s a great idea to plug them into a crypto mining profitability calculator and model a few scenarios.

Let’s look at two hypothetical miners to drive this home.

| Miner Spec | Miner A (Older Model) | Miner B (Newer Model) |

|---|---|---|

| Hash Rate | 100 TH/s | 100 TH/s |

| Power Consumption | 3,300 W | 2,200 W |

| Efficiency (J/TH) | 33 J/TH | 22 J/TH |

| Conclusion | Both miners have the same raw power, but Miner B is 33% more efficient, making it far more profitable over its lifespan. |

As the table shows, even with the exact same hash rate, the more efficient machine wins every time. It earns the same amount of crypto but costs significantly less to run, fattening your profit margins day in and day out. When you’re comparing ASIC mining rigs, always go for the model with the best efficiency rating you can afford.

How to Compare and Choose the Right ASIC Miner

So, you understand the core specs of an ASIC. That’s step one. Now comes the real challenge: using that knowledge to make a smart investment. Choosing the right ASIC mining rig isn’t as simple as grabbing the one with the biggest hash rate number. It’s a calculated decision to find the machine that gives you the best return, balancing its upfront cost against its performance and, most importantly, its day-to-day running expenses.

Think of this as your practical framework. We’re going to move beyond the spec sheets and dig into how you can compare different models and figure out if they’ll actually make you money.

Calculating Your Potential Return on Investment

The heart of any good comparison is a profitability calculation. It’s a simple exercise, really, but it’s what translates a miner’s specs into a real-world projection of daily, monthly, or yearly income. To run the numbers, you’ll need four key pieces of the puzzle:

- Miner’s Hash Rate (TH/s): The raw horsepower of the machine.

- Miner’s Power Consumption (W): How much electricity it’s going to suck from the wall.

- Your Electricity Cost ($/kWh): Your local power rate. This is the single most critical variable and the one people most often underestimate.

- Current Cryptocurrency Price and Network Difficulty: These are the market variables that dictate how much your mined coins are actually worth.

Once you have these numbers, you can plug them into any online mining profitability calculator. What these tools do is pretty straightforward: they take your potential daily mining revenue and subtract your daily electricity cost. The number left over is your potential profit.

Key Factors Beyond the Numbers

A positive ROI calculation is a great start, but it absolutely does not tell the whole story. Several other factors can make or break your investment in the long run. Don’t get so focused on the math that you forget these crucial qualitative aspects when choosing between ASIC mining rigs.

- Manufacturer Reputation: You want to stick with the heavy hitters. Brands like Bitmain (the makers of the Antminer series) and MicroBT (the WhatsMiner series) have a long track record of building reliable hardware and providing decent support.

- Warranty and Support: A solid warranty is your safety net. Before you buy, check the warranty period and exactly what it covers. Good, accessible customer support can be a lifesaver when you run into a technical snag.

- Hardware Durability: Do some digging. Look for reviews and check out community forums to see what real users are saying about the build quality and common failure points for a model you’re considering. Some miners are just built tougher than others.

Choosing a miner is like buying a car. You wouldn’t just look at the horsepower; you’d also consider the fuel economy, reliability ratings, and the manufacturer’s warranty. The best choice is a well-rounded machine, not just the fastest one.

The market for ASIC Bitcoin mining hardware is a battlefield, and it’s constantly changing. Projections show it expanding at a 7.7% CAGR from 2025 to 2031, a trend fueled by the relentless race for better efficiency as the Bitcoin network’s difficulty climbs. This competition, led by giants like Bitmain, MicroBT, and Canaan, means that new and improved models are always just around the corner. You can read more about these market trends and the future of ASIC hardware.

A Look at Leading ASIC Miner Models

To put all this theory into practice, let’s look at how some of the leading models on the market today stack up. The table below breaks down the critical specs we’ve discussed, showing the trade-offs between hashing power and power consumption. Pay close attention to how the newest models are pushing hash rates to new highs while simultaneously driving down their J/TH efficiency ratings.

Comparison of Leading ASIC Miner Models

Here is a detailed breakdown of key performance and efficiency metrics for popular ASIC models from leading manufacturers.

| Model | Manufacturer | Algorithm | Hash Rate (TH/s) | Power (Watts) | Efficiency (J/TH) |

|---|---|---|---|---|---|

| Antminer S21 XP | Bitmain | SHA-256 | 270 | 3645 | 13.5 |

| WhatsMiner M66S | MicroBT | SHA-256 | 298 | 5513 | 18.5 |

| Antminer S19 XP | Bitmain | SHA-256 | 141 | 3031 | 21.5 |

| WhatsMiner M50S++ | MicroBT | SHA-256 | 150 | 3300 | 22.0 |

| Antminer L7 | Bitmain | Scrypt | 9500 MH/s | 3425 | 0.36 J/MH |

| Goldshell KD MAX | Goldshell | Kadena | 40.2 | 3350 | 83.3 J/TH |

Ultimately, the “best” ASIC mining rig is the one that best fits your specific situation. A large-scale miner with access to incredibly cheap power might prioritize raw hash rate above all else. In contrast, a home miner paying standard residential rates needs to be obsessed with finding the lowest J/TH possible to stay profitable over the long haul.

By combining careful calculation with solid research into the less-obvious factors, you can find a machine that will be a productive asset for years, not a noisy paperweight.

Managing Power and Cooling for Profitability

Getting your hands on a top-tier ASIC mining rig is the easy part. The real work—and the secret to turning a profit—lies in taming the two biggest operational beasts: power consumption and heat. Get these wrong, and even the most powerful machine on the market will do little more than burn a hole in your wallet.

Here’s a hard truth: the exact same ASIC can be a cash cow in one location and a financial dead end in another. The deciding factor? Almost always the local price of electricity. A miner with a modest hash rate running on cheap power can easily out-earn a beast of a machine in a high-cost energy grid. Your electricity bill isn’t just an expense; it’s the primary lever for your entire operation’s profitability.

Choosing the Right Cooling Solution

Every single watt an ASIC pulls from the wall gets converted into two things: cryptographic hashes and a whole lot of heat. Dealing with that thermal output isn’t just about stopping your expensive hardware from melting into a puddle. It’s about maintaining peak stability, maximizing efficiency, and squeezing every last day out of its operational lifespan.

Cooling strategies run the gamut from simple fans for a home setup to sophisticated, industrial-grade systems for sprawling mining farms. Your choice will come down to your budget, scale, and environment.

- Air Cooling: This is the default for most miners. It’s straightforward, relying on powerful built-in fans to suck in cool air and blast out the hot air generated by the hash boards. It gets the job done for small operations, but it’s incredibly loud. We’re talking 75-85 decibels—like having a lawnmower running in the next room.

- Hydro Cooling: A major step up, hydro cooling circulates liquid through water blocks mounted directly on the ASIC chips. It’s far more effective at whisking heat away and slashes the noise down to a much more manageable 50 decibels. This makes it a great choice for miners who need to operate in noise-sensitive spaces.

- Immersion Cooling: For the most serious operations, this is the holy grail. The entire ASIC is submerged in a specialized, non-conductive fluid that absorbs heat directly from every component. This method provides unparalleled thermal stability, completely eliminates fan noise, and even protects the hardware from dust and corrosion.

Key Takeaway: Don’t think of cooling as a cost. It’s an investment. Better heat management leads directly to a longer hardware life, steadier performance, and even opens up the possibility of safe overclocking to boost your hash rate.

How Advanced Cooling Unlocks Performance

The advantages of hydro and immersion cooling are about more than just keeping things cool and quiet. By creating a super-stable thermal environment, these systems can dramatically extend the life of your ASIC mining rigs. They prevent the wild temperature swings you see with air cooling, which reduces physical stress on the delicate silicon chips and solder points.

This stability is also what unlocks a new level of performance. Trying to overclock an air-cooled ASIC is a gamble; the extra heat can cause catastrophic failure in a heartbeat. But in an immersion tank or hydro setup, the superior heat dissipation gives you the headroom to safely push your hardware past its factory limits. You can squeeze out more hashing power without threatening the machine’s longevity. This is precisely how professional mining farms gain their competitive edge.

To see how all these pieces fit together, from the electrical outlet to the network cable, our guide on a complete Bitcoin miner setup walks through the entire process. At the end of the day, your power and cooling strategy is every bit as critical as the miner you buy.

Using Mining Pools to Secure Consistent Payouts

Even with the most powerful ASIC mining rig on the market, you’re playing a game of chance. Going at it alone—what we call solo mining—is the equivalent of trying to hit the Powerball jackpot. Sure, the prize is massive, but the odds of your machine being the one to solve the next block are infinitesimally small. You could run your miner for years, maybe even decades, without ever seeing a single reward.

That’s precisely why almost every miner on the planet joins a mining pool. It’s a simple, powerful concept: instead of competing against everyone, you team up. You combine your ASIC’s hash power with thousands of other miners from across the globe.

Think of it like a lottery syndicate. One ticket has a slim chance of winning, but a thousand tickets bought together drastically improve the odds. When the pool finds a block, the reward is split among everyone who contributed, proportional to the work their machine did. This simple shift turns mining from a high-stakes gamble into a predictable, steady stream of income.

Understanding Payout Models

Now, not all pools share the winnings in the same way. The specific payout model a pool uses will directly affect your bottom line, so it’s critical to know the difference before you point your expensive hardware at their servers. The two systems you’ll see most often are PPLNS and FPPS.

Each method has its own trade-offs, really boiling down to a choice between higher potential rewards with more volatility, or slightly lower but rock-solid predictable payments. If you’re new to this, our guide on how to join a mining pool walks you through the entire setup process.

Let’s look at how these payout systems actually work.

| Payout Model | How It Works | Pros | Cons |

|---|---|---|---|

| PPLNS (Pay Per Last N Shares) | Your payout is based on the valid “shares” you contributed over the last set number of rounds before the pool found a block. | Rewards can spike when the pool gets “lucky” and finds blocks faster than expected. It benefits long-term, loyal miners. | Payouts are variable and can fluctuate significantly day-to-day. Hopping between pools can mean losing out on unpaid work. |

| FPPS (Full Pay Per Share) | The pool pays you a predetermined rate for every single valid share your miner submits, whether the pool finds a block or not. | Delivers completely stable and predictable daily income. You are paid for every hash your machine produces. | The average payout is slightly lower because the pool operator absorbs all the risk of block “luck” and variance. |

Key Takeaway: For any miner who needs to cover electricity bills and wants predictable cash flow, FPPS is almost always the better choice. It takes luck entirely out of the equation, guaranteeing you get paid for the exact work your ASIC does, every single day.

Ultimately, mining pools are what make running an ASIC mining rig a feasible business for anyone who isn’t a massive, publicly-traded company. By socializing the rewards, they tame the brutal variance of solo mining and provide the consistent income necessary to operate profitably.

Navigating the Market and Avoiding Common Pitfalls

Jumping into the world of ASIC mining rigs can feel a bit like the Wild West, but a little know-how goes a long way in protecting your investment. Your first big fork in the road is deciding between a brand-new machine and a second-hand one. There’s no single right answer, and each path has real consequences for your bottom line.

A new miner gives you the comfort of a manufacturer’s warranty. If a component dies an early death, you’re covered. That peace of mind, however, comes with a higher price tag. On the flip side, used hardware can get you in the game for a lot less cash, but you’re also buying its history—and all the potential wear and tear that comes with it.

New vs. Used ASIC Miners

To figure out what’s right for you, you need to honestly weigh the pros and cons against your budget and how much risk you’re willing to take on.

| Factor | New ASIC Miners | Used ASIC Miners |

|---|---|---|

| Price | You pay top dollar for a pristine machine with a full warranty. | The price is much lower, which could mean a faster return on your investment. |

| Warranty | Includes a full manufacturer’s warranty, usually for 6-12 months. | Typically sold “as-is,” meaning no warranty and no support if it breaks. |

| Condition | It’s in perfect working order, straight from the factory. | You have no idea how it was treated. It could have been running in a hot, dusty garage for a year. |

| Lifespan | You get the entire expected operational life of the hardware. | Part of its lifespan has already been used up by the previous owner. |

For most people just starting out, a new miner is the safer bet. If you’re an experienced miner who knows your way around diagnostics and isn’t afraid of a little repair work, you might find a great deal in the used market.

Spotting Red Flags and Scams

The market’s massive growth has, unfortunately, attracted its share of scammers. The global ASIC miner market was valued at USD 10.78 billion in 2024 and is expected to balloon to USD 27.86 billion by 2032. This explosive growth is dominated by giants like Bitmain and MicroBT, who control over 95% of the network hashrate. With so much money flowing, you have to be careful. You can read more about the explosive growth of the ASIC market.

Here are a few classic red flags to watch out for:

- Prices That Are Too Good to Be True: If you see a brand-new, top-tier ASIC listed for a price that seems unbelievable, it is.

- Vague or Stock Photos: A legitimate seller will show you actual photos of the machine they’re selling, not generic images pulled from a manufacturer’s website.

- Unusual Payment Methods: Be extremely cautious if a seller insists on non-reversible payments like crypto or wire transfers. There’s no recourse if things go south.

- No Verifiable Reputation: Always buy from established vendors with a track record. Look for real reviews on mining forums or trusted marketplaces.

One of the most common scams is a slick, professional-looking website that appears overnight, takes a bunch of pre-orders, and then disappears without a trace. Always do your homework on a vendor before sending any money.

Finally, remember that every ASIC mining rig has an expiration date on its profitability. As network difficulty climbs and new, more efficient models hit the market, your older hardware will eventually become obsolete. Going into this with realistic expectations about this tech cycle is crucial for protecting your capital and making smart decisions.

Your Top ASIC Mining Questions Answered

Jumping into ASIC mining for the first time? You’ve probably got a lot of questions. Let’s tackle some of the most common ones head-on, so you can get started with a clear understanding of what you’re getting into.

Seriously, How Loud Are These Things? Can I Run One in My House?

Let’s be direct: ASICs are incredibly loud. A standard air-cooled miner churns out a constant 70-85 decibels. To put that in perspective, it’s like having a vacuum cleaner or a lawnmower running in the room, 24/7. It’s not background noise; it’s a constant, high-pitched hum that makes them a terrible fit for a living room, bedroom, or home office.

So, can you run one at home? Yes, but not without some planning. Most home miners set them up in a garage, a workshop, or a well-ventilated basement—somewhere the noise won’t drive everyone crazy. For those who need to keep the sound down, building a soundproof enclosure or investing in advanced (and more expensive) hydro or immersion cooling systems are popular solutions.

How Long Will an ASIC Miner Actually Last?

This is a two-part answer. Physically, an ASIC can be a real workhorse, often lasting 3 to 5 years, sometimes even longer. The key is giving it a good home: a clean, cool environment with stable power is essential for its physical longevity.

The more important question, though, is how long it remains profitable. This economic lifespan is usually much shorter, typically around 2 to 3 years. Two unstoppable forces are working against you here. First, as more miners join the network, the mining difficulty for coins like Bitcoin constantly climbs. Second, manufacturers are always releasing new models that are faster and more efficient. Eventually, your older machine will cost more in electricity than it earns in crypto, and that’s when its useful life is over.

Do I Need to Hire an Electrician?

Almost certainly, yes. Modern ASIC mining rigs are serious power hogs. They’re designed to run on a 220V-240V circuit, not the standard 110V-120V outlets you find all over your house in North America. Why? Higher voltage is simply more efficient for delivering that much power.

Trying to run a high-wattage ASIC on a standard household circuit is a recipe for disaster. It’s not just inefficient; it’s a major fire hazard. You’ll need to bring in a licensed electrician to install a dedicated high-voltage circuit and the proper outlet to run your miner safely and effectively. Don’t skip this step.

Can I Use One ASIC to Mine Different Coins?

No, you can’t. An ASIC is a one-trick pony, and that’s by design. Its hardware is physically engineered to solve one specific type of mathematical problem—the cryptographic algorithm. This extreme focus is what gives it such a massive performance advantage, but it also makes it completely inflexible.

Here’s how that plays out in the real world:

- A SHA-256 ASIC can only mine coins like Bitcoin (BTC) or Bitcoin Cash (BCH). It’s physically incapable of mining anything else.

- A Scrypt ASIC is built for coins like Litecoin (LTC) and Dogecoin (DOGE).

- An Ethash ASIC targets coins like Ethereum Classic (ETC).

This means your very first decision is choosing which cryptocurrency you want to mine. That choice locks you into a specific type of ASIC, so choose wisely.