Bitcoin mining cost

Figuring out the true bitcoin mining cost isn’t as simple as looking up a single number. It’s a dynamic calculation that balances the cost of your gear against your power bill and a handful of other operational details. The final cost to mine one whole Bitcoin can swing wildly, from tens of thousands of dollars to well over a hundred thousand, all depending on how lean and efficient your mining operation is.

The Real Cost of Mining Bitcoin Explained

Before we get into the number-crunching, you have to grasp the core financial commitments. I like to think of a mining operation as a high-performance race car. The car itself—your hardware—is a massive upfront investment. But it’s the fuel, the electricity, that becomes the relentless, day-in-day-out expense that decides whether you can even finish the race, let alone win it.

This dynamic is exactly why you have to understand every single cost component before you even think about plugging in your first machine. Success isn’t just about owning the fastest miner; it’s about running the smartest, most efficient financial operation possible. In short, understanding your costs is the first step to turning a profit.

Breaking Down the Primary Expenses

At its heart, your total cost is a mix of two things: the money you spend upfront (Capital Expenditures, or CapEx) and the money you spend to keep things running (Operational Expenditures, or OpEx). While that shiny new ASIC miner is the most obvious expense, it’s the ongoing costs that will make or break your profitability over the long haul.

Here are the main cost buckets you absolutely have to account for:

- Hardware Investment: This is the initial cash outlay for your Application-Specific Integrated Circuit (ASIC) miners.

- Electricity Consumption: The big one. This is easily the largest and most critical ongoing expense you’ll face.

- Infrastructure & Cooling: You need a place to put your miners, plus shelving, proper ventilation, and robust cooling systems to keep them from overheating.

- Mining Pool Fees: You’ll pay a small percentage of your earnings to a mining pool in exchange for smoother, more consistent payouts.

- Maintenance & Repairs: Things break. You need to budget for hardware failures and routine upkeep.

Make no mistake, electricity is the undisputed king of operational costs for any Bitcoin miner, usually making up anywhere from 60–90% of all running expenses. To stay in the black, most commercial miners are hunting for electricity prices below $0.03–$0.06 per kWh, a target that becomes even more crucial when factoring in the cost of new hardware. You can dig deeper into these mining-economics models to see how they directly shape profitability.

In summary: Your cost per kilowatt-hour is the single most important variable in your entire mining operation. It has more impact on your profitability than almost any other factor.

A Summary of Cost Components

To help you visualize how all these expenses stack up, let’s lay them out. This table gives a clear, at-a-glance overview of where your money is likely going in a typical Bitcoin mining setup.

Table: Core Components of Bitcoin Mining Costs

| Cost Component | Expense Type | Typical Share of Total Cost | Primary Influencing Factor |

|---|---|---|---|

| Hardware (ASIC) | Capital (CapEx) | 30% – 50% | ASIC Model Efficiency & Market Price |

| Electricity | Operational (OpEx) | 40% – 60% | Local Price per kWh |

| Infrastructure | Capital (CapEx) | 5% – 10% | Facility Size and Cooling Method |

| Pool Fees | Operational (OpEx) | 1% – 3% | Selected Mining Pool’s Fee Structure |

| Maintenance | Operational (OpEx) | 1% – 5% | Hardware Age and Operating Conditions |

As you can see, the initial hardware purchase and the ongoing electricity bill are the two heavyweights. Getting these two right is the first and most important step toward building a profitable mining venture.

Your Upfront Investment in Mining Hardware

When you start adding up the numbers for your own mining operation, one cost will dwarf all the others: the hardware. For Bitcoin, this means getting your hands on an Application-Specific Integrated Circuit (ASIC) miner. Let’s be clear: the days of mining with a gaming PC or a rack of GPUs are long over. The only way to compete on the Bitcoin network today is with these specialized machines.

Think of an ASIC as a race car built for a single track. It’s engineered to do one thing and one thing only—solve the complex math problems at the heart of Bitcoin mining—and it does it faster and more efficiently than any other piece of tech on the planet. This raw, specialized power makes it the non-negotiable price of entry.

Evaluating ASICs: The Two Critical Metrics

As you start shopping around, you’ll be hit with a wall of technical specifications. It’s easy to get lost in the jargon, but you only need to focus on the two numbers that truly dictate a miner’s profit potential.

- Hash Rate (TH/s): This is the machine’s raw power, measured in terahashes per second (TH/s). Think of it as the horsepower of your mining rig. A higher hash rate means it can run more calculations every second, giving you a better shot at solving the next block and earning that Bitcoin reward.

- Energy Efficiency (J/TH): This tells you how much electricity the ASIC burns to generate one terahash of power. It’s measured in Joules per terahash (J/TH), and here, a lower number is what you want. A more efficient machine wastes less electricity as heat and turns more of it into profitable work.

A beast of a miner with a sky-high hash rate is completely useless if it’s an energy hog. Your electricity bill will eat your profits alive. The real trick is finding the sweet spot: the best balance of raw hashing power and rock-solid efficiency.

Key Takeaway: Raw power doesn’t guarantee profit. The most successful miners are the ones running the most efficient hardware because it directly attacks their biggest ongoing cost: electricity.

Comparing Modern ASIC Miners

Let’s see how this plays out in the real world by comparing a few popular models. Pay close attention to the relationship between the hash rate and that all-important J/TH efficiency number. You’ll see that the newest machines deliver a massive leap in performance for every watt they pull from the wall.

Table: ASIC Model Comparison

| ASIC Model | Hash Rate (TH/s) | Power Consumption (Watts) | Efficiency (J/TH) |

|---|---|---|---|

| Bitmain Antminer S21 Pro | 234 TH/s | 3510 W | 15.0 J/TH |

| MicroBT Whatsminer M60S | 186 TH/s | 3441 W | 18.5 J/TH |

| Bitmain Antminer S19k Pro | 120 TH/s | 2760 W | 23.0 J/TH |

| Bitmain Antminer S19j Pro | 100 TH/s | 2950 W | 29.5 J/TH |

Look at that difference. The newer S21 Pro is almost twice as efficient as the older S19j Pro. This constant march of technology is exactly why you have to account for the next major cost.

The Hidden Cost of Hardware Depreciation

An ASIC miner isn’t a buy-it-once-and-forget-it purchase. It’s a depreciating asset with a very real, and often surprisingly short, competitive lifespan. Its value drops over time for two simple reasons:

- The Bitcoin network’s difficulty is always rising.

- Manufacturers are constantly releasing newer, more efficient models.

As more powerful miners join the network, the overall hash rate climbs, making it tougher for your older gear to keep up and earn its share. This isn’t just an abstract accounting principle; it’s a real-world expense that will hit your bottom line. You have to build the cost of eventually replacing your hardware right into your business plan.

If you’re just getting started, our complete guide on how to start crypto mining can help you put all the initial pieces together. By treating depreciation as a recurring operational cost from day one, your financial models will reflect the tough, competitive reality of the mining world.

The Ongoing Costs of a Mining Operation

Once you’ve made the initial investment in hardware, your focus has to shift—and shift quickly—to managing the day-to-day costs. This is your operational expense, or OpEx, and it’s where the real battle for long-term profitability is won or lost. While several things add up, one expense towers over all the others: electricity.

Your power bill is the relentless, meter-spinning reality of Bitcoin mining. It’s no exaggeration to say that your price per kilowatt-hour ($/kWh) is the single most critical variable in your entire operation. A few cents’ difference can be the line between a thriving venture and one that’s just burning cash.

Electricity: The Unrivaled King of OpEx

Figuring out what your miner costs to run is pretty straightforward. You just need to know its power draw in watts and what you pay for electricity. Let’s use a modern ASIC like the Antminer S19k Pro as an example. It pulls about 2760 Watts.

Here’s how to calculate its daily electricity consumption:

- Convert Watts to Kilowatts: 2760 W / 1000 = 2.76 kW

- Calculate Daily kWh: 2.76 kW × 24 hours = 66.24 kWh per day

- Calculate Daily Cost: 66.24 kWh × your electricity rate ($/kWh) = Your Daily Cost

The sheer scale of this is mind-boggling when you zoom out. The entire Bitcoin network is estimated to consume around ~175 TWh per year. That’s more than enough to power many mid-sized countries. This hunger for power is exactly why you see massive mining farms popping up in places with the cheapest electricity, like the United States, Kazakhstan, and Canada. You can get a deeper look at this global power dynamic in this Bitcoin electricity consumption analysis.

To see just how much this matters, look at how the daily running cost for that single S19k Pro changes with different power rates.

Table: Daily Running Cost vs. Electricity Rate (Antminer S19k Pro)

| Electricity Rate ($/kWh) | Daily Cost | Monthly Cost | Annual Cost |

|---|---|---|---|

| $0.04 | $2.65 | $79.50 | $954 |

| $0.08 | $5.30 | $159.00 | $1,908 |

| $0.12 | $7.95 | $238.50 | $2,862 |

| $0.16 | $10.60 | $318.00 | $3,816 |

The math is brutal. Doubling your electricity rate doubles your single biggest expense. It’s why serious mining operations are almost always built around access to wholesale, industrial-grade power contracts.

The Bottom Line: Success in mining isn’t about being in a specific country; it’s about being on the right side of the power meter. Access to cheap, reliable electricity is the ultimate competitive advantage.

Don’t Forget These Other Critical Expenses

While the electricity feeding your ASICs is the main event, it’s not the only cost draining your wallet. A truly accurate financial picture has to account for these other essentials.

- Cooling Costs: ASICs generate an incredible amount of heat. Keeping them cool enough to run efficiently requires powerful fans and ventilation systems, which, you guessed it, use a lot of electricity themselves.

- Facility and Infrastructure: Whether you’re renting rack space in a data center or running your own facility, you have to budget for things like rent, security, and general maintenance.

- Mining Pool Fees: Unless you’re running a warehouse full of miners, you’ll need to join a mining pool to get consistent payouts. These pools take a small cut, typically 1-3% of your earnings, for their service. If you’re new to the concept, our guide explains everything you need to know about how to join a mining pool.

- Routine Maintenance: Hardware doesn’t last forever. You’ll be replacing fans, cleaning out dust filters, and troubleshooting hardware failures. All of this adds to your total bitcoin mining cost over time.

- Internet Connectivity: It’s not a huge expense, but a rock-solid, low-latency internet connection is absolutely non-negotiable. If your miners are offline, they’re just expensive paperweights.

By keeping a close eye on every one of these ongoing expenses, you can build a realistic model of your operation’s financial health. It’s the only way to make smart decisions and stay profitable in the long run.

How to Calculate Your Mining Breakeven Point

Once you’ve got a handle on all your costs—from the hardware itself to the power bill—the big question becomes: when do you actually start making money? That’s your breakeven point. It’s the moment your mining revenue finally overtakes all your accumulated expenses.

Figuring this out isn’t about guesswork; it requires putting your numbers to work. You’ll need to project your potential revenue against your fixed and ongoing costs to see exactly where those two lines intersect.

Assembling Your Profitability Variables

To get a realistic picture of your potential profit, you first have to nail down a few key data points. Think of these as the essential ingredients for any mining profitability recipe.

Here’s what you need to have on hand:

- Miner Hash Rate (TH/s): This is the raw horsepower of your ASIC miner.

- Power Consumption (Watts): The amount of juice your machine pulls from the wall.

- Electricity Cost ($/kWh): Your power rate. Honestly, this is the single most important variable in the whole equation.

- Mining Pool Fee (%): The cut the pool takes for organizing the mining effort.

- Current Bitcoin Price ($): The market value of BTC, which obviously swings wildly.

- Network Difficulty: A measure of how competitive mining is at any given moment.

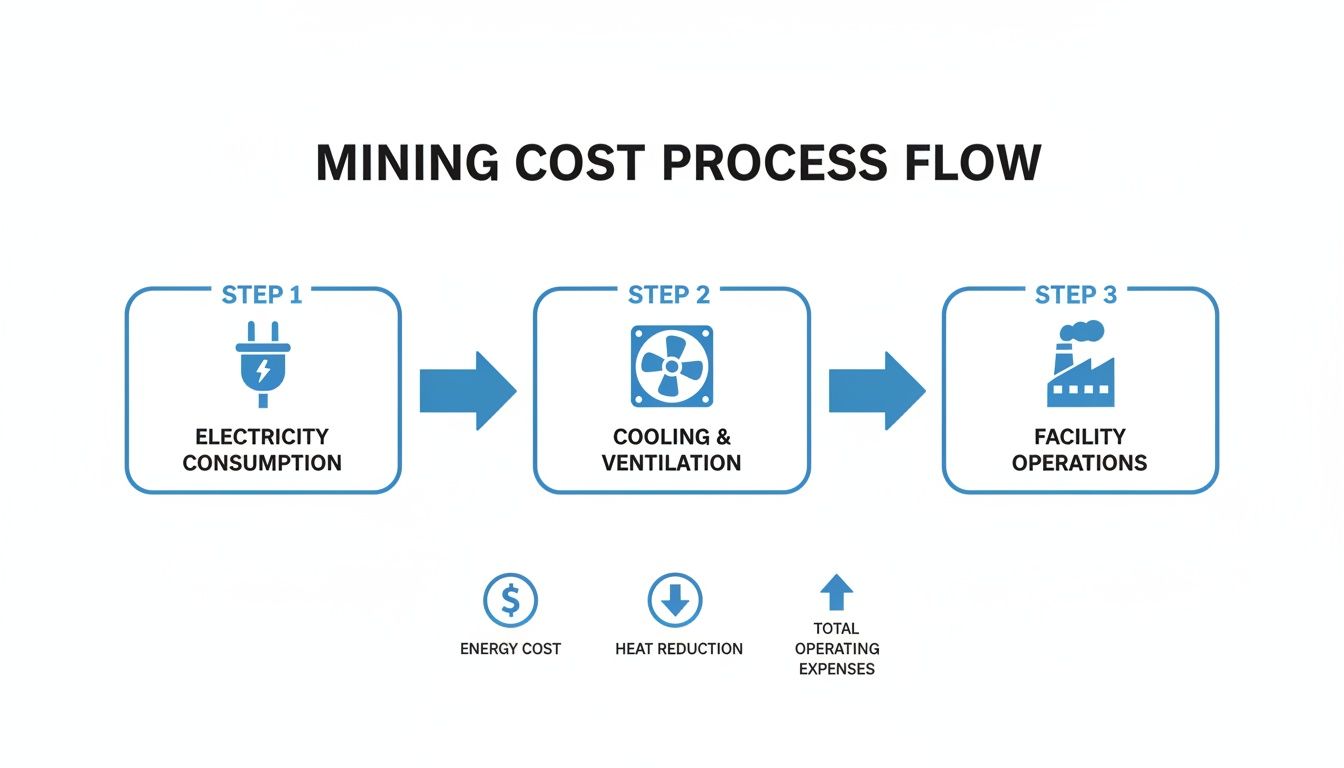

With these numbers in hand, you can start plugging them into a simple formula to see what your daily revenue looks like and then subtract your daily costs to find your profit. The flow of operational costs is pretty intuitive: electricity powers your miners, the miners get hot and need cooling, and all of it sits inside a facility you have to pay for.

This just drives home how interconnected everything is. Your power costs don’t just run the miners; they also run the cooling systems needed to keep those miners from melting down. It all feeds into your daily breakeven calculation.

A Concrete Calculation Example

Let’s make this real. We’ll run the numbers for a popular and reliable workhorse, the Bitmain Antminer S19k Pro. First, let’s lay out our key stats for the machine and our operation:

- Hash Rate: 120 TH/s

- Power Consumption: 2760 Watts

- Electricity Rate: $0.08/kWh

- Pool Fee: 2%

Now, let’s figure out our biggest operational cost—electricity. The math is straightforward:

(2760 W / 1000) * 24 hours * $0.08/kWh = $5.30 per day

So, it costs $5.30 just to keep this machine running for 24 hours. The next step is estimating daily revenue, but that’s where things get tricky. Revenue is a moving target, completely dependent on the live Bitcoin price and the current network difficulty. This is exactly why experienced miners lean heavily on online calculators for up-to-the-minute estimates.

The Breakeven Point: Your daily breakeven is the Bitcoin price at which your mining revenue is exactly equal to your daily operational cost. In our example, that’s $5.30. If you’re earning more than that, you’re in the green for the day. If not, you’re in the red.

Finding Your Return on Investment (ROI)

Covering your daily power bill is one thing, but paying back the several thousand dollars you spent on the miner itself is the real goal. This is your Return on Investment (ROI). To calculate your ROI, you need to know your daily profit (Revenue – Costs), not just your gross revenue. Let’s assume that after we plug our numbers into a calculator, we find our net profit for the day is $2.50.

- ROI Calculation: (Initial Hardware Cost / Daily Profit) = Days to ROI

If that Antminer S19k Pro cost you $2,000, the math would look like this:

$2,000 / $2.50 per day = 800 days

This tells us it would take roughly 800 days of continuous, profitable mining just to pay off the hardware. And remember, that timeline will shrink or expand dramatically based on what the market does.

Using an Online Mining Calculator

Trying to calculate your revenue manually is a fool’s errand. The network changes too fast. The best and most accurate way to do it is with a dedicated mining calculator. These tools are lifesavers—they pull in the live Bitcoin price and network difficulty for you automatically.

To get the hang of it, check out our guide on using a crypto mining profitability calculator which breaks down how to make this whole process a breeze.

Squeezing Every Penny: Actionable Ways to Cut Your Mining Costs

Knowing your breakeven point is one thing; actively pushing it lower is how you win the game. Profitability in Bitcoin mining is a constant battle for efficiency. Every fraction of a cent you can shave off your operational costs drops directly to your bottom line. This isn’t a “set it and forget it” business—it demands a hands-on approach to optimizing every single variable.

This means you’re always on the hunt for cheaper electricity, constantly fine-tuning your hardware, and being incredibly picky about your partners. By zeroing in on a few key areas, you can slash your overall bitcoin mining cost and protect your profit margins, even when the market turns against you.

Tame Your Biggest Expense: Power and Cooling

Electricity is the undisputed king of mining operational costs, so any savings here will have an outsized impact on your profitability. While packing up and moving to a region with dirt-cheap power isn’t practical for most, there are still plenty of moves you can make right where you are.

- Hunt for Better Power Deals: The big players lock in favorable long-term rates by negotiating Power Purchase Agreements (PPAs) directly with energy producers. While that’s likely out of reach for a smaller operation, the principle is the same: always be shopping around for better commercial or industrial electricity plans.

- Get Smart About Cooling: Don’t forget that your cooling system is a massive power hog in its own right. An efficient setup, like a hot-aisle/cold-aisle configuration, is critical. It prevents your ASICs from just sucking in their own hot exhaust, which forces their internal fans to work overtime and burn more electricity.

Think of it this way: every watt you save on cooling is a watt you don’t have to pay for. Those small improvements compound into serious savings over the life of your machines.

Your Mining Pool is Your Business Partner—Choose Wisely

Who you mine with is one of the most important decisions you’ll make. The right mining pool can stabilize your income, while the wrong one can slowly bleed you dry. Pools vary wildly in their fees, how they pay you, and their overall reliability. The biggest difference you’ll encounter is the payout model. The two most common are:

- Pay-Per-Share (PPS/PPS+): The pool pays you for every valid piece of work (a “share”) you submit, whether it finds a block or not. This gives you highly predictable, stable income, but you’ll usually pay slightly higher fees for that guarantee. The pool takes on the risk.

- Pay-Per-Last-N-Shares (PPLNS): With PPLNS, you only get paid when the pool actually finds a block. Your payout depends on how many shares you contributed in the time leading up to the find. This means your income can be lumpy and inconsistent, but because you’re sharing the risk, the fees are typically lower, making it more profitable over the long run.

Just look at this snapshot from MiningPoolStats. It lays out the top Bitcoin pools, showing their market share, fees, and payout models—everything you need for a side-by-side comparison.

At a glance, you can see how the fees for a PPS+ pool like Binance Pool stack up against a PPLNS pool. This is where you have to decide: do you want the steady paycheck, or are you willing to ride the waves for potentially higher long-term rewards?

Key Takeaway: Choosing a pool isn’t just about finding the lowest fee. It’s about matching the pool’s entire model—payouts, fees, and all—to your own risk tolerance and cash flow needs.

Fine-Tuning Your Fleet: Firmware and Performance

Finally, you can get more out of the hardware you already own. Custom firmware unlocks the ability to go under the hood of your ASICs and adjust their performance, letting you fine-tune the balance between power consumption and hashrate.

- Underclocking (Efficiency Mode): Here, you intentionally reduce your miner’s clock speed and voltage. Yes, it lowers its hashrate, but it slashes power consumption even more dramatically, which improves its Joules per Terahash (J/TH) efficiency. This is a killer strategy during a bear market when survival depends on being the most efficient operator in the room.

- Overclocking (Performance Mode): This is the opposite—you push your hardware to its limits for a higher hashrate, but it comes at the cost of much higher power draw and heat output. You’d only do this when the price of Bitcoin is high enough to justify the massive electricity bill, and only if your cooling can handle the extra stress.

By actively managing these settings, you stop being a passive miner and become a strategic operator. You’re no longer just at the mercy of the market; you’re adapting to it to protect your profitability.

The Environmental Impact and Future of Mining

Talk about the cost of Bitcoin mining, and you can’t ignore the elephant in the room: its environmental footprint. The sheer amount of electricity needed to run and cool thousands of specialized machines has put the industry under a microscope, sparking a serious debate about its long-term viability. This isn’t just about public perception; it’s a real strategic challenge that’s forcing a major shift in how mining operations are built and run.

At the heart of the matter is the network’s massive energy appetite. This has, quite fairly, raised concerns about carbon emissions, especially when mining farms are plugged into power grids that lean heavily on fossil fuels. But the story isn’t that simple, and it’s changing fast as the industry grows up.

The Pivot Towards Sustainable Mining

In a fascinating turn of events, miners are now leading the charge toward sustainable and often-overlooked energy sources. This isn’t just an effort to look good—it’s a hard-nosed business decision. Renewable energy like hydro, solar, and wind is frequently generated in remote places where there’s more supply than local demand. The result? Some of the cheapest electricity you can find anywhere in the world.

This natural alignment gives miners a powerful reason to help fund and stabilize new renewable energy projects. We’re seeing this trend play out in a few really interesting ways:

- Hydroelectric Power: Miners are setting up shop in regions with tons of hydropower, from North America to Scandinavia, to get their hands on steady, low-cost power.

- Stranded Solar and Wind: New operations are being built right next to huge solar and wind farms to soak up excess energy that the local grid can’t always use.

- Flared Gas Mitigation: One of the most clever solutions involves using natural gas that would otherwise be wastefully burned off—or “flared”—at oil drilling sites. This turns a polluting byproduct into a productive energy source for mining.

The bottom line is that the mining industry’s constant hunt for cheap power is naturally pushing it toward the very energy sources the world needs more of: renewables and waste-to-energy solutions. This creates a win-win scenario where miners offer consistent demand that makes new green energy projects financially feasible.

The data backs this up. While a good chunk of the network still runs on traditional power, the shift is undeniable. Some reports suggest that around 50–55% of the electricity consumed by Bitcoin now comes from low-carbon sources. Of course, that means a substantial 45–50% still comes from fossil fuels, leading to significant CO2 emissions each year. You can get a much deeper look into Bitcoin’s carbon footprint and the push for greener practices to understand the complete picture.

Ultimately, the future of profitable mining is tied directly to sustainable energy. As competition gets tougher, the miners who will win are the ones who can lock in the cheapest, most reliable power sources. And more and more, that power is going to be green.

FAQ: Common Questions About Bitcoin Mining Costs

Diving into the numbers behind Bitcoin mining can feel overwhelming, so let’s tackle some of the most frequent questions to clear up the financial realities of the industry.

How does the Bitcoin halving affect my costs?

The Bitcoin halving is a seismic event for miners. While it doesn’t directly change your operational costs—your power bill and rent stay the same—it slashes your revenue in half overnight. This effectively doubles the cost to produce a single bitcoin.

Suddenly, efficiency becomes a brutal game of survival. Miners who were barely profitable before the halving often find themselves deep in the red. This is when you see older-generation hardware get unplugged for good and miners with high electricity costs get forced out of the market. In short, cost efficiency isn’t just a goal; it’s the only thing that keeps you in the game post-halving.

Can I still make money mining from home?

Honestly, for almost everyone, the ship has sailed on profitable home mining. The biggest killer is the cost of residential electricity. You’re paying retail rates, while large-scale farms are negotiating industrial prices that are a fraction of what you’re charged.

If you’re paying more than $0.10 per kilowatt-hour, it’s practically impossible to turn a profit. The rare exceptions are people with access to virtually free power and the capital to buy the latest, most efficient ASICs. The romantic image of a profitable mining rig humming away in a garage is a relic of Bitcoin’s early days. Mining has professionalized, and today, success hinges on massive economies of scale and access to wholesale electricity.

What’s the real difference between solo and pool mining?

This is a fundamental choice every miner has to make, and it comes down to your appetite for risk versus your need for consistent income.

- Solo Mining: Think of this as playing the Powerball. You’re on your own, dedicating all your hashrate to finding a block. If you hit it, you get the entire multi-bitcoin reward. The catch? The odds are so infinitesimally small for an individual that you could mine for years—or even a lifetime—and find absolutely nothing.

- Pool Mining: This is like joining a massive office lottery pool. You combine your hashrate with thousands of other miners, which vastly increases the collective chance of finding blocks regularly. When the pool wins, the reward is split up and paid out to everyone based on the work they contributed.

For virtually every miner out there, pool mining is the only practical option. It swaps the impossible dream of a solo jackpot for a steady, predictable stream of smaller payments.

How do I handle taxes on mined Bitcoin?

Taxes are a critical and often-forgotten part of your total bitcoin mining cost. Don’t ignore them. In most places, like the United States, cryptocurrencies you mine are treated as income.

This means you’re generally taxed on the fair market value of the Bitcoin at the moment you mined it. If you hold onto that Bitcoin and sell it later for a profit, you’ll likely owe capital gains tax on the appreciation, too. Tax rules are notoriously complex and change based on where you live, so it’s absolutely crucial to talk to a qualified tax professional.