Bitcoin Mining for Beginners

If you’re just getting started with Bitcoin mining, the core idea is pretty straightforward. Think of miners as the decentralized bookkeepers for the entire Bitcoin network. They volunteer their computers to verify transactions, and in return, they earn newly created bitcoin for keeping the global ledger honest and secure.

What Is Bitcoin Mining and Why Does It Matter?

Bitcoin runs on a massive public record book called the blockchain. Every single transaction is recorded here. But unlike a traditional bank’s private ledger, the blockchain is distributed across thousands of computers worldwide. This transparency makes the system incredibly difficult to cheat.

Bitcoin mining is the engine that keeps this system running. Miners have two main jobs:

- Confirming Transactions: They gather recent transactions into “blocks,” validate them, and ensure no one is trying to spend the same bitcoin twice.

- Issuing New Bitcoin: For their effort, the first miner to successfully add a new block to the chain earns a reward. This reward is made up of brand-new bitcoin plus all the transaction fees from that block.

This incentive system is what makes Bitcoin work. It encourages people to contribute their computing power to the network, which in turn keeps it secure and running smoothly.

How Does Bitcoin Mining Actually Work?

So, how do miners earn that reward? It’s not as simple as just turning on a computer. They are all competing to solve a very difficult mathematical puzzle. The first miner to find the solution gets the right to add the next block to the blockchain and claim the reward.

This competitive process is known as Proof of Work (PoW). It’s called that because a miner has to prove they’ve done the computational “work”—expending real-world energy—to solve the puzzle.

This Proof of Work system is the bedrock of Bitcoin’s security. It makes attacking the network incredibly expensive and ensures that everyone agrees on the official transaction history without needing a bank or central authority to oversee it.

Let’s break down the essential concepts that drive the mining process.

Bitcoin Mining Core Concepts at a Glance

This table simplifies the key terms you’ll encounter as you learn about Bitcoin mining.

| Concept | Simple Explanation |

|---|---|

| Proof of Work (PoW) | The competitive puzzle-solving process that miners use to validate transactions and create new blocks. |

| Hashrate | The total combined computing power of all miners on the network. A higher hashrate equals a more secure network. |

| Mining Difficulty | A score that represents how hard it is to solve the puzzle. It adjusts automatically to keep block times consistent. |

| Block Reward | The amount of new bitcoin paid to a miner for successfully adding a new block to the blockchain. |

These elements work together to create a self-regulating and secure system.

The total computing power being contributed by all miners is called the hashrate. The more miners that join, the higher the hashrate, and the more secure the network becomes. To keep things on a predictable schedule, the Bitcoin protocol automatically adjusts the puzzle’s difficulty so that a new block is found roughly every 10 minutes.

This elegant design maintains a steady and predictable supply of new coins. As of early 2024, more than 93% of all bitcoins that will ever exist have already been mined. The rest will be released slowly until the final coin is mined sometime around the year 2140.

In summary, Bitcoin mining is the process of securing the network and creating new coins. It’s a competitive race where specialized computers solve complex puzzles, and the winner gets a reward. To get a feel for the current landscape, it’s worth checking out real-time data on platforms that track Bitcoin mining pool statistics.

The Essential Tools for Modern Bitcoin Mining

If you’re just starting your journey into Bitcoin mining, the first thing to understand is that the game has completely changed. The romantic notion of mining Bitcoin on a home computer or even a tricked-out gaming PC is a thing of the past. The global competition is just too fierce.

Today, anyone who’s serious about mining relies on highly specialized hardware built for one job and one job only: solving Bitcoin’s cryptographic puzzles as fast as humanly—and mechanically—possible.

The Rise of ASIC Miners

The only piece of equipment that really matters in modern Bitcoin mining is the Application-Specific Integrated Circuit, or ASIC miner.

An ASIC is a hyper-specialized machine. Your laptop is a generalist; it can browse the web, handle spreadsheets, and stream videos. An ASIC, on the other hand, is built from the ground up to do nothing but mine Bitcoin.

This singular focus gives it a mind-boggling performance advantage, making it thousands of times more powerful than even the best graphics cards (GPUs). Trying to compete against an ASIC with a regular computer is like showing up to a Formula 1 race with your daily driver. You’re just not in the same league.

An ASIC miner isn’t just an upgrade; it is the required tool for anyone serious about Bitcoin mining. Its laser focus on the SHA-256 algorithm—the one Bitcoin uses—makes all other hardware obsolete for this specific purpose.

To figure out which ASIC is right for you, you need to look at two crucial numbers. These metrics will make or break your mining operation.

Key Hardware Performance Metrics

When you start shopping for an ASIC, you’ll be hit with a lot of specs. But two of them stand out as the most important for determining a machine’s power and potential profitability.

- Hashrate (TH/s): This is the raw horsepower of the miner. It tells you how many trillions of guesses the machine can make every second to solve the block puzzle. A higher hashrate directly translates to a better chance of finding the next block.

- Energy Efficiency (J/TH): This metric is every bit as critical as hashrate. It measures how much energy, in Joules, the miner burns to produce one terahash of computing power. A lower J/TH number is better, as it means the miner is more efficient and your electricity bills will be lower.

The sweet spot is an ASIC with a high hashrate and a low energy efficiency rating. This combo maximizes your potential rewards while keeping your biggest ongoing expense—electricity—in check.

Comparing ASIC Miner Metrics

To see how this works in the real world, let’s compare two different ASICs. This simple comparison shows why you have to look at both numbers together.

| Metric | Antminer S19 | Antminer S21 | Why It Matters |

|---|---|---|---|

| Hashrate | 95 TH/s | 200 TH/s | Miner B is 50% more powerful, giving it a significantly higher chance of solving blocks. |

| Efficiency | 34,2 J/TH | 17б5 J/TH | Miner B is far more efficient, using less electricity for every calculation it makes. |

Even if both machines cost the same upfront, Antminer S21 is the obvious choice. Its superior efficiency translates to lower running costs over the long haul, which is often the single biggest factor in whether a mining operation turns a profit.

Essential Mining Software

Once you’ve got the hardware, you need software to put it to work. Luckily, the software side of things is pretty straightforward and usually involves just two key components.

- Mining Software: Most ASICs today come with their own software pre-installed, which you can access through a web browser on your computer. This interface is where you’ll connect your miner to a mining pool, check its performance, and tweak settings.

- A Bitcoin Wallet: Before you earn a single satoshi, you need a safe place to store your rewards. A Bitcoin wallet gives you a unique address where the mining pool will send your share of the mined coins. Make sure you choose a wallet where you, and only you, control the private keys.

The takeaway here is simple: successful mining starts with the right tools. You absolutely need an ASIC miner, and the best one will have a high hashrate combined with excellent energy efficiency.

Calculating the Real Costs and Profitability of Mining

Before you spend a single dollar on a shiny new ASIC miner, you need to think like a business owner. A hopeful guess about future profits just won’t cut it. To succeed in Bitcoin mining, you need a cold, hard look at the numbers. It’s not about having the fastest machine; it’s about running the most cost-effective operation.

The financial breakdown is actually pretty straightforward. It all boils down to two key costs:

- Upfront Hardware Cost: This is your ticket to the game—the ASIC miner itself. Prices can range from a few hundred dollars for older models to well over $10,000 for the latest rigs.

- Ongoing Electricity Cost: This is the silent killer of mining profitability. An ASIC is a power-hungry beast that runs 24/7, and your electricity bill will reflect that. You simply cannot ignore this cost.

The single most critical factor that will make or break your mining operation is your local electricity rate, measured in dollars per kilowatt-hour ($/kWh). A cheap power source can make an average miner profitable, while high-cost electricity can turn even the best hardware into a money pit.

The Ever-Changing Profitability Puzzle

Beyond the costs you can control, your potential earnings are at the mercy of the entire Bitcoin network. These factors are constantly in flux, which means a profitable setup today might not be profitable tomorrow. Getting a handle on them is crucial for managing your expectations.

Two of the biggest moving targets you need to watch are:

- Network Difficulty: Think of this as the network’s built-in balancing mechanism. As more miners join and the total hashrate climbs, the difficulty automatically increases to keep block times around 10 minutes. For you, higher difficulty means your hardware is fighting for a smaller slice of the same pie.

- The Bitcoin Halving: This is a pre-programmed event that happens about every four years, cutting the block reward in half. The most recent halving in April 2024 slashed the reward from 6.25 BTC to just 3.125 BTC, effectively cutting miners’ revenue in half overnight.

These events have a real impact. For instance, the mining difficulty shot up to record levels right after the 2024 halving, squeezing margins across the board. You can find more insights on these crypto mining industry trends on chainup.com.

Using a Profitability Calculator

So, how do you pull all these numbers together and see if mining makes sense for you? The best way is to use an online Bitcoin mining profitability calculator. These tools do the heavy lifting, giving you a realistic estimate based on what’s happening in the market right now.

To get an accurate picture, you’ll need a few key pieces of information.

Key Inputs for an Accurate Calculation

Here’s a quick rundown of the essential data points you’ll need to plug into any good calculator.

| Data Point | What It Is | Example Value | Why It’s So Important |

|---|---|---|---|

| Hardware Hashrate | Your ASIC’s raw computing power, measured in terahashes per second (TH/s). | 200 TH/s | This determines how many “lottery tickets” you get in the race to find the next block. |

| Power Consumption | How much electricity your miner draws from the wall, measured in Watts. | 3500 W | This is the foundation for calculating your biggest operational cost. |

| Electricity Cost | What you pay per kilowatt-hour ($/kWh). | $0.10/kWh | The make-or-break variable for your long-term profitability. |

| Pool Fee | The small percentage your mining pool takes for their service. | 2.5% | It’s a small but steady cut that comes right off the top of your earnings. |

Once you input these numbers, the calculator will estimate your daily, monthly, and yearly earnings after subtracting your electricity costs. The bottom line: never start mining without first calculating your potential profitability. This simple step can save you from a costly mistake. For a deeper dive, check out our guide on how to start crypto mining for more tips.

Why Joining a Mining Pool Is a Smarter Strategy

Trying to mine Bitcoin by yourself today is like buying a single ticket for a billion-dollar lottery. Sure, it’s technically possible to win, but the odds are astronomical. This is precisely why almost every new miner chooses to join a mining pool.

A mining pool is a group of miners who combine their computing power (or hashrate) to hunt for the next Bitcoin block together. It’s the digital equivalent of an office lottery pool. Instead of everyone hoping their one ticket is the winner, the group buys hundreds, massively boosting the chance that someone in the pool hits the jackpot.

When the pool finds a block, the reward (currently 3.125 BTC) is shared fairly among all contributors based on how much work they did. This transforms mining from a high-stakes gamble into a source of steady, predictable income.

Comparing Solo Mining vs Pool Mining

For any beginner, this is a crucial decision. Going it alone versus joining a team directly shapes how—and if— you’ll see a return on your investment.

To make it crystal clear, this table breaks down the fundamental differences.

| Feature | Solo Mining | Pool Mining |

|---|---|---|

| Probability of Reward | Extremely low. You could mine for years without ever finding a block. | Much higher. The pool’s combined hashrate finds blocks regularly. |

| Payout Frequency | Highly infrequent. You only get paid if you solve the block. | Very frequent. You receive small, steady payouts whenever the pool solves a block. |

| Income Stream | All or nothing. You receive the full block reward, or zero. | Predictable and consistent. Your income is based on your share of the work. |

| Hardware Requirement | Requires an immense amount of hashrate to be even remotely competitive. | Accessible to anyone with a single, modern ASIC miner. |

As you can see, pool mining smooths out the wild swings of luck inherent in the process. It offers a reliable income stream, which is critical for covering your ongoing electricity costs.

For anyone starting out, joining a mining pool isn’t just a recommendation; it’s practically a necessity. It’s the difference between gambling on a lottery win and earning a predictable return on your investment.

Choosing the Right Mining Pool

Once you’re sold on pooling your resources, the next puzzle is picking the right one. Not all pools are created equal, and your choice impacts your earnings. The best decision comes down to a few key factors.

Here’s what you need to look at when comparing your options:

- Payout Structure: Pools use different models to calculate your share, like Pay-Per-Share (PPS) or Pay-Per-Last-N-Shares (PPLNS), each with its own risk-reward profile.

- Pool Fees: Every pool takes a small cut for running the service, usually between 1% and 4%. Don’t just chase the lowest fee; weigh it against the pool’s reputation and features.

- Reliability and Uptime: You only make money when your miner is online. Look for pools with a proven history of stable servers and minimal downtime.

- Minimum Payout Threshold: This is the smallest balance you need before the pool sends Bitcoin to your wallet. A lower threshold means you get paid more frequently.

Making an informed choice from the start saves you the headache of switching pools later. If you’re ready to get connected, our guide on how to join a mining pool provides a complete walkthrough.

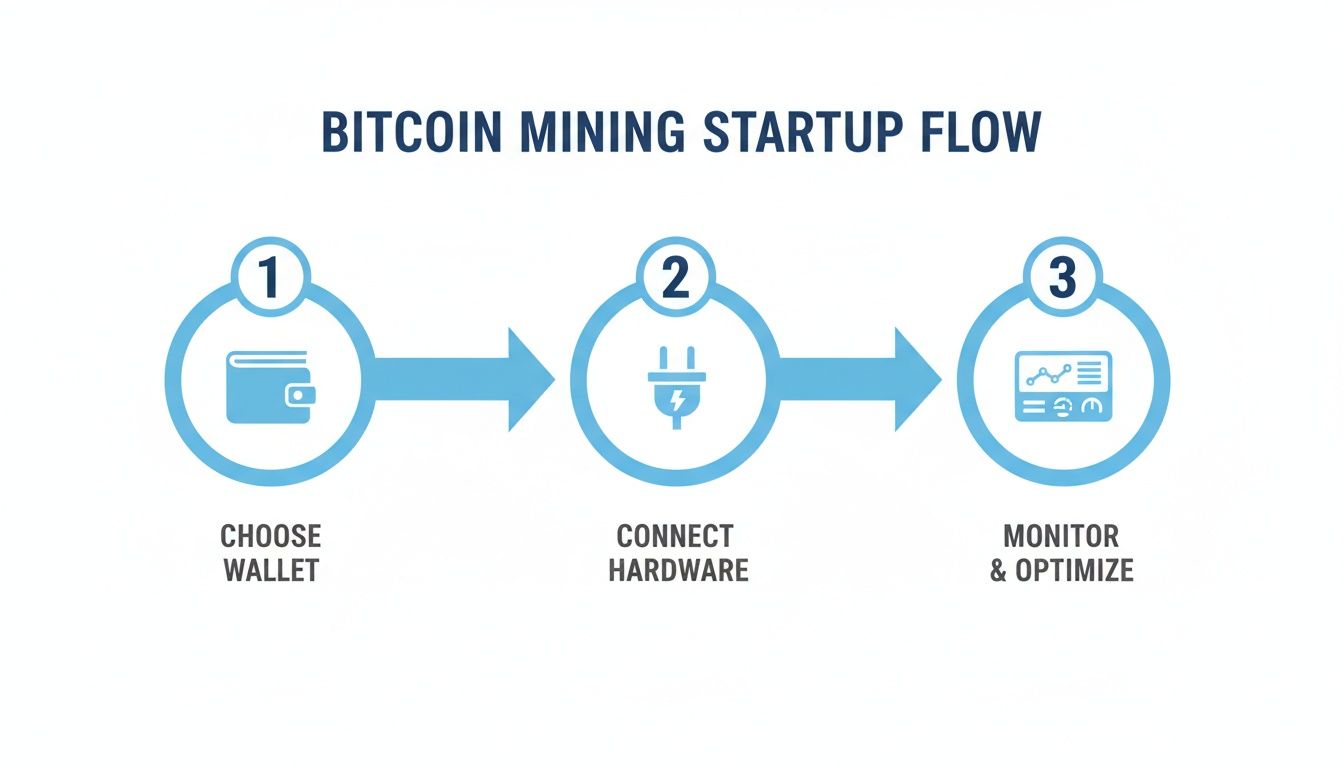

Your Step-by-Step Guide to Going Live

Alright, you’ve got the theory down—you know about hardware, costs, and mining pools. Now it’s time to put that knowledge into practice. This is your launch sequence, a straightforward checklist that takes you from initial research all the way to the moment your miner starts hashing.

Following these steps in order turns a seemingly complex technical job into a manageable process.

Phase 1: Pre-Launch Preparations

Before you even think about buying a miner, you need to do your homework. These foundational steps are what separate a profitable operation from an expensive hobby.

- Run the Numbers (Seriously): This is your make-or-break moment. Grab your latest utility bill to find your exact electricity rate (e.g., $0.12/kWh). Plug that number, along with the specs of an ASIC you’re considering, into a reliable online Bitcoin mining profitability calculator. If the math doesn’t work on paper, it definitely won’t work in real life.

- Select and Buy Your ASIC Miner: Your research should point you toward an ASIC that hits the sweet spot between a high hashrate (TH/s) and top-tier energy efficiency (J/TH). Always buy your rig from a reputable vendor or directly from the manufacturer to avoid scams.

- Set Up a Secure Bitcoin Wallet: Your mined coins need a home. Create a non-custodial Bitcoin wallet, which gives you full control over your private keys. Write down your seed phrase, store it somewhere safe and offline, and never, ever share it.

- Research and Join a Mining Pool: Compare top mining pools based on their fee structure, payout model (like FPPS or PPLNS), and server locations. Once you’ve picked one, sign up and create a “worker name” to identify your ASIC on the pool’s network.

Phase 2: Hardware Setup and Configuration

With your prep work done and the hardware delivered, it’s time to get your hands dirty.

- Connect Your ASIC to Power and the Internet: Find a good spot for your ASIC with plenty of ventilation—it will be loud. Most ASICs require a high-power outlet (usually 220V-240V), so ensure your wiring can handle the load. For a stable connection, plug it directly into your router with an Ethernet cable.

- Configure the Miner’s Software: Power up the ASIC. From another computer on the same network, find your miner’s IP address to access its web dashboard. This is where you’ll enter the mining pool details from step 4: the pool’s server address (stratum URL), your pool username, and the worker name you created.

- Go Live and Start Monitoring: Once you save your pool settings, the ASIC will restart and begin working. Log in to your mining pool’s dashboard. After a few minutes, you should see your worker pop up and start reporting its hashrate. That’s it—you are officially mining Bitcoin!

Common Pitfalls and the Future of Mining

Every new miner makes mistakes, but knowing the common pitfalls can save you from an expensive headache. It’s easy to focus only on a machine’s hashrate while ignoring the bigger picture.

Common rookie mistakes include:

- Miscalculating the true cost of electricity, including taxes and fees.

- Underestimating the intense heat and noise an ASIC miner produces.

- Buying old, inefficient hardware because it’s cheap, only to lose money on power bills.

The Global Mining Landscape

Avoiding those personal blunders is critical, but you also need to understand the competitive world you’re stepping into. Where Bitcoin mining happens isn’t random; it’s a constantly shifting map dictated by energy prices and government policies.

This simple flowchart breaks down the three core phases of getting started.

As you can see, the real work starts well before you ever plug in a machine, beginning with a secure wallet and ending with constant performance monitoring.

Large-scale mining operations flock to regions with two key ingredients: cheap power and friendly regulations. Right now, the United States is the undisputed leader, commanding around 37.8% of the global Bitcoin hashrate. Its robust infrastructure and access to low-cost energy have created a welcoming environment for miners. You can get a deeper dive into the top 10 Bitcoin mining countries at Hashrate Index.

What Does the Future Hold for Mining?

This industry never sits still. Two clear trends are defining the road ahead for Bitcoin mining:

- The Green Revolution: There’s a powerful push toward sustainable energy. Miners are increasingly turning to hydro, solar, and wind power not just for environmental reasons, but because they are often the cheapest sources of electricity.

- The Relentless Pursuit of Efficiency: As network difficulty climbs and block rewards shrink, miners must get smarter. The only way to stay in the game is to squeeze every last hash out of every watt of power. This means deploying the latest-generation ASICs and perfecting cooling solutions.

Key Takeaway: The future of profitable Bitcoin mining belongs to the efficient. Success will be found by operators who can lock in low-cost, sustainable power and run a lean, optimized setup. The days of plugging a machine into your wall and hoping for a profit are long behind us.

Frequently Asked Questions About Bitcoin Mining

Jumping into Bitcoin mining is exciting, but it’s natural to have a few lingering questions. Let’s tackle some of the most common ones that come up for beginners to make sure you’re starting on solid ground.

Can I Mine Bitcoin With My Gaming PC?

Back in Bitcoin’s infancy, you absolutely could. But today? The answer is a hard no.

The competition on the network has grown so fierce that you need highly specialized hardware, known as ASICs, just to have a shot. A gaming PC’s GPU, even a top-of-the-line one, is simply outmatched—it’s like bringing a shovel to a job that requires an industrial excavator. It’s thousands of times less efficient at solving Bitcoin’s specific puzzle (the SHA-256 algorithm) than a modern ASIC.

Trying to mine with your gaming rig would just run up your electricity bill with virtually zero chance of ever earning a reward. While GPUs are still great for mining other types of cryptocurrencies, they’ve long been retired from the Bitcoin mining game.

Is Bitcoin Mining Still Profitable for a Small Operator?

This is the million-dollar question, and the answer boils down to one critical variable: cheap electricity.

If you’ve managed to secure power for significantly less than the average person pays—think under $0.07 per kilowatt-hour—then yes, it’s possible to turn a profit. But you’d still need the latest, most efficient ASIC miner to make the numbers work.

For most hobbyists paying standard residential electricity rates, breaking even is a serious challenge, let alone making money. The steep upfront cost for the hardware combined with the constant power draw makes it a tough financial nut to crack. Before you even think about buying a machine, run your exact numbers through a good profitability calculator.

How Are Bitcoin Mining Earnings Taxed?

While tax laws differ around the world, most places (including the U.S.) treat newly mined Bitcoin as income. The moment those coins hit your wallet, they have a taxable value.

It’s usually a two-step process:

- Income Tax: You owe income tax on the fair market value of the Bitcoin at the time you received it from your mining pool.

- Capital Gains Tax: If you hold onto that Bitcoin and later sell it for a profit, you’ll likely owe capital gains tax on the increase in value.

Keeping meticulous records is non-negotiable—you need to log the date, amount, and value for every payout. Honestly, this can get complicated fast, so it’s always a smart move to talk to a tax professional who knows their way around cryptocurrency.

How Do I Manage the Heat and Noise from an ASIC?

Don’t underestimate this part. ASICs are loud, power-hungry machines. We’re talking about a constant, high-pitched hum that can easily top 75 decibels, and they pump out a ton of heat. Managing this is crucial for both your safety and your sanity.

- Ventilation is Key: You can’t just stick an ASIC in a closet. It needs to be in a well-ventilated space, like a garage or basement, where you can set up a dedicated exhaust to vent all that hot air directly outside.

- Noise Dampening: You’ll never make an ASIC silent, but you can definitely muffle it. Some miners build soundproof enclosures or even explore more advanced solutions like immersion cooling to bring the noise down to a manageable level.