GPU Pool Mining

Picture this: you and a few friends decide to pool your money to buy a massive number of lottery tickets. Your individual chance of winning the jackpot is basically zero, but by combining your resources, you dramatically increase the odds of your group hitting the winning numbers. When you do, everyone gets a slice of the prize.

That’s the core idea behind GPU pool mining. It’s a collaborative strategy that turns the high-stakes gamble of crypto mining into a more predictable and steady source of income.

In this guide, we’ll break down exactly what GPU pool mining is, how it works, and how you can use it to turn your hardware into a consistent earner.

So, What Exactly Is GPU Pool Mining?

At its heart, GPU pool mining is a team sport. Instead of going it alone, individual miners from all over the world connect their rigs to a central “pool” server. This creates a massive, collective force of computing power—or hashrate—all working together to solve the complex cryptographic puzzles required to validate a new block on a blockchain.

When the pool’s combined power successfully finds a block, the reward (newly minted coins and transaction fees) is split among all the contributors. Your cut is based on the amount of work your GPU contributed to the effort. This simple but powerful model solves the biggest headache for individual miners: wildly unpredictable payouts.

The Problem with Flying Solo

Trying to mine on your own, or “solo mining,” is a true high-risk, high-reward game. If your rig happens to solve a block before anyone else on the planet, you get the entire reward—a massive payday. It sounds great, right?

The catch is that the odds are stacked impossibly against you. With a small home setup, you could run your hardware for months, maybe even years, without ever finding a block. All that time, you’re racking up electricity bills with absolutely nothing to show for it. It’s a classic “feast or famine” situation that just isn’t sustainable for most people.

Key Takeaway: GPU pool mining smooths out this volatility. It swaps the tiny chance of a huge, one-time reward for the near certainty of small, regular payouts. This turns a lottery ticket into a reliable income stream, making mining a viable venture for almost anyone.

Why Collaboration Is King

When you join a pool, you’re not just contributing your hashrate; you’re joining a collective that finds blocks far more frequently. Instead of hoping for that one lucky break years from now, a large pool might find multiple blocks every single day.

This model is more relevant than ever. After Ethereum’s big switch in 2022 (known as “The Merge”) ended its GPU mining, a huge amount of processing power was suddenly looking for a new home. Miners flocked to other GPU-friendly coins like Ethereum Classic (ETC) and Ravencoin (RVN).

Pools supporting these alternatives saw their hashrates explode, with some growing between 20% and 150%. Profitability for miners was swinging wildly by 40-60% from one month to the next, reinforcing just how crucial pools are for stabilizing earnings. You can see these market shifts for yourself on sites like MiningPoolStats.

Solo Mining vs GPU Pool Mining At a Glance

To make the choice clearer, here’s a side-by-side breakdown of the two approaches. This table highlights the fundamental differences that matter most to someone just starting out.

| Feature | Solo Mining | GPU Pool Mining |

|---|---|---|

| Payout Frequency | Extremely low and unpredictable (months or years) | High and consistent (daily or even hourly) |

| Income Stability | Very high variance (all or nothing) | Low variance (steady, predictable income stream) |

| Probability of Success | Very low, depends entirely on individual luck | Very high, based on the pool’s collective power |

| Best For | Large-scale operations with massive hashrate | Individual miners and small-to-medium farms |

In summary: The right path depends on your hardware investment and how much risk you’re willing to take. For the overwhelming majority of people getting into crypto mining, GPU pool mining offers the only practical path to earning a consistent return.

How GPU Mining Pools Actually Work

So, we’ve talked about why you’d join a mining pool—it’s like being in a lottery syndicate to get more frequent, smaller wins. Now, let’s pull back the curtain and see exactly how the group buys the tickets and splits the prize. It gets a little technical, but the core ideas are surprisingly simple once you break them down.

The whole system hinges on one critical thing: proving you’re actually contributing to the group effort. The pool needs a fair and consistent way to measure the work your GPU is doing compared to thousands of others. This is where hashrate, difficulty, and shares come into the picture.

The Key Ingredients: Hashrate, Difficulty, and Shares

Think of these three elements as the gears that make the entire mining pool machine run smoothly.

Hashrate: This is the raw horsepower of your GPU, plain and simple. It’s a measure of how many guesses your hardware can make per second to solve the network’s cryptographic puzzle. A higher hashrate means you’re throwing more computational muscle at the problem and contributing more to the pool’s total power.

Difficulty: This is a number the cryptocurrency network sets to keep block discovery on a predictable schedule (e.g., one block every 10 minutes for Bitcoin). It’s the complexity of the puzzle. A mining pool takes this massive network difficulty and sets a much, much lower internal “share difficulty” for its members.

Shares: This is the most important concept to grasp. A share is simply proof that your GPU found a potential solution that meets the pool’s lower difficulty target. It’s like a mini-solution—it’s not valuable enough to solve the entire block on its own, but it proves to the pool operator that your rig is online and pulling its weight.

Let’s go back to our lottery analogy. Imagine the pool is searching for a 10-digit winning number (the block solution). Instead of asking every miner to find that exact 10-digit number, the pool says, “Just find me any number that ends in a 7.” Finding one doesn’t win the jackpot, but it proves you’re actively searching. Every time you find one, you submit it as a share.

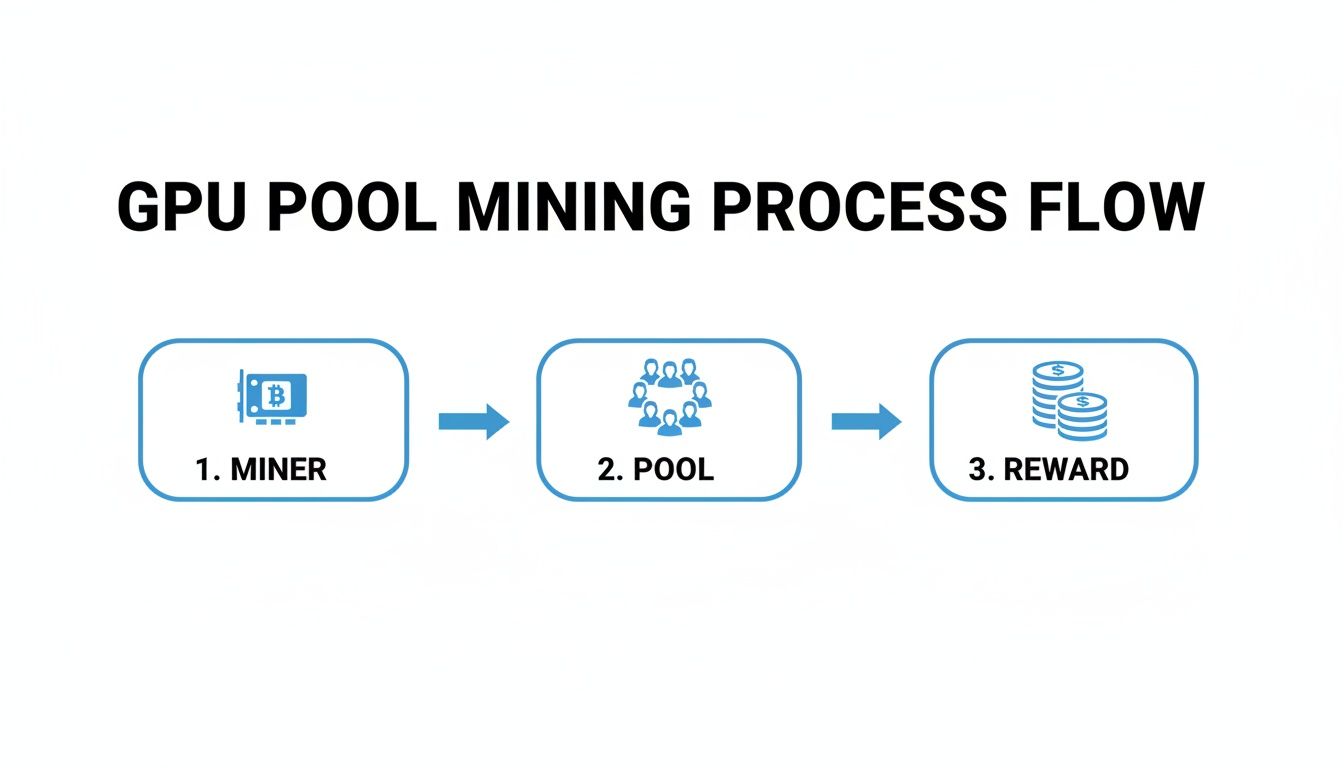

This flow shows how all those individual efforts come together to produce a collective result.

As you can see, your work flows into the pool, which then concentrates all that power to find blocks and distribute the rewards back to everyone.

From Your Rig to Your Wallet

So how does this all turn into actual crypto hitting your wallet? It’s a constant cycle that looks something like this:

- Your mining software connects to the pool’s server and is given a “job”—a unique slice of the puzzle to work on.

- Your GPU gets to work, hashing away at millions or billions of attempts per second.

- Whenever your GPU finds a solution that meets the pool’s easier share difficulty, it submits that share back to the pool.

- The pool validates your share and credits it to your account. This is your proof of work.

- Sooner or later, one of the countless shares submitted by someone in the pool—maybe you, maybe someone else—will also happen to meet the much higher network difficulty. That’s the golden ticket. The block is found!

- The pool receives the block reward from the network and then carves it up, paying out each miner based on the number of valid shares they submitted.

If you’re wondering about the nuts and bolts of connecting your hardware, our guide on how to join a mining pool walks through the practical steps.

In short: The share-based system is what guarantees you get paid for your contribution, even if your specific GPU never lands the final winning blow.

Decoding Pool Payouts: PPLNS vs. PPS vs. FPPS

Once your GPU rig is connected to a pool and humming along, you face one of the most important decisions: how do you want to get paid? This isn’t just about collecting crypto; it’s about choosing a reward structure that fits your appetite for risk and your need for predictable income.

Mining pools don’t all pay out the same way. The three most common models you’ll run into are Pay-Per-Share (PPS), Pay-Per-Last-N-Shares (PPLNS), and Full-Pay-Per-Share (FPPS). Each one has a different way of calculating your contribution, which creates a unique trade-off between stability and potential rewards.

Pay-Per-Share (PPS): The Predictable Paycheck

Think of PPS as getting paid a fixed hourly wage. It doesn’t matter if your employer made a big sale or had a slow day—your paycheck is the same. That’s the core idea behind the PPS model.

Under PPS, the pool operator pays you a set amount for every valid share your GPU submits. This payment is based on a statistical average of how many shares it should take to find a block. What this means for you is a completely steady and predictable income stream tied directly to your hashrate. All the luck, good or bad, is removed from your side of the equation.

- Key Feature: You get a guaranteed payment for every valid share you contribute.

- Risk Level: Extremely low for the miner; all the risk is on the pool operator.

- Best For: Miners who value a stable, predictable daily income and want to eliminate the volatility of pool luck.

Because the pool operator takes on all the risk, PPS pools charge the highest fees, often 1-3% more than other models.

Pay-Per-Last-N-Shares (PPLNS): The Loyalty Reward

If PPS is a steady wage, PPLNS is more like a sales commission. You get paid only when the team closes a deal (finds a block), and your cut is based on how much work you put in leading up to that success. This model is all about rewarding consistent, loyal miners.

Instead of paying for every single share, PPLNS systems only calculate payouts after a block is successfully mined. Your reward is based on the number of shares you submitted within a recent “window”—defined as the last ‘N’ number of total shares sent to the pool. If you keep your rigs running consistently on one pool, you’ll have a strong presence in that window and earn a fair cut of the reward.

The Bottom Line: PPLNS is a variance-based model that rewards commitment. Your earnings will ebb and flow with the pool’s luck, but in return, you keep more of the rewards thanks to lower operational fees.

The downside? If you jump between pools—a practice known as “pool hopping”—you might contribute a ton of work, only to have your shares fall outside the payment window when a block is finally found. That means you get nothing for your effort.

Full-Pay-Per-Share (FPPS): The Hybrid Approach

FPPS is an attempt to give miners the best of both worlds. It merges the stability of the PPS model with the lucrative bonus of transaction fees, which can be a huge part of the total block reward on many popular networks.

Just like in PPS, the FPPS model gives you a guaranteed, fixed payment for every share you submit. But here’s the key difference: when the pool finds a block, it also distributes all the transaction fees from that block among the miners. This “bonus” is paid out proportionally based on your contribution.

This structure gives you the peace of mind of a stable base income from the block subsidy, plus the variable upside from the transaction fees.

Comparison of Mining Pool Payout Schemes

Choosing the right payout scheme ultimately comes down to your personal strategy and how much variance you’re comfortable with. This table breaks down the core differences to make the decision clearer.

| Payout Method | How It Works | Pros | Cons | Best For |

|---|---|---|---|---|

| PPS | Fixed payment for every share, regardless of when the pool finds a block. | Highly predictable and stable income. No miner risk from pool variance. | Highest fees. You get no share of transaction fees. | Risk-averse miners who want a guaranteed daily paycheck. |

| PPLNS | Payment is based on your shares in the last “N” window when a block is found. | Lower fees. Potentially higher long-term rewards, including transaction fees. | Income is variable and depends on pool luck. Not ideal for pool hoppers. | Loyal, long-term miners who can tolerate income fluctuations. |

| FPPS | A fixed payment per share (like PPS) plus a proportional share of transaction fees. | Combines the income stability of PPS with the higher reward potential of PPLNS. | Fees are generally higher than PPLNS, but lower than pure PPS. | Miners who want a good balance between stability and profit potential. |

In conclusion: Each model has its place. Your goal is to find the one that lets you sleep at night while aligning with your long-term mining goals.

How to Choose the Right GPU Mining Pool

Picking a GPU mining pool isn’t just about finding the one with the lowest advertised fee. The right pool can be the difference between steady, predictable earnings and frustratingly inconsistent returns. To make the right call, you need to look past the marketing and really dig into the factors that will directly hit your bottom line.

Think of it as a checklist. By walking through each of these points—from a pool’s raw power to its reputation in the community—you can find the perfect home for your hardware.

Key Factors for Choosing a Pool

Here are the four essential criteria to evaluate:

Evaluate Pool Hashrate and Network Dominance

A pool’s total hashrate is one of the most critical metrics. A larger pool finds blocks more often, which means more consistent and reliable payouts for you. A tiny pool, on the other hand, can feel a lot like solo mining, with long “dry spells” where you’re earning nothing. Data from 2024-2025 showed that top pools for coins like ETC or RVN can command 30-60% of the total hashrate. You can explore the analysis of top mining pools to see how dominance plays out in the real world.Check Server Location and Latency (Ping)

The physical distance between your rig and the pool’s server has a huge impact on your efficiency. This delay is what we call latency, or ping. A high ping increases your risk of submitting “stale shares”—solutions that get rejected because someone else found the block first. This means you did the work for nothing.Rule of Thumb: Always choose a pool with a server geographically close to you. Aim for a ping under 100ms, but if you can get under 50ms, you’re in the sweet spot.

Review Payout Thresholds and Fees

The fee is what everyone looks at first, but the details matter more.- Pool Fee: This is the slice the operator takes, usually somewhere between 0% and 3%. A lower number is attractive, but a well-run, stable pool with a 1% fee will almost always earn you more than a glitchy one with a 0.5% fee.

- Minimum Payout Threshold: This is the smallest balance you need before the pool sends crypto to your wallet. High thresholds are a pain for smaller miners, as earnings can get locked up for weeks. Look for pools with low or adjustable minimums.

Assess Transparency and Reputation

At the end of the day, you’re trusting a third party with your money. Spend time on forums like Reddit, Discord, and Bitcointalk to see what real miners are saying. A good pool provides a clear, real-time dashboard showing your hashrate, shares (valid, stale, and invalid), and estimated earnings. A long, steady track record is always a safer bet.

In summary: By carefully balancing hashrate, latency, fees, and reputation, you can confidently pick a pool that truly works for you and maximizes your mining returns.

Getting Your Miner Configured and Tackling Common Problems

Alright, you’ve picked your pool. Now it’s time for the fun part: getting your hardware hashing. This step involves configuring your mining software—the program that serves as the essential link between your GPUs and the mining pool you just joined.

You’ll come across various programs like T-Rex, Gminer, or lolMiner, but they all operate on the same fundamental principles, requiring a few key pieces of information to get started.

Your Universal Configuration Checklist

No matter what software you use, it’s going to ask for three core details to connect to a pool. Think of it like addressing a package: you need the pool’s address, your “paid-to” name, and a label for which machine sent it.

Stratum URL: This is the pool’s server address, like

stratum+tcp://us1-etc.ethermine.org:4444. Always pick the server geographically closest to you.Wallet Address: This is your personal crypto wallet address for the coin you’re mining. It’s where the pool will send your payouts. Triple-check this address. One tiny typo will send your rewards into the void forever.

Worker Name: This is just a simple label to identify your rig on the pool’s dashboard (e.g.,

Rig01orGamingPC). It’s crucial for tracking performance if you run multiple machines.

Once you have those, a typical command to fire up your miner might look like this:t-rex.exe -a etchash -o stratum+tcp://us1-etc.ethermine.org:4444 -u YOUR_WALLET_ADDRESS -p x -w Rig01

Troubleshooting Common Mining Headaches

Even with a flawless setup, things can go wrong. Here are the most common snags you’ll hit and how to fix them.

1. Rejected or Stale Shares

Seeing red “rejected” messages is disheartening. A “stale share” means your GPU did the work correctly, but you submitted the answer too late.

- Cause: The number one culprit is high latency (ping) to the pool’s server.

- Solution: Switch to a pool server geographically closer to you. You’re aiming for a ping well below 100ms.

An “invalid share” means your GPU submitted a mathematically wrong answer.

- Cause: This is almost always due to an unstable GPU overclock.

- Solution: Back off your GPU’s memory overclock settings in small steps (25-50 MHz at a time) until the invalid shares disappear.

Pro Tip: Stability is king. Your goal should always be 100% accepted shares.

2. Miner Won’t Connect to the Pool

If your software just sits there, it’s usually a simple typo or a network block.

- Carefully check your stratum URL and port number for typos.

- Make sure your firewall or antivirus isn’t blocking the mining software.

- Check the pool’s website or Discord to see if their server is online.

3. Frequent Crashes or Reboots

A rig that keeps restarting usually points to a hardware problem, typically related to heat or power. A solid build, as detailed in our guide to building a GPU mining rig, is your first line of defense.

- Overheating: Use monitoring software to watch GPU temperatures. If they’re creeping past 75-80°C, increase fan speeds or improve airflow.

- Insufficient Power: Ensure your Power Supply Unit (PSU) has enough wattage to handle all your components at full tilt, with at least a 20% safety buffer.

Optimizing Profitability and Managing Financial Risks

Running a successful GPU mining operation is less about having the beefiest hardware and more about running a small business. Every watt of electricity, every dollar spent, has to be accounted for. To succeed, you have to think strategically about the economic levers you can pull.

Your profitability isn’t a fixed number; it’s a moving target influenced by three core variables: your electricity cost, the market price of the coin you’re mining, and the network’s current mining difficulty.

Calculating Your Break-Even Point

Before you can optimize for profit, you need to know your baseline. This is where a profitability calculator becomes your best friend. These online tools let you plug in your GPU model, its hashrate, power draw, and electricity cost to forecast your earnings.

Using a calculator helps you nail down your break-even point—the price and difficulty at which your mining revenue perfectly covers your power bill. This number is everything. It tells you when to keep mining, when to switch coins, or when it’s cheaper to shut down. To get a handle on these numbers, check out our guide on using a crypto mining profitability calculator.

The Business Mindset: Start thinking of your electricity bill as your “cost of goods sold” (COGS). The mission is simple: make sure the crypto you earn is always worth more than the power it took to mine it.

The Art of Profit-Switching

The crypto market is a 24/7 beast, and the most profitable coin to mine today might not be the most profitable tomorrow. This is where profit-switching comes in. It’s the strategy of automatically moving your hashrate to whatever coin offers the highest returns at any given moment. Some specialized mining pools and advanced software can even handle this for you.

This dynamic approach keeps your GPUs focused on the most lucrative work, maximizing your immediate earnings. It’s not a “set it and forget it” solution, though; you have to monitor it to ensure it remains efficient.

Essential Risk Management Strategies

Like any business venture, GPU mining comes with its own set of risks. The crypto hardware market is on a trajectory to grow by $19.8 billion between 2024 and 2029, which means more competition and climbing network difficulties. Real-world data shows that to stay in the green, most modern GPUs need an electricity rate below $0.06–$0.12 per kWh. You can dig deeper into the numbers in the full cryptocurrency mining hardware market research.

Here are the big risks you need a plan for:

- Hardware Failure: GPUs are workhorses running 24/7. Things will break. Keep spare parts on hand for likely points of failure, like cooling fans and power supplies.

- Market Volatility: Crypto prices swing wildly. The key is to avoid making emotional decisions. Don’t panic-sell during a crash, and consider a strategy for taking profits during market highs to cover your costs and lock in some gains.

FAQ: Common Questions About GPU Pool Mining

We’ve walked through the what, why, and how of GPU pool mining. But let’s be real—you probably still have some specific questions buzzing around. Here are some quick, no-nonsense answers to the things miners ask most.

What’s the bare minimum gear I need to start?

You don’t need a warehouse full of servers to get in the game. A solid gaming PC with a single modern GPU is the perfect launching pad. Think something like an NVIDIA RTX 30-series or an AMD RX 6000-series card.

The most critical spec is the video memory, or VRAM. You’ll want a card with at least 6-8GB of VRAM, as the files for many popular coin algorithms (like the DAG file for ETH-like coins) simply won’t fit on less. While you could technically fire up an older card, your hashrate will likely be so low that the electricity bill eats any potential profit.

How often do pools actually pay out?

This comes down to two things: the pool’s rules and how much hashing power you’re contributing. Most big pools have an automated system that sends your earnings once you hit a certain minimum.

- For a single GPU: You might see a payout hit your wallet anywhere from every few days to once a week.

- For multiple rigs: You could easily be getting paid daily, or even a few times a day if you’re pushing serious hashrate.

Before you commit, always find the pool’s minimum payout threshold. Make sure it’s a target you can realistically hit without waiting for weeks on end.

Do I have to pay taxes on mining rewards?

In most parts of the world, yes. The moment that crypto reward lands in your wallet, it has a cash value. That value is generally considered taxable income, and governments want their cut.

Important: Crypto tax law is a minefield and changes constantly. We’re miners, not accountants. It is absolutely essential that you talk to a qualified tax professional in your area to figure out your exact obligations. Don’t risk it.

What are the risks of mining new, obscure altcoins?

Chasing a brand-new coin can feel like a gold rush. The mining difficulty is low, and the dream of hitting it big is powerful. But this is the high-risk, high-reward corner of the mining world, and it’s full of pitfalls.

Here are the biggest risks:

- Massive Volatility: The coin’s price could skyrocket, but it’s just as likely to plummet to zero overnight.

- No Place to Sell: You might mine thousands of coins only to discover there’s no liquidity or no exchange willing to list them.

- Outright Scams: The project could be a classic “rug pull,” where the developers hype it up, attract miners and investors, and then disappear with the money, leaving the coin worthless.