How to Create a Mining Pool

So, you’re thinking about starting your own mining pool. It’s an ambitious project that involves a lot more than just spinning up a few servers. Done right, you can create a reliable income stream for yourself and your miners by turning the lottery of solo block discovery into a predictable business.

But let’s be realistic. This is a tough market. In this guide, we’ll walk through the entire process, from understanding the competitive landscape to deploying a secure, stable pool that miners can trust.

Understanding the Modern Mining Pool Landscape

Before you write a single line of code, you need to get the lay of the land. Building a pool isn’t just a technical challenge; it’s a strategic one. Your biggest hurdle won’t be the software—it’ll be convincing miners to leave established, trusted pools and direct their hashrate to you.

Why Pools Exist in the First Place

Mining pools solve a core problem with Proof-of-Work (PoW) blockchains: variance. For an individual, solo mining is a long-shot gamble. Sure, you get the entire block reward if you win, but the odds are astronomically against you unless you’re running a massive farm. Most solo miners could go for years without finding a single block. It’s just not a viable model.

A mining pool changes the game entirely by pooling everyone’s hashrate.

- Massively Increases the Odds: Combined power means the pool finds blocks far more regularly than any single member ever could.

- Creates Predictable Income: Instead of a massive, once-in-a-lifetime payout, miners get smaller, consistent rewards based on the work they contribute.

- De-risks the Entire Operation: Mining transforms from a lottery ticket into something resembling a steady job.

In short, pools make crypto mining a sustainable economic activity for the average participant.

A Harsh Reality: Market Concentration

Let’s be blunt: the days of a small, bootstrapped pool becoming a major player overnight are mostly behind us. For major coins like Bitcoin, the market is incredibly concentrated. A handful of industrial-scale Goliaths dominate the scene.

The numbers don’t lie. Just 50 entities control over 50% of the entire network hashrate, and the top ten pools control nearly 90% of it. Behemoths like Foundry USA, Antpool, and ViaBTC command a combined hashrate of well over 60%. This is the competition. They have brand recognition, trust built over years, and enormous economies of scale.

Key Takeaway: Simply existing is not enough. Your pool needs a compelling reason for miners to switch from operators they already know and trust. Being “just another pool” is a surefire way to operate with zero hashrate.

Finding Your Angle: The Value Proposition

To have any chance of success, you need a unique selling point. You have to offer something the giants don’t, or can’t, do as well. Here are a few ways to find your competitive edge:

- Ultra-low fees: Can you run a leaner operation and pass the savings on to miners? A 0% fee during launch is a common, if temporary, tactic.

- A killer user experience: Many big pool dashboards are clunky and outdated. A slick, modern interface with deep analytics can be a huge differentiator.

- Niche coin focus: Instead of fighting for a sliver of the Bitcoin network, why not become the go-to pool for a promising new altcoin? You can build a loyal community from the ground up.

- World-class support: Large pools can be impersonal. Offering fast, expert support from real humans who know the tech can build incredible loyalty.

Grasping these market dynamics is the real first step. Without a clear strategy to pull hashrate your way, even the most technically flawless pool will sit empty. If you’re new to this side of the equation, it’s worth seeing how the other half lives first. Our guide on how to join a mining pool can give you a valuable perspective from a miner’s point of view.

Architecting Your Core Infrastructure

Alright, with the planning out of the way, it’s time to get your hands dirty and build the actual foundation of your mining pool. This is where the blueprint becomes reality. We’re talking about the physical and digital nuts and bolts that will power your entire operation. Your pool’s success boils down to three core components: powerful server hardware, a lightning-fast network, and a smart choice for the first coin you support.

Get any of these wrong, and you’re in for a world of pain. An underpowered server or a laggy network connection doesn’t just cause small glitches; it leads directly to stale shares. That means frustrated miners, a bad reputation, and a pool that’s dead on arrival.

Choosing Your Server Hardware

Think of your server as the heart of the whole operation. It’s the central hub that has to juggle thousands of connections from miners all at once. When a miner submits a share, your server has milliseconds to validate it and fire back a response. This is not the place to be cheap. A basic server setup will buckle under the load of just a few hundred miners.

Here’s what to focus on for a robust setup:

- CPU: You need a modern multi-core processor. Aim for at least 8-16 cores to comfortably handle concurrent connections and the demands of the pool software.

- RAM: Don’t start with less than 32 GB. Aiming for 64 GB or more is a safer bet, providing enough headroom for the coin daemon, pool software, and a growing database of miner stats.

- Storage: Speed is everything. Use NVMe SSDs for your operating system and databases to prevent I/O bottlenecks that can grind share validation to a halt.

Designing a Low-Latency Network

In the mining world, latency is your worst enemy. The round-trip time—from your pool sending a job to a miner, to their rig sending back a completed share—is everything. A delay of just a few hundred milliseconds can be the difference between a paid share and a worthless, stale one.

This is why a globally distributed network isn’t a luxury; it’s a necessity if you want to attract miners from around the world. Setting up Stratum server nodes in key regions like North America, Europe, and Asia will slash latency for your miners and make your pool far more attractive.

Key Takeaway: Your number one network goal should be minimizing stale shares. If your stale rate creeps over 1-2%, experienced miners will notice and jump ship to a more efficient pool that’s physically closer to them.

Ultimately, your network has to be built for pure speed and rock-solid reliability. This directly impacts your miners’ profitability, which is the single biggest factor in whether they decide to stick with you. If you want to see things from their side, our guide on how to start crypto mining provides some great context.

Selecting Your First Cryptocurrency

It’s tempting to go straight for the king, Bitcoin. But let’s be real—competing for Bitcoin hashrate means going up against established giants with massive resources. That’s a losing battle from day one. A much smarter play is to start with a less crowded altcoin. This gives you a chance to build a community and earn your reputation in a smaller, more manageable space.

Use this table to evaluate potential coins:

| Factor | Description | Why It Matters |

|---|---|---|

| Network Difficulty | How hard is it to find a block? | Lower difficulty is your friend. It means your pool can find blocks more often with less hashrate, which leads to more consistent payouts and helps build miner confidence early on. |

| Community Size | Is there an active community around the coin? | A vibrant community is a built-in audience of potential miners. Scour forums, Discord servers, and social media to see if people are actually talking about it. |

| Existing Competition | Who are the other pools supporting this coin? | Hunt for coins that only have a couple of big pools. This is your opening. You can carve out a niche by offering better features, lower fees, or just being more engaged with the community. |

In summary, choosing that first coin is a critical business decision. Balancing these factors correctly sets your pool up for a successful launch and provides a solid foundation for future growth.

Choosing Your Pool Software and Payout Model

Once you’ve mapped out your hardware and network, it’s time to tackle the two decisions that will truly define your mining pool: the software that runs it and the business model that attracts miners. Think of your pool software as the engine—the core technology that manages connections, validates shares, and talks to the blockchain. Your payout model, on the other hand, is your value proposition. It’s how you convince a miner to point their expensive hardware at your servers instead of a competitor’s.

These two choices are completely intertwined. The software you pick can limit the payout schemes you can offer, and the business model you want will heavily influence which software makes the most sense.

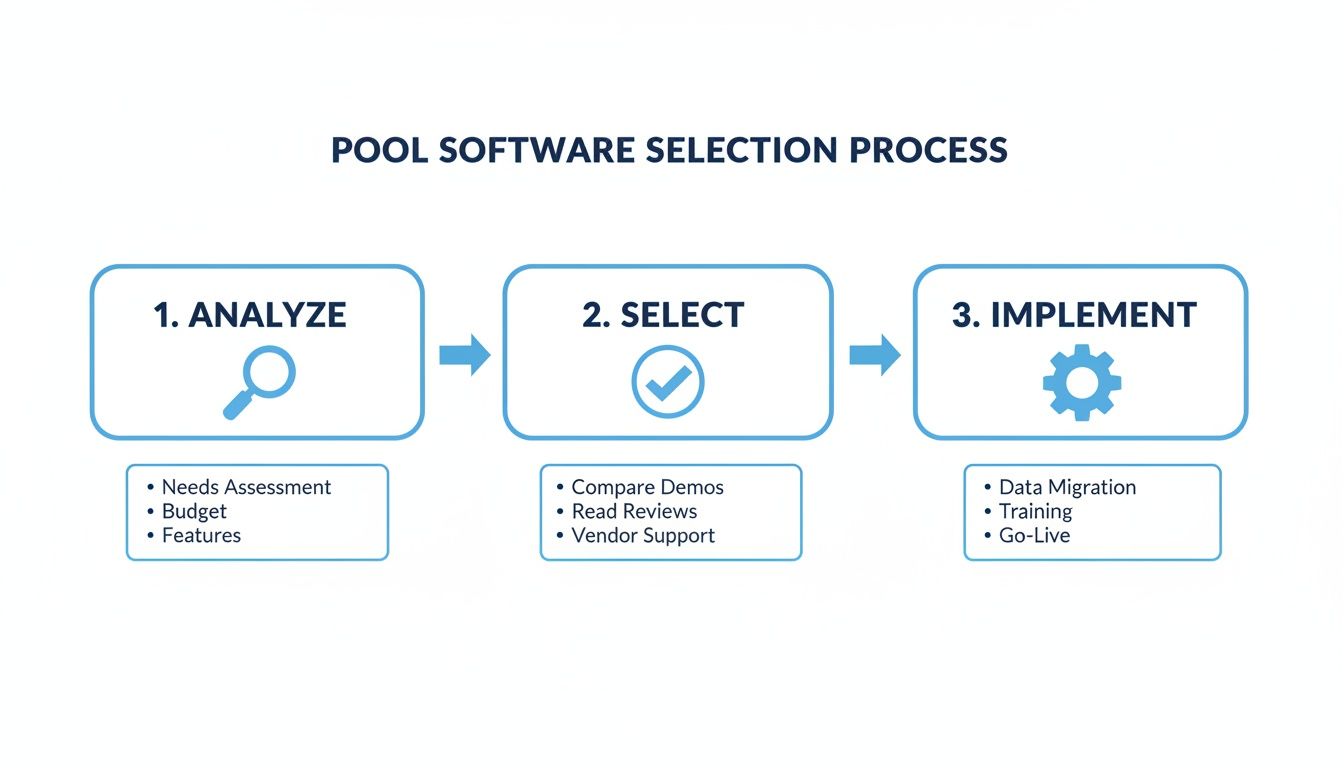

Evaluating Mining Pool Software Options

The software world is essentially split into two camps: open-source and commercial. Each comes with its own set of very real trade-offs in cost, control, and support.

- Open-Source (e.g., CKPool, NOMP): These platforms are free and give you complete control. If you have development skills, you can customize every aspect. The catch? You’re on your own for setup, security, and troubleshooting.

- Commercial/Proprietary: These are usually polished, ready-to-go solutions backed by a support team. They handle backend complexity for a smoother launch. The price is either a license fee or a percentage of your pool’s revenue, and you lose flexibility for custom features.

For a new operator, starting with a well-documented open-source project like NOMP (Node Open Mining Portal) can be a great learning experience, but be prepared for a steep learning curve.

Dissecting the Payout Models

This is arguably the most critical decision you’ll make. Your payout model is a direct statement about how risk is shared between you and your miners. It’s the core of your promise to them, and different models attract entirely different kinds of miners.

History shows that the right model can make or break a pool. Early pioneers like F2Pool, which launched in 2013, drew in millions of users with innovative features. Today, top pools prove that a smart business model is just as important as the tech. You can find more detail on how these top-tier mining pools operate and maintain their market share in this guide.

At its core, the choice boils down to a few common structures.

Comparison of Mining Pool Payout Models

This table breaks down the most common payout models, comparing them by miner payment predictability, pool operator risk, and typical fee structures.

| Payout Model | Miner Payout Stability | Pool Operator Risk | Best For Miners Who… | Example Pool Strategy |

|---|---|---|---|---|

| PPS+ (Pay Per Share Plus) | Very High | High | Value predictable, guaranteed income and are willing to pay a higher fee for it. | Attracting large-scale, professional mining farms that need stable revenue forecasting. |

| FPPS (Full Pay Per Share) | Very High | High | Are identical to PPS+ miners but also want a share of transaction fees from found blocks. | Competing directly with PPS+ pools by offering a slightly more lucrative, but similar, risk-free model. |

| PPLNS (Pay Per Last N Shares) | Moderate | Low | Are loyal, long-term miners who prefer lower fees and are comfortable with some payout variance. | Building a dedicated community of miners who stick with the pool through good times and bad. |

| SOLO | Extremely Low | None | Are large-scale miners who want to use pool infrastructure but retain the full block reward when they find a block. | Serving a niche market of “solo” miners who have enough hashrate to find blocks on their own occasionally. |

As you can see, the risk you absorb as an operator is inversely related to the risk your miners take on. With PPS+ and FPPS, you must pay miners for every valid share, even if your pool gets unlucky and doesn’t find a block. PPLNS, however, only pays out when the pool actually finds a block, shifting the risk of bad luck onto the miners.

Strategic Insight: Your payout model is a marketing tool. A PPS+ or FPPS model signals stability and low risk, attracting risk-averse miners. A PPLNS model, with its lower fees, signals a partnership with miners, appealing to those who plan to stay with your pool long-term.

Ultimately, this is where you define your pool’s identity. Are you building a flexible, community-focused pool on open-source software with a PPLNS model? Or a professional, high-stability operation with a commercial backend and an FPPS model? This foundational decision shapes everything that comes next.

Deploying and Configuring Your Technical Stack

Alright, you’ve done the planning and picked your software. Now it’s time to roll up your sleeves and bring your mining pool to life. This is where we move from blueprints to a living, breathing system, connecting all the servers, software, and wallets you’ve chosen. The goal is simple in concept but complex in execution: get every single component talking to each other flawlessly.

This process builds on all the analysis and selection work you’ve done up to this point, turning your strategy into a functional reality.

Let’s get into the nuts and bolts of the implementation.

Setting Up the Coin Daemon

Think of the coin daemon as the very heart of your pool. It’s a full node that connects you directly to the blockchain. Your pool software pings this daemon constantly, asking for new block templates to send to miners and using it to broadcast solved blocks back to the network.

When you set this up, your focus is squarely on two things: synchronization and security.

- Initial Blockchain Sync: The first time you fire up the daemon, it needs to download the entire history of the blockchain. For major coins, this is a massive task that can take hours or even days to sync. Let it finish completely before connecting your pool software.

- Configuration: You’ll need to edit the daemon’s configuration file (usually a

.conffile) to set up RPC (Remote Procedure Call) credentials. This is the username and password your pool software uses to communicate with the node. Use a strong, unique password here.

A misconfigured or out-of-sync daemon is a classic rookie mistake and a critical point of failure.

Configuring the Stratum Server

The Stratum server is your pool’s front door. It’s the gateway that manages potentially thousands of simultaneous connections from miners’ ASICs and GPUs. Its job is to hand out work from the coin daemon and validate the shares miners submit back. Here, efficiency and low latency are everything.

Properly configuring your Stratum server is crucial for minimizing stale shares. You’ll need to define:

- Port Numbers: Set up different ports for different mining difficulties to accommodate everything from a massive ASIC farm to a single-GPU hobbyist.

- Daemon Connection: Point the Stratum server to your coin daemon’s IP address and port, using those secure RPC credentials you just created.

- Pool Backend Integration: Tell the Stratum server how to report valid shares to your accounting system.

Pro Tip: Don’t just deploy one Stratum server. Deploy several in key geographic regions. This isn’t a “nice-to-have”—it’s a requirement to be competitive. A miner in Asia connecting to your server in North America will have terrible latency and a high stale rate. A local server solves that problem.

For anyone new to the miner side of things, our guide on the complete Bitcoin miner setup gives a great overview of what your future users will be doing to connect.

Implementing Payouts and Accounting

This is where you handle the money, making it the most critical and sensitive part of your entire stack. Your accounting system has to track every valid share from every miner and calculate their earnings based on your chosen payout model. Thankfully, many open-source pool packages like MPOS (Mining Portal Open Source) come with built-in modules to handle this.

Your checklist for this part absolutely must include:

- Share Tracking: Double and triple-check that your system is correctly recording shares and assigning them to the right miner accounts.

- Payout Automation: Set up a cron job or another scheduled script to handle payments automatically when miners hit a set threshold. Automation reduces errors and builds trust.

- Wallet Security: The wallet that sends out payments is a “hot wallet,” making it a huge target for hackers. Secure it with everything you’ve got and only keep enough funds in it to cover a day or so of payouts.

In summary, a flawless technical deployment is key. Any error in the daemon, Stratum, or payout system can lead to downtime and financial loss, destroying your reputation before you even get started.

Hardening Security and Ensuring Operational Uptime

Getting your pool live is a huge step, but the real challenge is just beginning. The moment you’re online, you’re a target. The difference between a successful pool and a forgotten one comes down to a relentless focus on security, stability, and uptime. Your job now shifts from building to defending. In this business, uptime and security aren’t just features—they’re everything.

Fortifying Defenses Against DDoS Attacks

It’s not a question of if you’ll get hit with a Distributed Denial of Service (DDoS) attack, but when. The entire goal of these attacks is to flood your Stratum servers with garbage traffic, knocking them offline so your miners can’t submit shares. For a mining pool, downtime is death.

A multi-layered defense is the only way to survive.

- Use DDoS Mitigation Services: Route all your public-facing Stratum servers through a professional DDoS mitigation service. These act as a massive filter, scrubbing malicious traffic before it reaches your infrastructure.

- Go Geo-Distributed: Spread your Stratum servers across different data centers and continents. If one region gets hammered, miners have other nodes to failover to seamlessly.

- Implement Rate Limiting: Configure your servers to cap the number of connections allowed from a single IP address, which can neutralize less sophisticated attacks.

- Obfuscate Your Network: Never expose the direct IP addresses of your core backend servers. Use proxies and load balancers to hide your most important assets.

Securing Pool Wallets and Funds

The ultimate prize for any attacker is your pool’s wallets. A breach here means losing your miners’ hard-earned rewards and your reputation. A strict, disciplined separation of hot and cold wallets is absolutely non-negotiable.

Your hot wallets, which are online to handle routine payouts, should contain the bare minimum needed for operations—maybe just enough for the next 24 hours of payments. The overwhelming majority of your funds must be stored in cold wallets, which are kept completely offline.

A critical security practice is to use multi-signature (multi-sig) wallets for all significant fund movements. Requiring authorization from multiple, geographically separate devices or individuals prevents a single point of compromise from draining your treasury.

Proactive Monitoring and Analytics

You can’t defend what you can’t see. Running a successful pool requires comprehensive monitoring and analytics for a real-time health check of your entire operation.

Your daily watchlist must include:

- Pool Hashrate: Is it stable? Sudden drops could mean a server is down.

- Block Finding Frequency: Are you finding blocks at a rate consistent with your share of the network hashrate?

- Server Health: Keep a close eye on CPU load, memory usage, and network latency.

- Stale and Invalid Shares: A spike here is a red flag for network issues.

Tools like MiningPoolStats are fantastic for seeing how you stack up against the competition. By keeping an eye on your pool’s public data, you can benchmark your performance against market leaders. You can learn more about how top pools navigate this competitive landscape to stay on top.

The key takeaway is this: security and uptime are not one-time tasks. They require constant vigilance and a proactive mindset to build a pool that doesn’t just survive, but thrives.

Frequently Asked Questions (FAQ)

How much does it cost to start a mining pool?

The cost can vary dramatically. A minimal setup using cloud servers for a new altcoin might cost a few hundred dollars per month. A professional, globally distributed pool for a major cryptocurrency could require an initial hardware investment of tens of thousands of dollars, plus significant ongoing operational costs for servers and DDoS protection.

Is running a mining pool profitable?

It can be, but it’s not a get-rich-quick scheme. Profitability depends on attracting a significant amount of hashrate and charging a competitive fee (typically 0.5% to 2%). Your main costs will be servers, bandwidth, and security services. The pool’s revenue is the fee collected on all block rewards found by your miners. A pool with low hashrate may operate at a loss for a long time.

What is the difference between PPLNS and PPS payout schemes?

- PPLNS (Pay Per Last N Shares): You only pay miners when the pool finds a block. Payouts are based on the number of shares a miner submitted within a recent “window” of shares. This is lower risk for the pool operator but results in more variable income for miners.

- PPS (Pay Per Share): You pay miners a fixed rate for every valid share they submit, regardless of whether the pool finds a block. This provides stable income for miners but is very high risk for the pool operator, who must have significant capital reserves to cover payouts during periods of bad luck.

What are the main legal requirements for running a mining pool?

Legal requirements vary by jurisdiction but are a critical concern. Key areas include:

- Business Registration: Operating as a legal entity (e.g., LLC, Corporation) is crucial to protect your personal assets.

- Tax Compliance: Pool fees are taxable income. You must report this revenue according to your local tax laws.

- AML/KYC Regulations: In many regions, mining pools are considered Money Service Businesses (MSBs) and must comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which may require you to verify the identity of your miners.

Consulting with a lawyer and accountant specializing in cryptocurrency is highly recommended before you launch.

How do I attract miners to my new pool?

Attracting the first miners is the biggest challenge. Key strategies include:

- Offering a 0% fee for an initial promotional period.

- Focusing on a new or underserved altcoin to build a community from the ground up.

- Providing a superior user experience with a modern, clean dashboard and detailed analytics.

- Being active in the coin’s community on platforms like Discord, Telegram, and forums to build trust and offer support.

- Ensuring rock-solid stability and low latency from day one to build a good reputation through word-of-mouth.