Is Crypto Mining Profitable?

So, you’re wondering if crypto mining is still profitable. The short answer is yes, it can be. But let’s be clear: the days of minting digital gold with a spare computer are long gone. For massive, industrial-scale operations with access to dirt-cheap power and the latest gear, it’s still a money-making machine. For the rest of us, it’s a much tougher game.

This guide will break down the honest reality of crypto mining profitability today. We’ll cover the essential factors, how to calculate your potential return, and the hidden risks that can sink your venture.

The Modern Crypto Mining Landscape

Today, making money from crypto mining is all about scale and squeezing every last drop of efficiency out of your setup. Success isn’t about having a powerful PC anymore; it’s about mastering a few core business principles that separate the profitable miners from those with expensive, power-hungry hobbies.

The Three Pillars of Profitability

If you’re serious about turning a profit in 2026 and beyond, you absolutely have to nail these three factors. They aren’t just suggestions; they’re the pillars your entire operation rests on.

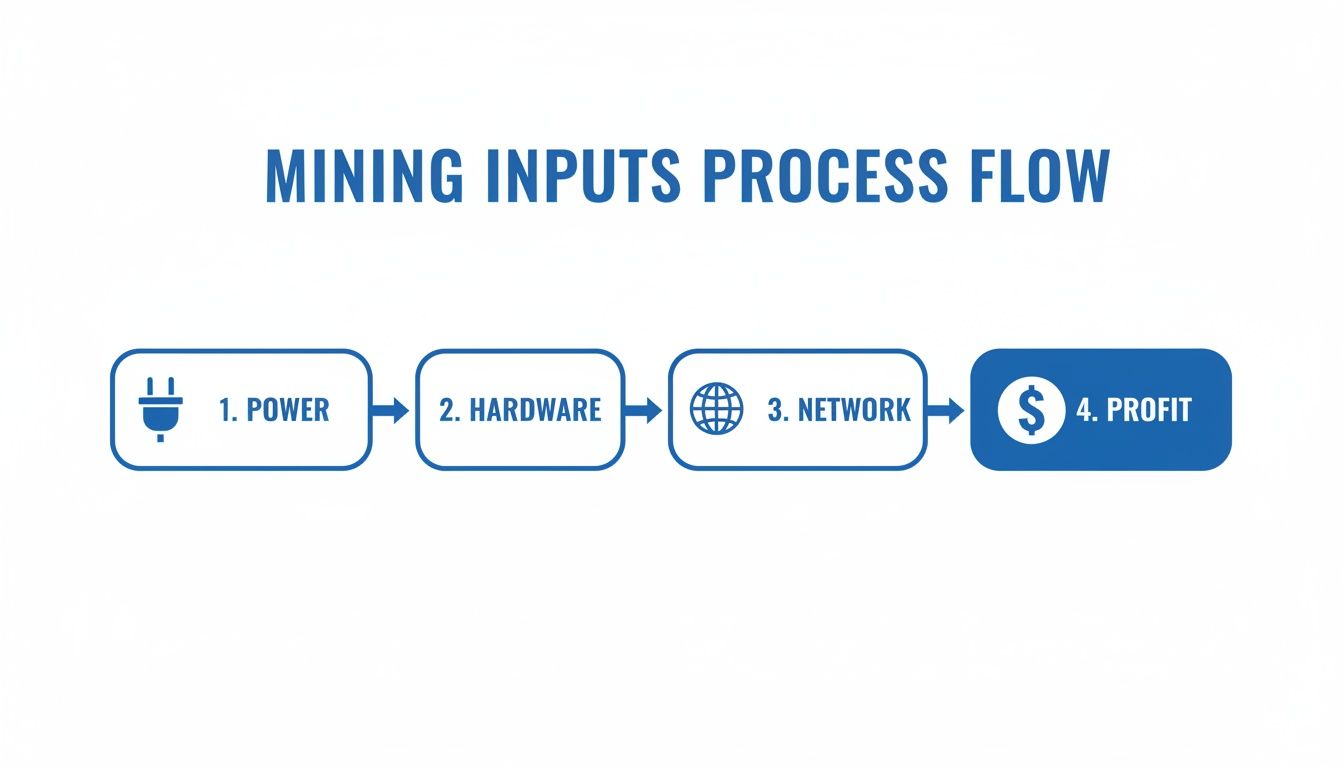

- Electricity Cost: This is your biggest, most relentless operational cost. If your price per kilowatt-hour (kWh) is too high, you could have the best hardware on the market and still be bleeding money every single day.

- Hardware Efficiency: The name of the game is getting the most computational power, or hash rate, for the least amount of electricity. This is measured in joules per terahash (J/TH), and it’s the metric that shows how well your machine turns power into potential profit.

- Operational Scale: Size matters. Big mining farms get better deals on everything—from bulk hardware discounts to negotiated electricity rates. They can also ride out market downturns that would wipe out a smaller miner.

The 2024 Bitcoin halving threw these realities into sharp relief. When the block reward was sliced from 6.25 BTC to 3.125 BTC, miner revenue was cut in half overnight. This single event forced a brutal reckoning across the industry.

Suddenly, the math became painfully simple. Only the most efficient operations—those with power costs under $0.03/kWh and the newest ASICs—could maintain healthy margins. Miners with costs creeping up to $0.06-$0.08/kWh found themselves underwater and were often forced to power down. You can find more analysis on crypto mining industry trends on chainup.com.

In summary: Crypto mining has evolved from a tech hobby into a ruthless business of cost optimization. Being a tech whiz isn’t enough anymore. You have to be a sharp operator who can manage expenses with military precision.

Crypto Mining Profitability at a Glance

This table breaks down the profitability potential for different miner profiles, showing just how much the operational details matter.

| Miner Profile | Typical Electricity Cost ($/kWh) | Hardware Type | Profitability Outlook |

|---|---|---|---|

| Home Hobbyist | $0.10+ | Older ASIC / High-end GPU | Unlikely to be profitable; often a net loss. |

| Small-Scale Miner | $0.06 – $0.09 | Mid-generation ASICs | Break-even at best; highly vulnerable to price drops. |

| Industrial Farm | < $0.04 | Latest-generation ASICs | Potentially very profitable, assuming operational efficiency. |

As you can see, the gap between a hobbyist and a professional operation is enormous. For anyone operating at a small scale, success isn’t just difficult—it’s a massive uphill battle against fundamental economic forces.

Understanding the Levers of Mining Profitability

So, is crypto mining actually profitable? The honest answer is: it’s complicated. Profitability isn’t a simple yes or no. It’s a constantly shifting equation with a few core variables you absolutely have to get your head around.

Think of it like any other business. You have your revenue and you have your costs. If your costs outstrip your revenue, you’re in the red. In mining, this relationship is brutally direct and unforgiving. Mastering these variables is the first—and most important—step to running a successful operation.

Hardware Efficiency: The Mileage of Your Miner

First up is Hardware Efficiency. It’s tempting to think the most powerful mining rig is always the best choice, but that’s a rookie mistake. A better way to think about it is like buying a car. You wouldn’t just grab the one with the biggest engine without checking its gas mileage, right?

Hardware efficiency is the “miles per gallon” of your mining setup. It’s all about how much computational power—your hash rate—you can squeeze out of every watt of electricity you pay for. A more efficient machine means more hashes for the same energy bill, which goes straight to your bottom line. This is precisely why the newest generation of Application-Specific Integrated Circuit (ASIC) miners always leaves older models in the dust; they’re engineered for maximum punch with minimal power draw.

Electricity Cost: The Fuel for Your Operation

Sticking with the car analogy, Electricity Cost is the price of your fuel. This is, without a doubt, the single biggest ongoing expense and the one factor that sinks most mining ventures. Your price per kilowatt-hour (kWh) dictates everything.

If your power is too expensive, even the most efficient hardware on the planet won’t turn a profit for you. There’s a reason you see massive mining farms popping up in places with access to dirt-cheap power, often with industrial rates below $0.04/kWh. For a much deeper dive into this critical cost, check out our guide on the real costs of Bitcoin mining.

Key Takeaway: Your local electricity rate is the bedrock of your entire profitability calculation. If that number is high, your path to breaking even gets exponentially steeper, no matter what other advantages you have.

Network Difficulty: The Race Against Everyone Else

Next, you have to contend with Network Difficulty. Picture yourself in a massive footrace, but every time a new runner joins, the finish line moves further away. That’s a perfect picture of how network difficulty works. It’s a clever, self-adjusting mechanism built into protocols like Bitcoin to keep blocks flowing at a steady, predictable pace (for Bitcoin, that’s roughly every 10 minutes).

When more miners plug their rigs into the network, the total global hash rate climbs. To keep the block time stable, the network automatically makes the cryptographic puzzle harder to solve. What this means for you is that your hardware—which hasn’t changed—is now fighting for a smaller and smaller piece of the pie.

Block Rewards and Halvings: The Prize Money

Finally, there’s the Block Reward—the prize you get for winning the race. When a miner successfully finds and validates a block, they receive a set amount of new coins, plus all the transaction fees from that block. This is your primary revenue stream.

But here’s the catch: the prize money doesn’t stay the same forever. For cryptocurrencies like Bitcoin, the block reward is programmed to slash itself in half every few years. This event is called the “halving”. For example, the 2024 Bitcoin halving cut the reward from 6.25 BTC all the way down to 3.125 BTC.

An event like that instantly and profoundly changes the game, literally cutting your base revenue in half overnight. Serious miners plan for these halvings years in advance because they fundamentally reshape the economic landscape of the entire industry.

Conclusion: These four levers—hardware, electricity, difficulty, and rewards—don’t exist in a vacuum. They form a complex, interconnected system where a change in one immediately affects the others. Your ability to understand and navigate them is what will ultimately determine if your mining venture succeeds or fails.

How to Calculate Your Potential Mining ROI

Alright, let’s move past the theory and get down to the brass tacks. This is where the rubber meets the road—the actual math that determines whether you’ll make money or lose your shirt.

At its core, the formula for figuring out your potential return on investment (ROI) is surprisingly simple. It all boils down to one daily calculation.

(Daily Revenue) – (Daily Operating Expenses) = Daily Profit

That’s it. This one equation is the heartbeat of every mining operation, from a single rig humming away in a basement to a sprawling, industrial-scale farm. Your revenue is simply the market value of the crypto you mine each day, while your operating expenses are almost entirely driven by your electricity bill.

Profitability is a constant balancing act. You win when the value of what you produce consistently outweighs what it costs to produce it.

Using an Online Profitability Calculator

Thankfully, you don’t need to dust off your old graphing calculator or build a complex spreadsheet to get a good estimate. There are fantastic online tools that do all the heavy lifting for you, giving you real-time profitability forecasts based on live market data.

These calculators are indispensable for any serious miner. To get a clear picture of your potential earnings, you just need to plug in a few key numbers:

- Your Hardware Model: Be specific. Choose the exact ASIC miner you own or are thinking about buying.

- Your Electricity Cost: This is the big one. Enter your price per kilowatt-hour ($/kWh) accurately.

- Your Pool Fee: Pop in the percentage your chosen mining pool charges, which is typically around 1-3%.

The calculator crunches the numbers instantly, spitting out your estimated daily, monthly, and yearly profit (or loss) for that specific machine under your specific conditions. It’s the most critical first step you can take before spending a single dollar.

If you want to dig deeper and tweak more variables, you can use a dedicated crypto mining profitability calculator to fine-tune everything.

A Real-World Case Study

Let’s walk through a quick, tangible example to see how this all plays out. Say you’re eyeing a modern ASIC miner for your setup.

- Initial Investment (Capex): The new-generation ASIC costs you $5,000.

- Miner Specs: It boasts a hash rate of 200 TH/s and pulls 3,500 watts (3.5 kW) from the wall.

- Operating Costs (Opex): You’ve secured a great electricity rate at $0.07/kWh, and your pool fee is a standard 1%.

First, let’s figure out your daily power cost. It’s a simple calculation:

3.5 kW × 24 hours × $0.07/kWh = $5.88 per day

Next, using an online calculator with today’s Bitcoin price and network difficulty, let’s say your rig is projected to earn $10.50 in revenue per day.

Now, we just apply that core formula we talked about:

$10.50 (Daily Revenue) – $5.88 (Daily Opex) = $4.62 (Daily Profit)

Okay, so you’re in the green. But when do you actually start making money? To find your break-even point, you divide the initial hardware cost by your daily profit:

$5,000 / $4.62 = 1,082 days

That’s a reality check. In this scenario, it would take nearly three years just to pay off the machine—and that’s assuming the price of Bitcoin and the network difficulty stay perfectly flat, which, as we all know, they never do.

Conclusion: This example drives home how sensitive your ROI is to both your upfront hardware investment and your ongoing power costs. Even a tiny swing in electricity prices or a dip in Bitcoin’s value can instantly flip a profitable operation into a losing one. Profitability lives on a knife’s edge, and understanding these numbers is the only way to stay on the right side of it.

Choosing the Right Mining Pool and Payout Method

For anyone asking if crypto mining is still profitable, the idea of going it alone is a tough sell. This is called solo mining, and it’s like buying a single lottery ticket and expecting to win the jackpot. Sure, the reward is massive—you’d pocket an entire block reward—but your odds of actually finding a block on your own are ridiculously low.

This is exactly why mining pools exist. Think of a pool as a lottery syndicate. Instead of playing solo, you combine your hashing power with thousands of other miners across the globe. By working together, the group finds blocks far more frequently, turning a once-in-a-lifetime long shot into a source of smaller, but much more predictable, payouts.

For the vast majority of miners, joining a pool isn’t just a smart move; it’s the only practical way to generate a steady income.

Comparison of Mining Pool Payout Models

Once a pool successfully finds a block, the reward has to be split among all the miners who contributed. How your slice of the pie is calculated depends entirely on the pool’s payout model. This table breaks down the most common methods to help you match one to your personal risk appetite.

| Payout Model | How It Works | Pros | Cons | Best For |

|---|---|---|---|---|

| PPLNS | Pays based on shares submitted in the last “N” rounds before a block is found. | Often has lower fees; rewards miner loyalty and long-term participation. | Payouts are variable and depend heavily on the pool’s luck. | Consistent miners who plan to stay with one pool for a long time. |

| FPPS | Pays a fixed rate for every share submitted, plus a share of transaction fees. | Highly predictable and stable income; removes the luck element entirely. | Fees are typically higher to cover the pool’s risk. | Miners who need predictable cash flow and want to minimize risk. |

| PPS+ | A hybrid model paying a fixed rate for the block reward and a PPLNS model for fees. | Offers a stable base income with the potential for higher earnings from fees. | More complex to calculate; can have higher effective fees than PPLNS. | Miners who want a balance of stability and the potential for higher rewards. |

The bottom line: Choosing a payout model is a classic trade-off between stability and potential upside. FPPS is like a steady paycheck, making it perfect for precise ROI calculations. PPLNS, on the other hand, introduces more variance but can yield higher returns for dedicated, long-term miners.

How to Evaluate and Choose a Mining Pool

With hundreds of pools competing for your hash rate, picking the right one demands a data-driven approach. This is where a tool like MiningPoolStats becomes your best friend, aggregating all the critical data you need to compare pools side-by-side. For a detailed walkthrough, our guide on how to join a mining pool is a great place to start.

When choosing a pool, you should focus on these key factors:

- Total Hash Rate: A higher hash rate generally means the pool finds blocks more frequently, which translates to more consistent payout cycles for you.

- Fees: Compare the management fees, which typically range from 1-3%.

- Payout Model: Choose the model (PPLNS, FPPS, etc.) that best fits your risk tolerance.

- Community Reputation: Look for pools with a long track record of reliability and transparent payouts.

Conclusion: In the end, choosing the right pool comes down to balancing these factors. A massive pool finds blocks more often, leading to regular payments, but your share of each reward will naturally be smaller. Using real-time data to make an informed choice is one of the most important steps you can take to keep your mining operation profitable.

Navigating the Hidden Risks of Mining

It’s one thing to see a profitable forecast on a spreadsheet. It’s another thing entirely to see that forecast evaporate into a real-world loss because you overlooked the hidden risks baked into crypto mining. Your success isn’t just about the math of revenue versus cost; it’s about preparing for the dynamic, unpredictable factors that can completely upend your operation.

Market and Network Risks

The most glaring risk is crypto price volatility. The asset you’re mining can swing wildly in value—sometimes by 20-30% or more in a single week. A sudden market crash can wipe out your profit margins overnight.

Even if the crypto market miraculously stayed flat, another powerful force is constantly working to shrink your profits: rising network difficulty. As more miners fire up more powerful hardware, the competition gets fiercer, and finding a block becomes statistically harder for everyone. This relentless climb means today’s top-of-the-line ASIC miner will earn less and less over time. You can see these numbers for yourself on platforms that track ASIC miner value.

The key takeaway here is that your mining hardware has a shelf life. What’s profitable today will become obsolete tomorrow. You have to be ready to reinvest in newer, more efficient tech just to stay in the game.

Operational and Regulatory Headaches

Beyond the market, you have to deal with the messy physical reality of running the hardware itself. These are the operational risks that often blindside newcomers.

- Hardware Failure: ASICs are high-performance machines pushed to their limits 24/7. Components like fans, power supplies, and the all-important hash boards can and do fail, leading to expensive downtime and repairs.

- Cooling and Maintenance: These machines scream and pump out a shocking amount of heat. Inadequate cooling will cause equipment failure and create a potential fire hazard. This makes regular cleaning, maintenance, and climate control an absolute necessity.

- Regulatory Uncertainty: The rulebook for crypto is still being written. A government could introduce new taxes, enforce strict environmental regulations, or even ban mining with very little warning, putting your entire investment in jeopardy.

- Tax Obligations: Mining profits are almost always considered taxable income. If you don’t get a handle on your local tax laws and report correctly, you could face some serious financial penalties down the road.

Conclusion: These hidden risks are precisely why a simple online profitability calculator can be so dangerously misleading. A successful mining operation is built on more than a good spreadsheet—it’s built on a solid risk management strategy that anticipates these challenges. Ignoring them is the fastest way to turn a promising venture into a very costly lesson.

The Final Verdict: Is Crypto Mining Worth It?

So, after all that, we get to the big question: is crypto mining still worth it?

The short answer is yes, but it’s a qualified yes. Let’s be clear: the game has changed entirely. What started as a hobby for tech enthusiasts tinkering in their basements has evolved into a cutthroat, capital-intensive industry. Profitability isn’t about having a fast computer anymore. It’s about running a lean, efficient business operation.

The Modern Miner’s Playbook

Think of this as your pre-flight checklist. If you can’t tick every one of these boxes with confidence, you’re better off staying on the ground.

- Secure Rock-Bottom Electricity Costs: This one is an absolute deal-breaker. You need power rates far below what you pay at home—think industrial-grade pricing around $0.03 to $0.05 per kWh.

- Invest in Top-Tier Hardware: Your ASIC miners’ efficiency is everything. You have to be running the latest-generation machines that crank out the most terahashes for every watt of power they pull.

- Achieve Meaningful Scale: A single miner is a lottery ticket, not a business. A truly profitable setup needs enough machines to smooth out the bumps, absorb maintenance costs, and ride out the crypto price rollercoaster.

The Bottom Line: Crypto mining has graduated from a passive hobby to a full-time industrial pursuit. It demands serious capital, technical know-how, and a sharp operational mind.

Who Can Still Be Profitable?

If you’re approaching this as a business—securing cheap power contracts, making a significant capital investment in the best hardware, and actively managing your farm to stay ahead of the curve—then yes, mining can absolutely be a profitable venture.

But for the casual hobbyist running a machine or two on residential power rates? The odds are stacked against you. The margins are already razor-thin, and they can be wiped out in an instant by a price drop, a difficulty spike, or an unexpected repair. For this group, it’s far more likely to end in frustration and loss than in profit.

The conclusion is simple: treat it like the serious, competitive business it has become, not a get-rich-quick scheme.

Frequently Asked Questions (FAQ)

Is crypto mining at home profitable?

For most people, crypto mining at home is not profitable. Residential electricity rates (often above $0.10/kWh) are typically too high to compete with large-scale mining farms that secure industrial rates. Furthermore, the heat, noise, and maintenance of modern mining hardware make it impractical for a home environment without significant investment in infrastructure.

Which crypto is most profitable to mine?

The “most profitable” crypto changes constantly. While Bitcoin is the most well-known, its high network difficulty means that smaller altcoins can often be more profitable to mine on a day-to-day basis. Profitability depends on the coin’s price, current network difficulty, and your specific hardware’s efficiency. Miners use online profitability calculators to track these metrics in real-time and switch between different coins to maximize their returns.

What is the minimum investment for crypto mining?

The minimum investment for a serious, potentially profitable mining operation is significant. A single, new-generation ASIC miner can cost between $2,000 and $10,000. Factoring in necessary electrical upgrades, cooling solutions, and shelving, a realistic starting budget for a small-scale setup would be in the $5,000 to $15,000 range. Anything less is likely to be a hobby that costs money rather than makes it.

Can I mine crypto without buying hardware?

Yes, this is known as cloud mining. You rent hashing power from a large data center and receive a share of the mining rewards. However, this space is filled with risks. Many contracts are structured with high fees that make profitability very difficult for the customer. The industry is also rife with scams. While legitimate services exist, you must exercise extreme caution and be aware that you have no control over the physical hardware.

How much can one Bitcoin miner make in a day?

The daily earnings of a single Bitcoin miner fluctuate wildly based on Bitcoin’s price, network difficulty, and the miner’s efficiency. In late 2024 and early 2025, daily revenues for a top-tier ASIC rig often ranged from $5 to $18 before electricity costs. After subtracting electricity expenses (which could be $5-$8 per day or more), the net profit can be quite thin and can easily turn into a loss during market downturns.