Most Profitable Crypto Coin to Mine

Pinpointing the single most profitable crypto to mine is a moving target, as it depends entirely on your specific hardware, electricity rate, and the ever-changing market conditions. For miners running high-end SHA-256 ASICs with access to cheap power, Bitcoin (BTC) is often the most reliable workhorse. However, for those with Scrypt ASICs, the merged mining of Dogecoin (DOGE) and Litecoin (LTC) presents a compelling alternative, allowing you to earn two distinct rewards for the same computational effort.

Ultimately, the right choice for you isn’t about finding a secret coin but about understanding the core factors that drive profitability and matching them to your unique setup.

Understanding the Core Factors of Mining Profitability

Figuring out the “most profitable coin” isn’t a simple answer; it’s a dynamic calculation. The mining landscape shifts constantly based on coin prices, network competition, and even hardware advancements. What’s printing money today could be a losing bet tomorrow.

A smart miner, then, has to think like an analyst, constantly weighing a handful of critical variables. Your profitability ultimately boils down to a delicate balance between your operational costs and the revenue you pull in from block rewards.

The Key Variables in Your Profit Equation

Before you can compare Bitcoin to Dogecoin or any altcoin, you need a solid grasp of the inputs that dictate your potential earnings. These factors are the foundation of any realistic profitability forecast.

Getting these right is non-negotiable for anyone serious about mining:

- Hardware Efficiency: This is a measure of your machine’s hashrate (its raw power) versus its energy consumption in watts. A more efficient miner delivers more hashes per watt, which directly cuts down your cost to mine each coin.

- Electricity Cost: Your price per kilowatt-hour (kWh) is one of your biggest ongoing expenses. A difference of just a few cents can be the line between a profitable operation and one losing money.

- Coin Price and Network Difficulty: The market value of the coin you’re mining is your revenue. The network difficulty, on the other hand, determines your slice of that revenue. As more miners join a network, the difficulty rises, and your individual share of the rewards shrinks.

The core challenge in crypto mining is managing the variables you can control (hardware, electricity) to overcome the variables you can’t (market price, network difficulty).

The interplay here is what trips people up. For instance, a 50% surge in a coin’s price might look like a huge win. But if the network difficulty doubles at the same time because everyone else jumped in, your actual daily profit could stay flat or even drop. That’s why a surface-level look is never enough.

The table below provides a quick reference for the core variables and how they directly influence your bottom line.

Core Factors Impacting Mining Profitability

| Factor | How It Affects Profit | Real-World Example |

|---|---|---|

| Hashrate | A higher hashrate increases the number of block reward shares you can find in a set time. | An ASIC pushing 200 TH/s will earn roughly twice as much as a 100 TH/s model on the same network, all else being equal. |

| Power Cost | Lower electricity costs (measured in $/kWh) directly reduce your operational expenses and increase your margin. | A miner in a region with $0.05/kWh power will be vastly more profitable than someone paying $0.15/kWh for the same hardware. |

| Coin Price | The current market value of the cryptocurrency sets the dollar value of the rewards you earn. | Earning 0.001 BTC is far more lucrative when Bitcoin is at $70,000 than when it’s at $35,000. |

| Network Difficulty | Higher difficulty means more miners are competing for the same rewards, lowering your individual earnings per unit of hashrate. | When thousands of new miners join the Dogecoin network, the difficulty rises, and each existing miner earns fewer DOGE per day. |

In short, successful mining is about mastering this equation. By optimizing your controllable costs and staying aware of market dynamics, you can consistently identify and pivot to the most profitable opportunities available to your specific setup.

How to Actually Figure Out Your Mining Profitability

Pinpointing the most profitable coin to mine isn’t a guessing game—it’s all about the numbers. Before you can realistically compare something like Bitcoin to Dogecoin, you need to get good at forecasting your potential returns. This means getting comfortable with a mining profitability calculator and understanding the inputs that paint an accurate financial picture.

An online calculator is your best friend here, but remember: garbage in, garbage out. Using inaccurate or outdated numbers will give you a flawed projection, and you could end up sinking time and electricity into a money-losing operation. Precision is everything.

The Essential Inputs for Your Calculation

To get a reliable estimate, you’ll need to pull together four key pieces of data specific to your mining setup and local costs. These variables are the bedrock of any serious profitability analysis.

Here’s a numbered list of what you need to nail down:

- Hardware Hashrate: This is the raw processing power of your mining rig, measured in hashes per second (like TH/s for ASICs or MH/s for GPUs). You can find this on the manufacturer’s spec sheet. A higher hashrate means you can run more calculations, boosting your odds of earning rewards.

- Power Consumption: This is how much electricity your hardware uses, measured in watts (W). Just like hashrate, this is a standard spec from the manufacturer. Efficiency is key; a rig with a high hashrate and low power draw is always more profitable.

- Electricity Cost: This is what you pay per kilowatt-hour ($/kWh), a number you can grab straight from your utility bill. This figure is a major factor in your operational costs and varies widely by location. A cheap electricity rate gives you a massive competitive edge.

- Pool Fees: Mining pools charge a small percentage of your earnings for their service, usually somewhere between 0.5% and 2%. It might seem small, but this fee eats into your net profit, so you have to account for it.

Once you have these figures handy, you can plug them into a solid calculator. For a deeper dive into picking the right tool, you can learn more about how a crypto mining profitability calculator works to get started.

Understanding the Moving Parts of the Market

Beyond the factors you control, two external variables are always in flux and directly impact your earnings. Most online calculators pull this data in automatically, but it’s critical to understand what they are and how they work.

- Coin Price: The current market value of a cryptocurrency determines how much your mined rewards are worth in fiat terms. A sudden price spike can make a coin wildly profitable overnight.

- Network Difficulty: This number reflects how much total computing power is competing on the network. When more miners jump in, the difficulty goes up, making it harder for anyone to find a block. This, in turn, reduces your individual share of the rewards.

Here’s the key relationship to grasp: coin price and network difficulty are often linked. A sharp price increase will attract a flood of new miners, which then drives up the network difficulty. This dynamic can actually cancel out some of the potential profit gains, meaning a big price rally doesn’t always lead to an equally big jump in your daily earnings.

By getting a handle on these inputs, you can run accurate, real-time profitability scenarios. This lets you constantly evaluate different coins and shift your strategy, ensuring your hardware is always pointed at the most lucrative target at any given moment.

Why Bitcoin Is Still King for ASIC Miners

When you ask what the most profitable coin to mine is, the conversation almost always lands on Bitcoin, and for good reason—especially if you’re running Application-Specific Integrated Circuit (ASIC) rigs. While new altcoins pop up constantly, Bitcoin’s immense market cap, deep liquidity, and battle-hardened network security offer a level of stability that serious miners depend on.

For anyone operating powerful SHA-256 ASICs, Bitcoin isn’t just one option among many; it’s the main event. These machines are purpose-built to do one thing: solve the cryptographic puzzle that powers the Bitcoin network. This specialization gives them a performance and efficiency edge that no GPU or CPU could ever match.

Thriving in a Post-Halving World

The Bitcoin network is designed to get tougher over time. The “halving,” an event that occurs roughly every four years, slashes the block reward in half, effectively reducing the supply of new Bitcoins. This built-in scarcity, paired with a difficulty that automatically adjusts to the network’s total computing power, creates an intensely competitive environment.

With the most recent halving behind us, the block reward has shrunk again, making operational efficiency the single most important factor for survival. It really boils down to two things:

- Top-Tier Hardware: You need to run the latest generation of ASICs. Machines that were profitable last year can become expensive paperweights, burning more in electricity than they generate in Bitcoin.

- Cheap Power: This is the ultimate competitive advantage. The largest mining operations are almost always located in regions with access to incredibly cheap electricity, allowing them to maximize their margins.

This is why pros obsess over their operational costs, fighting for every fraction of a cent per kilowatt-hour. In the post-halving era, it’s a game of razor-thin margins where only the most efficient operations can turn a profit.

Bitcoin mining is a professional’s game. The era of hobbyists mining BTC profitably on a home computer is long gone. Today, success requires significant capital investment in cutting-edge hardware and a strategic approach to managing power costs.

This shift toward professionalization is precisely what has cemented Bitcoin’s status as the premier asset for dedicated, large-scale mining operations.

Why You Can’t Afford to Go It Alone

For virtually every miner out there, solo mining is a losing game. The Bitcoin network is so massive that the odds of an individual miner finding a block on their own are astronomically low. You could run your hardware for years without finding a single block, earning nothing in the process.

This is where mining pools become essential. By joining a pool like Foundry USA or Antpool, you combine your hashrate with thousands of other miners. This collective power dramatically increases the chances of finding blocks regularly. When the pool successfully mines a block, the rewards are shared among all participants, proportional to the computing power they contributed. This model turns a lottery ticket into a steady, predictable income stream.

Choosing the right pool is a critical decision. You need to weigh a few key factors:

- Payout Model: Pools use different reward systems like PPLNS (Pay Per Last N Shares) or FPPS (Full Pay Per Share), which can affect the consistency of your payouts.

- Fees: Expect to pay a pool fee, typically between 1% to 2%, which is deducted directly from your earnings.

- Network Share: Larger pools find blocks more often, which translates to more frequent payouts for their members.

Breaking Down the Profitability Equation

For miners with modern ASICs and access to cheap power, Bitcoin consistently holds its ground. Take a top-tier machine like the S21 Pro, which pushes 234 TH/s while drawing 3510W. In the right conditions, it can generate around $9.95 per day in profit.

With a competitive electricity rate of $0.05/kWh, you could see a return on investment (ROI) in just six to twelve months. This setup effectively produces BTC at a cost basis of $35,000–$45,000 per coin—a very healthy margin at current market prices. You can see a detailed analysis of the top Bitcoin mining machine profitability on CryptoMinerBros.

At the end of the day, Bitcoin’s dominance isn’t an accident. Its robust network, established infrastructure, and clear economic incentives make it the benchmark for all other mineable coins. For ASIC miners with a long-term strategy, it remains the undisputed king.

The Power of Merged Mining Dogecoin and Litecoin

While Bitcoin dominates the conversation for SHA-256 ASIC miners, a uniquely profitable strategy exists for those running Scrypt-based hardware. It’s called merged mining, and it allows a single ASIC miner to secure two different blockchains at the same time, earning full rewards from both without using a single extra watt of electricity.

The undisputed champions in this arena are Dogecoin (DOGE) and Litecoin (LTC). This dual-reward system makes the DOGE/LTC combination a serious contender for the most profitable crypto to mine. You’re essentially getting two income streams for the price of one, which fundamentally changes the profitability math for Scrypt miners.

How Merged Mining Actually Works

The concept works because both Dogecoin and Litecoin share the same hashing algorithm: Scrypt. Think of your Scrypt ASIC as constantly working to solve cryptographic puzzles. Each correct solution, or “share,” it submits is like a lottery ticket for finding the next block.

With merged mining, the work your miner does for the primary network (Litecoin) is also used to validate blocks on the secondary network (Dogecoin). The networks are set up to recognize and accept the same proof-of-work. This means every hash your machine generates pulls double duty, contributing to the security of both blockchains simultaneously.

Merged mining is the ultimate form of operational efficiency. You’re not splitting your hashrate between two coins; you’re applying 100% of your hardware’s power to both networks at once, effectively doubling your reward potential without any extra power draw.

This synergy completely transforms the profitability landscape. Instead of choosing between mining LTC or DOGE, you get to mine both. This built-in efficiency gives you a significant competitive edge and acts as a buffer against market volatility—if one coin’s price dips, the other might hold steady, smoothing out your returns.

Profitability And The Hardware Edge

Of course, this strategy hinges on having the right gear. Scrypt ASICs, like those in Bitmain’s Antminer L series, are purpose-built to handle this algorithm with extreme efficiency. The latest models crank out impressive hashrates while keeping power consumption manageable, making them perfect for maximizing returns from the dual-coin setup.

Dogecoin and Litecoin consistently rank as highly profitable Scrypt-based coins for merged mining. This is fueled by a constant stream of rewards: 10,000 DOGE blocks are issued about every minute, which are merged with Litecoin’s 6.25 LTC block rewards that come every 2.5 minutes.

For perspective, a top-tier Scrypt miner—like a future Nov 2025 model running at 27 GH/s and 5670W—could bring in an estimated $5.79 per day. This structure simplifies the hardware investment. You aren’t just betting on a single coin’s future; you’re investing in the health and profitability of two established networks.

The Role Of Specialized Mining Pools

To pull off a merged mining strategy, you need the right infrastructure, and that’s where specialized mining pools come in. Trying to merged-mine solo is just as impractical as solo mining Bitcoin—your odds of finding a block are astronomically low.

Pools like LitecoinPool.org, F2Pool, and 2Miners handle all the technical heavy lifting. They configure their systems to properly submit your work to both the Litecoin and Dogecoin networks, collect all the block rewards, and distribute your share back to you.

Here’s what to look for in a good merged mining pool:

- Clear Payout Structure: The dashboard should transparently show you earnings for both LTC and DOGE.

- Reliable Payout Model: PPLNS (Pay Per Last N Shares) is a common and fair model that provides consistent rewards.

- Low Fees: A competitive fee, usually around 1-2%, means more of the mined crypto ends up in your wallet.

- High Hashrate: A pool with a larger slice of the global network hashrate finds blocks more often, leading to steadier payouts.

By joining a reputable pool, you can point your Scrypt ASIC to their server and start earning both coins almost immediately. To see which one fits your needs, you can track and compare pool performance using these Dogecoin mining pool statistics. It makes a sophisticated and highly effective mining strategy accessible to just about anyone.

Finding Your Edge in GPU and CPU Mining

The high-stakes game of Bitcoin mining, dominated by purpose-built ASIC machines, is just one part of the story. For miners running consumer-grade hardware, a completely different and far more dynamic world exists. If you’re working with Graphics Processing Units (GPUs) or even Central Processing Units (CPUs), the path to profitability isn’t about chasing the biggest names—it’s about finding niche opportunities.

This corner of the market is in constant flux. The most profitable coin to mine on a GPU today might be an afterthought next week. To succeed here, you need to be flexible, do your homework constantly, and get comfortable with a bit of calculated speculation.

The Lay of the Land for Consumer Hardware

The real power of GPU and CPU mining comes down to one thing: algorithm diversity. While an ASIC is a one-trick pony, built for a single algorithm, your everyday hardware can adapt to mine dozens of them. This agility lets you pivot on a dime to whatever coin is offering the best returns.

Better yet, several algorithms are specifically engineered to be “ASIC-resistant,” intentionally keeping the playing field level for consumer hardware. This design helps prevent massive, well-funded operations from completely centralizing a coin’s network.

- KawPow: This algorithm behind coins like Ravencoin (RVN) is built for GPUs and regularly switches up its hashing functions to make designing a specialized ASIC a nightmare.

- RandomX: Powering Monero (XMR), RandomX is heavily optimized for modern CPUs, making it one of the few consistently profitable choices for CPU mining.

- Ethash and Etchash: Even though Ethereum has moved on, its mining legacy lives on. Forks like Ethereum Classic (ETC) still use variations of its original GPU-friendly algorithm.

The goal for most hobbyists and small-scale miners isn’t long-term holding. It’s about short-term profit. You might mine a speculative coin for a few weeks, cash out your earnings, and fire up a profitability calculator to find your next target. This is a much faster, more active strategy than the “set it and forget it” approach in the Bitcoin world.

How to Spot and Vet Niche Coins

Finding the next profitable coin is both an art and a science. It means keeping an eye on market trends, tracking new project launches, and doing a deep dive into a network’s health. Get in early on the right project before its network difficulty explodes, and the returns can be massive. But the risks are just as high.

Many of these niche coins are plagued by low market liquidity and extreme price volatility. A single large holder deciding to sell can crater the price, and a sudden rush of new miners can evaporate your profitability overnight. Due diligence isn’t just recommended; it’s essential. Before you ever point your hash rate at a new coin, you need to assess its viability using resources like the explorers and pool directories on MiningPoolStats.

Here’s a quick breakdown of popular GPU and CPU mining algorithms and what makes them tick.

| Algorithm | Primary Hardware | Popular Coins | Key Characteristic |

|---|---|---|---|

| KawPow | GPU | Ravencoin (RVN), Neoxa (NEOX) | Designed to resist ASICs, giving consumer GPUs a fair shot. |

| RandomX | CPU | Monero (XMR), Zephyr (ZEPH) | A memory-intensive algorithm fine-tuned for CPU performance. |

| Etchash | GPU | Ethereum Classic (ETC) | A variant of Ethash with a smaller memory footprint, making it great for GPUs with less VRAM. |

Balancing the Risk with the Reward

Let’s be clear: GPU and CPU mining is inherently speculative. Unlike Bitcoin, with its decade-plus track record, many of these smaller projects are unproven. Their long-term survival is anything but guaranteed.

Your strategy has to reflect that reality. Smart miners in this space rarely hang onto speculative coins for long. The proven approach is to mine whatever is most profitable right now, regularly convert those earnings into a more stable asset like Bitcoin or cash, and then re-evaluate the market. This tactic locks in your profits and shields you from the all-too-common collapse of a project you were mining just yesterday.

Ultimately, for anyone with consumer hardware, the answer to “what is the most profitable crypto to mine?” changes constantly. By staying informed, using the right profitability tools, and actively managing your risk, you can turn your gaming PC or spare CPU into a productive asset.

How to Choose the Right Coin for Your Setup

There’s no secret, single “most profitable” coin to mine. The real answer is much more personal—it’s about building a strategy that fits your specific hardware, electricity costs, and the live market. Profitability is a moving target, so let’s break down how to create a clear framework for making the smartest choice for your operation.

The best way forward is to be methodical. If you follow a clear set of steps, you can go from a vague question to a data-backed decision that’s right for you.

A Step-by-Step Evaluation Process

This five-step process is designed to help you sift through the noise and land on the right coin and pool to maximize your profitability.

- Know Your Hardware’s Algorithm: This is the absolute first step. You have to know what your hardware was built to do. If you have a SHA-256 ASIC, you’re mining Bitcoin or a related fork. A Scrypt ASIC is for Litecoin and Dogecoin. GPUs and CPUs are more flexible but don’t pack the same specialized punch.

- Calculate Your Precise Electricity Cost: Pull out your utility bill and find your exact cost per kilowatt-hour ($/kWh). This single number is the most critical input for any real profitability calculation. In many cases, it’s what separates a profitable operation from a losing one.

- Use a Profitability Calculator: Once you have your hardware specs and power cost, plug them into a reliable online profitability calculator. These tools are invaluable because they pull real-time data on coin prices and network difficulty, giving you a live snapshot of what you could earn right now.

- Research Project Viability: If a coin that isn’t a household name like Bitcoin pops up as profitable, do your homework. Dig into the project’s long-term goals, see if the developers are active, and check the community sentiment. You don’t want to dedicate your hashrate to a project that’s about to fade away.

- Select a Reputable Mining Pool: The final piece of the puzzle is your pool. Compare your options based on their fee structure, payout model (PPLNS vs. FPPS), and their total share of the network hashrate. This ensures you get consistent, reliable payouts. If you’re just getting started, our guide on how to start crypto mining breaks down the fundamentals.

Situational Recommendations

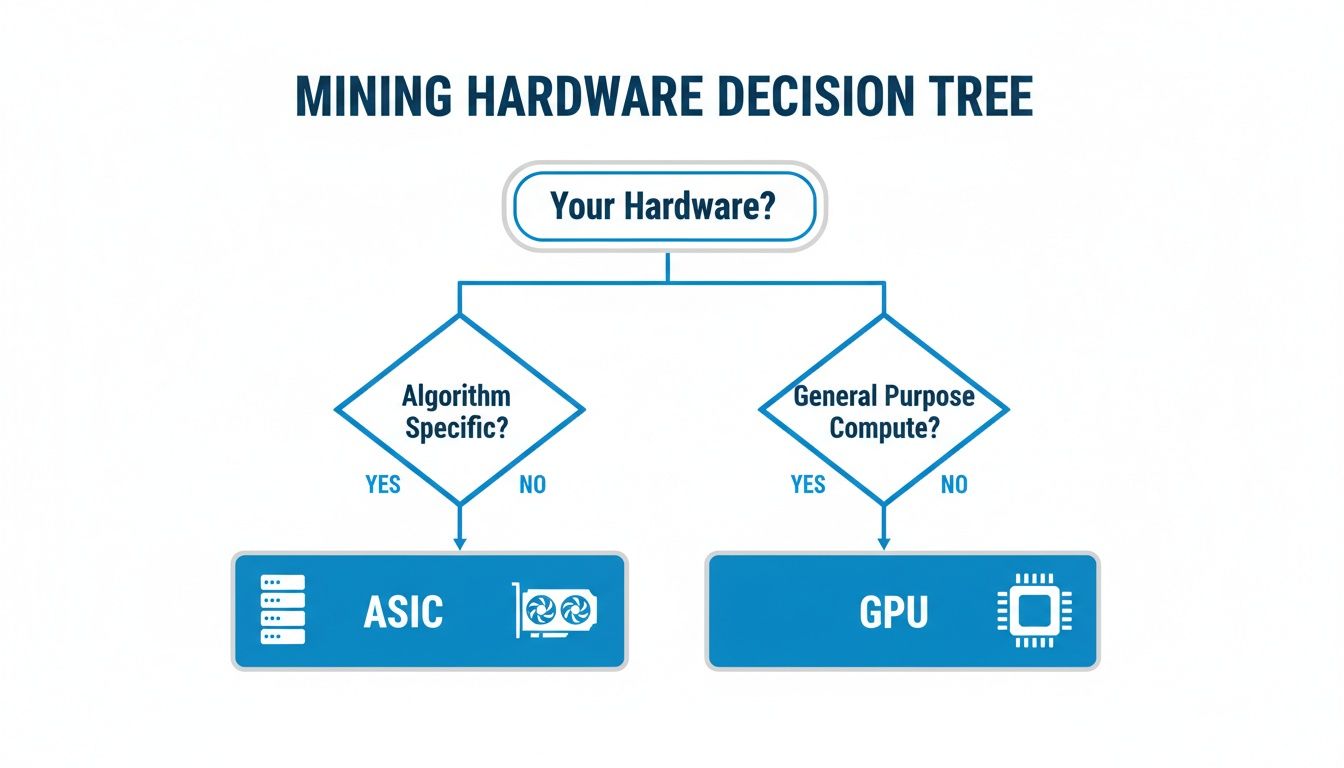

This decision tree gives you a great visual for how your hardware dictates your mining path right from the start.

As you can see, specialized gear like an ASIC locks you into a specific algorithm. General-purpose hardware like a GPU or CPU keeps your options more open.

Key Takeaway: The “best” coin is entirely dependent on your setup. There is no one-size-fits-all answer, only the right answer for your specific situation.

Let’s look at two common scenarios:

- For SHA-256 ASIC Owners: If you’re running efficient SHA-256 ASICs and have access to low-cost power, Bitcoin remains the undisputed king. Its stability, deep liquidity, and incredibly robust network make it the default choice for any serious, professional-grade mining operation.

- For Scrypt ASIC Miners: The dual rewards you get from merged mining Dogecoin and Litecoin are a powerful combination. You’re essentially earning two different coins for the same amount of work, which fundamentally boosts your revenue potential and efficiency.

In conclusion, choosing the right coin is a strategic decision, not a lucky guess. By systematically evaluating your hardware, costs, and the market, you can confidently identify the most profitable path for your mining journey.

Frequently Asked Questions (FAQ)

Is crypto mining still profitable?

Yes, but profitability today hinges on efficiency. It really boils down to two things: how much hashing power you get for every watt you burn, and what you pay for that electricity. If you have access to cheap power—think under $0.07 per kWh—and you’re running modern, efficient ASICs, then mining big players like Bitcoin can still be a very lucrative venture. For everyone else, profitability often means hunting for promising GPU-mineable altcoins and mining them strategically.

What is the easiest crypto to mine?

For beginners with standard consumer hardware (a powerful GPU), a coin using an ASIC-resistant algorithm like KawPow (Ravencoin) or Etchash (Ethereum Classic) is often considered easiest to start with. The software is widely available, and there are many guides and pools to help you get set up quickly. However, “easiest” does not always mean “most profitable,” so always run the numbers through a profitability calculator first.

Can you mine Bitcoin with a PC?

Technically, yes, but it is not profitable in any realistic scenario. The Bitcoin network’s difficulty is so high that it requires specialized ASIC miners to have any chance of earning rewards. Trying to mine Bitcoin with a standard PC’s CPU or GPU would consume more in electricity costs than you would ever earn back in BTC, resulting in a net loss.

Is mining crypto legal?

In most Western countries, including the United States, Canada, and much of Europe, crypto mining is perfectly legal for individuals and businesses. However, the legal status varies significantly worldwide. Some countries have imposed heavy restrictions or outright bans due to concerns over energy consumption and capital controls. Always research and understand the specific laws and regulations in your jurisdiction before investing in mining hardware.